Gold shattered records this week, blasting past $3,000 per ounce—a level that felt almost impossible just a few years ago.

But while most of the market is celebrating, Morningstar’s market strategist David Sekera is waving a warning flag. He’s predicting Gold could drop all the way back to $1,820, near 2023 levels.

Is he a genius contrarian… or dead wrong?

Let’s dissect the real drivers of Gold—from Fed policy to Indian weddings—and why the next few years could redefine this market forever.

Gold at $1,820 — Crazy Talk?

Sekera’s prediction stands out—because everyone else is bullish.

Citi is calling for $3,500, some analysts are whispering $8,000, and central banks are buying more Gold than ever before.

Yet here’s Sekera, predicting a 40% drop. At first, it sounds extreme—like saying Bitcoin’s going back to $3,000.

But his argument isn’t totally off the rails.

The case for a Gold crash

Sekera bases his forecast primarily on:

real interest rates,

inflation trends,

supply dynamics,

and economic conditions in the U.S.

Let’s go through them, one by one—with a few of my own takes along the way.

1/ Rising real interest rates

Gold’s worst enemy isn’t the Fed—it’s real yields (interest rates minus inflation).

If the Fed manages to tame inflation (or if inflation cools naturally) while keeping nominal rates high, real rates could rise sharply.

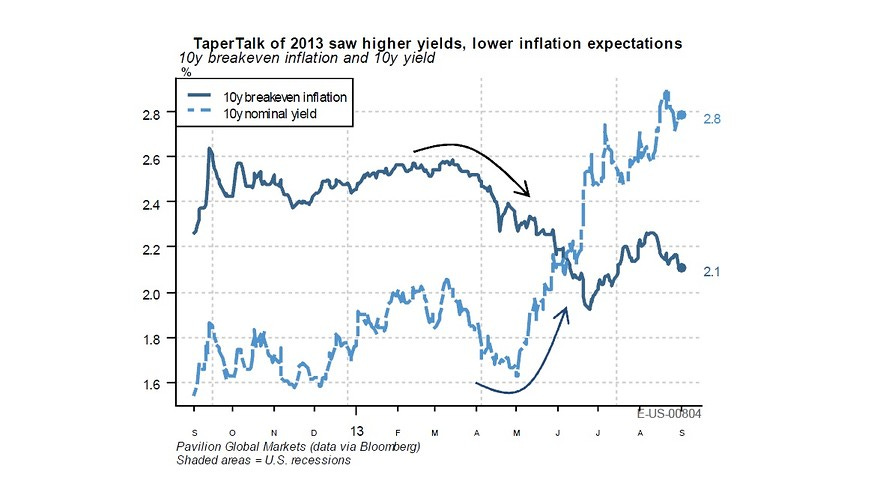

And historically, that’s bad news for Gold. Remember 2013’s Taper Tantrum? Gold dropped 28% in six months as real yields jumped.

Sekera sees a similar risk ahead: inflation fades, the Fed holds firm, and real yields climb—pressuring the metal lower.

My take:

Real rates matter, no doubt. But what if inflation doesn’t cooperate? The Fed has a shaky track record—they’ve missed 9 of the last 5 recessions, according to some jokes. If they cut rates prematurely (like in 2019), real rates collapse, and Gold rips.

Plus, look at the global picture: Europe’s on the edge of a recession, China’s property crisis is dragging on, and emerging markets are buried in debt. If the Fed decides to pivot to support growth, Gold could become a safe haven again.

2/ Demand destruction & substitution

Sekera brings up a classic market idea: “the cure for high prices is high prices.” When Gold gets too expensive, buyers start looking elsewhere. Jewelry—over 50% of global Gold demand—and industrial use (about 10-15%) could see some “substitution.”

In plain terms: if Gold hits $3,000, some people might switch to silver, lab-grown diamonds, or just stop buying altogether.

My take:

Let’s look at one of the largest Gold consumers: India and China.

In India, Gold isn’t just an asset—it’s cultural. It’s tied to weddings, festivals, and passed down through generations. People don’t think in dollar terms.

Yes, demand dipped a bit around $3,000, but it didn’t collapse.

China in the meantime keeps adding Gold to its reserves - a long-term move to reduce reliance on the U.S. dollar.

When it comes to industrial demand, sure—some tech companies might replace Gold with palladium in basic circuits.

But advanced chips, like Apple’s M3 Ultra, still need Gold for its superior conductivity. Each chip uses about 0.03g of Gold. At $3,000, that’s around $3 per chip—not a big deal for a $4,000 device.

3/ New supply “awakened” by high prices

Sekera also points out that high prices can bring new Gold supply online. Mines that weren’t profitable before suddenly look attractive.

Lower energy prices and better tech (including AI) help bring down costs, which could eventually increase supply and pressure prices.

My take:

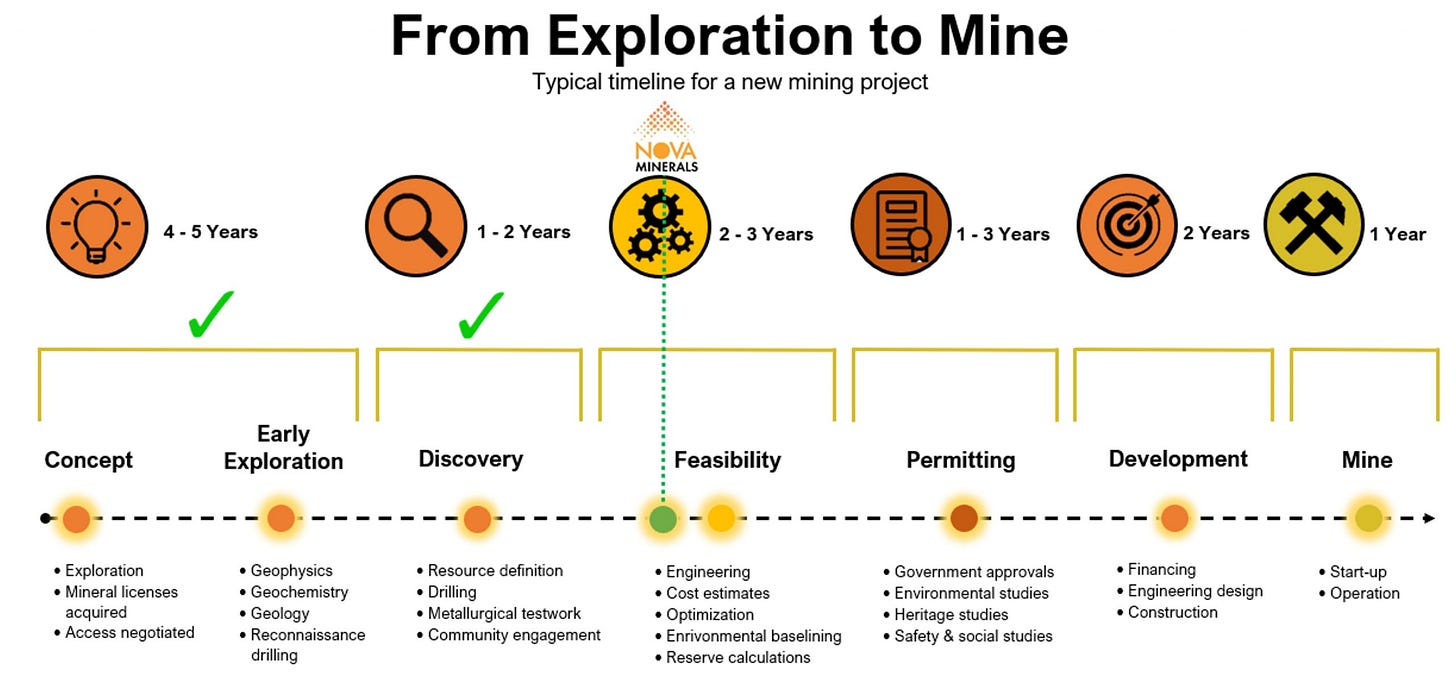

In theory, yes—but in reality, new mining projects take years.

Permitting is a nightmare. Look at Newmont’s Yanacocha mine in Peru—it took forever to get approved. Even at $3,000, ESG rules and local protests slow everything down.

Plus, ore quality is declining. Most new projects are dealing with lower-grade Gold, which means deeper digging and more expensive operations.

High prices don’t magically produce high-grade Gold.

4/ U.S. economic factors: Trump, Musk, and the dollar

Under a potential Trump administration—with Elon Musk helping run a “Department of Government Efficiency”—there could be massive spending cuts.

If they slash a trillion dollars from the budget, the dollar could strengthen—typically bearish for Gold.

But there’s a flip side: big budget cuts might slow growth, stir up recession fears, and ironically, boost demand for Gold as a safe haven.

Sekera’s overall view isn’t that Gold crashes overnight. He sees a long, gradual shift over four to five years as these trends play out.

Even if he’s right, there could still be strong short-term rallies before any major pullback happens.

Historical Corrections: A Cautionary Tale

Big drops in Gold aren’t new. History shows that even in strong macro environments, the metal has taken some serious hits:

1980–mid-80s: When the Fed hiked rates to 20%, Gold fell by about 65% from its peak.

1996–99: Gold slid 38%, while the UK sold off a big chunk of its reserves at rock-bottom prices.

2008–09: During the global financial crisis, Gold dropped 30% as hedge funds scrambled for liquidity—even safe havens got sold off.

2011–15: A 45% decline followed Gold’s then-record high of ~$1,900, driven by a stronger dollar and recovering global growth.

So corrections in the 20–45% range aren’t rare. A 40% drop from $3,000 lands us around $1,800, right where Sekera is aiming.

The question is: what kind of catalyst would spark that scale of a decline, and how likely is it that multiple catalysts align at once?

Is This 2011 All Over Again? Probably Not

History doesn't always repeat—it rhymes.

The current situation feels very different from past corrections:

✅ Central banks globally are net buyers, driven by currency devaluation fears.

✅ Physical Gold shortages are increasingly apparent, with significant delivery delays in markets like New York and London.

✅ Inflationary pressures, despite cooling, remain structurally high due to persistent geopolitical tensions and supply chain disruptions.

The current market sentiment

Globally, we’re witnessing profound instability.

While the U.S. is talking about cutting spending, global debt is bigger than ever. Countries rolling over debt at higher rates are feeling the pressure. At some point, the math breaks—and central banks turn to monetary easing or currency debasement.

China, Saudi Arabia, and even some U.S. hedge funds are loading up on Gold—hedging against currency risk and global turmoil. This kind of structural demand helps put a floor under prices.

And unlike in past cycles, Gold is not trading like a typical risk asset.

Lately, it’s been rallying even when stocks fall, showing that investors see it as more than just an inflation hedge—it’s a crisis hedge.

My Take: Why Sekera’s Right… and Wrong

Sekera's $1,820 call isn’t impossible. But it ignores a key point: Gold isn’t just about economics—it’s about trust.

The $1,820 crash requires:

A Fed victory over inflation without causing a recession (near-impossible).

Central banks halting Gold buys (they’re accelerating).

Substitution killing jewelry demand.

Peace breaking out in Ukraine, Taiwan, and the Middle East (a stretch)

On the other hand, to hit $5,000, all it takes is:

One Fed policy mistake.

One BRICS country pegging its currency to Gold.

Gold is probably overextended, yes.

But a full-blown crash to $1,820? Unlikely.

A more realistic pullback might be in the 20–25% range, especially if real rates spike or the dollar strengthens.

That would take Gold to around $2,300–2,400—a realistic correction scenario aligning with previous cycles without signaling structural collapse.

Trading Tactics

For traders, the key takeaway is simple: know the difference between a correction and a crash.

Gold hitting $3,000 feels exciting, but that alone isn’t a sell signal. Corrections are part of the game—and often great buying opportunities if the long-term trend stays intact.

Risk management over forecasting: Don’t lock yourself into a single price target. Focus on risk vs. reward. If you’ve made strong gains in the past year, consider:

Taking partial profits

Using options to hedge

Setting tighter stop-losses

The goal isn’t to call the top—it’s to protect capital.

Watch the data: Gold reacts quickly to surprises in:

Inflation reports (CPI, PCE)

Fed statements and rate decisions

Treasury auctions

10-Year TIPS yield (real interest rates)

A small change in expectations can move Gold by $50+ in a single day.

Global politics: Gold is hypersensitive to geopolitics. Keep an eye on:

U.S. trade talks with the EU or China

Conflicts in the Middle East, Ukraine, or Taiwan

Sudden sanctions or energy shocks

Crisis headlines can fuel quick rallies. Peace deals or a stronger dollar? That could send Gold lower.

Pay attention to mining activity: An increase in:

New mine approvals

Large-scale M&A between miners

Expansions into lower-grade ore zones

…usually signals that the industry sees higher prices ahead.

But if the sector starts expanding too fast, it can also mark the top of a cycle—just like in past commodity booms.

Bottom Line: Embrace the Uncertainty

Sekera’s $1,820 call is a good reality check. No market goes straight up.

But the structural conditions driving Gold's current supercycle—global instability, fiat depreciation, central bank demand, and physical shortages—make his scenario unlikely.

A pullback? Likely.

A full crash? Less so.

As a trader, you don’t need to pick a side. You just need to stay flexible, watch the signals, and be ready to pivot. Whether it’s $2,300 or $5,000, Gold will move—and your job is to be ready either way.

Gold might stumble, but it's not about to break.

Safe trading,

and remember: All that glitters is not Gold,

Joe

Disclaimer:

The information provided here is for educational and informational purposes only. It does not constitute financial or trading advice, and it should not be taken as such. You should conduct your own independent research and consult with a qualified financial professional before making any trading or investment decisions. All forms of trading and investing involve risks, and past performance is not indicative of future results.