Are We Running Out of Gold? The Truth Behind London’s Supply Crisis—And How to Profit from It

Hello, fellow traders!

Gold is making history.

Prices are smashing record highs, physical Gold is vanishing from London vaults, and institutional giants are moving massive quantities of bullion across the Atlantic at an unprecedented pace.

Is this just another market anomaly, or is the world’s most important Gold trading hub quietly running out of supply?

If London can no longer meet its Gold obligations, the entire global pricing mechanism could be on the verge of breaking.

Let’s explore the hidden forces driving this crisis, what it means for Gold pricing and trading in the future, and—most importantly—what you, as a Gold trader, can do to prepare.

Gold’s Recent Explosive Moves

In late January, Gold catapulted to a new all-time high, defying virtually every piece of conventional market wisdom.

Normally, you’d expect precious metals to dip when the dollar firms or when the Federal Reserve sounds hawkish on interest rates.

Instead, Gold powered higher.

The official reasons offered up by the media were dizzying: expectations for new tariffs on various imports, a surprising GDP downturn, a hold on interest rate cuts, and a softening dollar.

But behind these headlines lies something more subtle—and possibly more significant—than run-of-the-mill economic indicators.

The London Gold Market Is Running Dry

The global market operates through two major hubs:

COMEX (New York) – Where futures contracts are standardized, traded, and frequently settled in cash rather than metal.

LBMA (London) – A loosely structured over-the-counter system connecting bullion banks, refineries, central banks, and large institutional players. Here, the trade is more about actual physical bullion, typically in the form of 100-ounce or 400-ounce bars, though huge trades can exist purely on paper as well.

For decades, the system functioned smoothly because the two markets were linked through an "Exchange for Physical" (EFP) mechanism.

In theory, if you hold a COMEX futures contract, you can exchange it for a physical position sourced out of the London market. This is how the “paper” side and the “metal in vaults” side stay in sync.

But lately, EFP swaps have gotten messy.

Why?

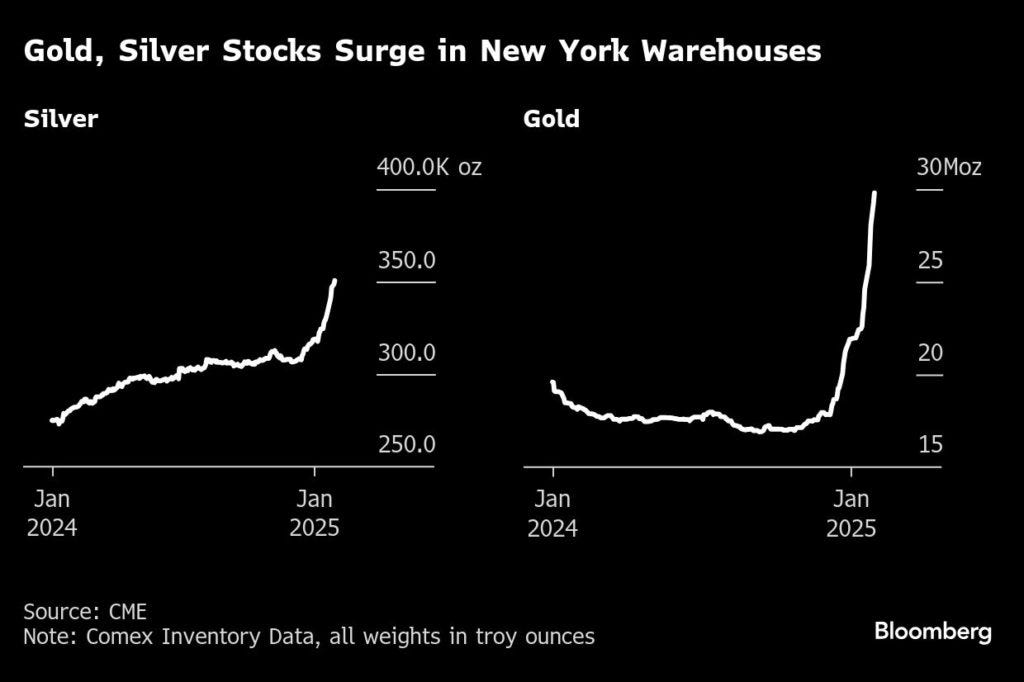

One large factor: enormous shipments of bullion have been leaving the UK for the United States as financial institutions move a reported 70–75% more Gold into COMEX-approved vaults than usual.

By some accounts, at least 350–400 metric tons made the jump from London to New York during a 6–8 month period.

The withdrawal backlog at the Bank of England—one of the world's largest Gold custodians—has ballooned from just a few days to eight weeks.

None of this is normal.

For decades, London has served as the heart of the global Gold trade, managing liquidity for central banks, hedge funds, and institutional investors.

But if London is struggling to fulfill orders, it raises a critical question:

Is there actually enough physical Gold to meet global demand?

What’s Exactly Causing The Gold Shortage Panic?

To say “Gold shortage” can be misleading—there is Gold in the ground and plenty above-ground in vaults.

However, the shortage is in the readily deliverable Gold that meets very specific standards (weight, purity, origin) and that can be moved quickly under the current logistical and regulatory environment.

Multiple factors are driving the Gold exodus from London and causing supply squeeze.

1/ Tariff fears

Trump has already floated 25% tariffs on steel and aluminum, and traders fear that Gold could be next.

Would tariffs on Gold really make sense?

Probably not.

Since technically, Gold is designated in the U.S. as a “monetary metal,” which in normal times means it’s not subject to the same duties as steel or agricultural commodities.

Still, the mere possibility of unpredictable new regulations has banks deciding they’d rather store their Gold on U.S. soil—just in case.

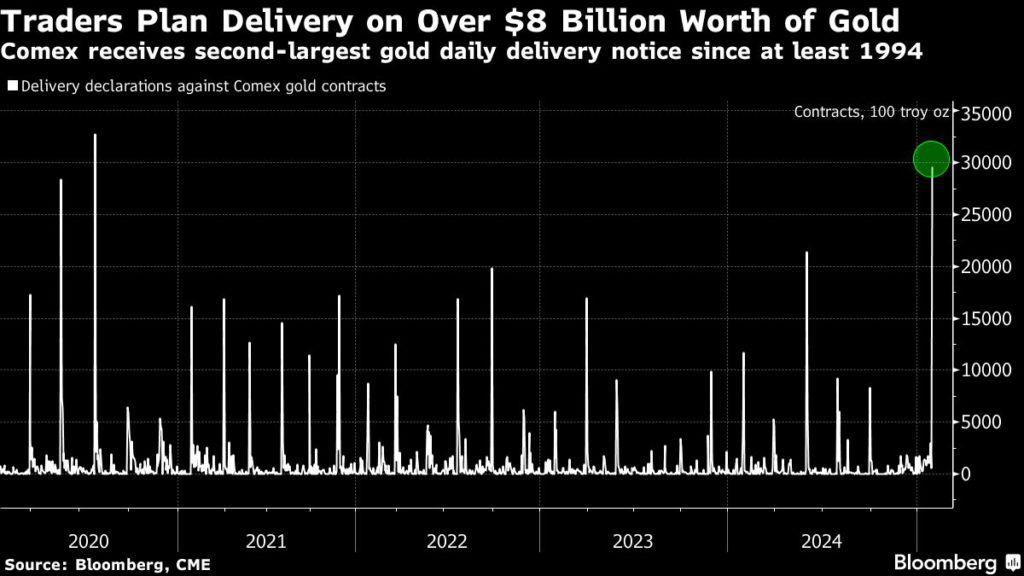

COMEX alone has amassed $39 billion worth of physical Gold since the U.S. elections, a sharp increase that suggests financial institutions are preparing for potential disruptions in the global Gold market.

Whether or not such tariffs ever materialize is almost beside the point.

Markets hate uncertainty, and in an environment where trade disputes can flare up overnight, big players would much rather move the metal first and ask questions later.

2/ Logistical backlogs

At the Bank of England, which holds one of the world’s largest stashes of bullion, reported wait times for withdrawals jumped from about 3-5 days to as long as 4-8 weeks.

Air freight capacity became a bottleneck.

A 400-ounce bar can’t just be shipped overnight in a regular FedEx box. Insurance, security escorts, and specialized carriers must line up perfectly.

During peak seasonal demand (especially around the year-end holiday cargo rush), flights that could haul Gold were scarce, leading to shipping delays.

3/ Extreme paper-to-physical leverage

In the LBMA/COMEX system, it’s common to trade far more “paper Gold” (futures, swaps, forwards) than actual bars exist.

The widely cited ratio of “paper vs. physical” can be anywhere from 70:1 to over 150:1, depending on whose data you use.

Many Gold bars are “leased” multiple times. A bullion bank might lease a bar from a central bank, then sell it forward, then that buyer leases it again—resulting in multiple claims on the same original bar.

So long as most holders settle in cash, the system works.

But if enough participants decide to stand up and say, “I’d like my actual metal, please,” the leverage can’t hold. That’s how you get panic, short squeezes, and price spikes.

Right now, we may be seeing the first rumblings of a more profound shift in investor sentiment—where physical possession matters and faith in the “paper claims” model starts to erode.

4/ Central banks, BRICS, and de-dollarization

Gold’s structural problems are intersecting with a broader global narrative: central banks are grabbing Gold with both hands, especially in emerging economies and the BRICS alliance.

According to the World Gold Council, central banks purchases exceeded 1,000 metric tons of Gold in 2024.

Most of that accumulation has been in Asia, the Middle East, and Eastern Europe—regions pivoting away from over-reliance on the dollar. This hoarding in Asia means that less London “Good Delivery” Gold is available for the big bullion banks in Western markets.

India, Turkey, Poland, and China have been particularly aggressive buyers, with China adding 10 metric tons in a span of December 2024.

So it’s one thing for a private investor to decide that Gold is safer than the stock market.

It’s a whole different ballgame when governments and central banks chase Gold. They buy in bulk, and they store it in large 400-ounce bricks.

If enough nations follow this path, even a seemingly vast supply can run short.

Bottom line

We’re in a situation where physical metal is, in theory, out there somewhere—but not necessarily in the right form, in the right place, or available at the right moment to satisfy immediate delivery demands.

When big banks or hedge funds suddenly need 100,000 ounces in a specific vault by next week, that’s when the system can seize up.

Contango vs. Backwardation: What Happens To The Gold Market and Prices

Right now, global Gold prices are largely set by futures in New York and by the over-the-counter market in London.

But imagine a scenario where:

London can’t fulfill deliveries, leading to rumors the metal simply isn’t there in sufficient quantities.

COMEX runs low on deliverable bars because so many institutions demand physical settlement rather than rolling contracts.

Investors flock to alternative bullion markets—Zurich, Shanghai, or private vault systems—because they’re convinced the “official” price is artificially low or supply is artificially constrained.

In that environment, the “paper price” of Gold might become decoupled from the physical price.

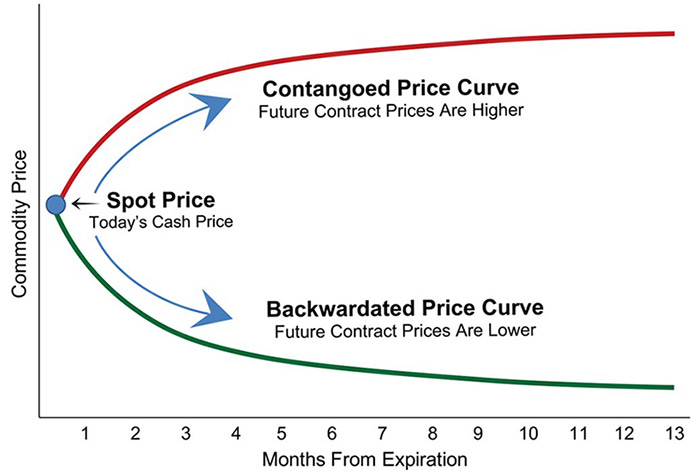

That’s when backwardation occurs - spot metal costs more than future contracts.

Unlike contango, which is the normal state where futures prices are higher due to storage costs and interest rates, backwardation suggests stress in the market—often due to concerns about delivery, liquidity, or geopolitical uncertainty.

For large institutions, central banks, or bullion banks, backwardation can be a red flag.

If major players believe others are aggressively securing physical metal, it can trigger a scramble for available Gold, leading to higher premiums and market distortions.

Possible future scenarios

1/ Short-term backwardation blips

These are usually caused by events like:

Geopolitical crises: A sudden war, major sanctions, or escalations in U.S.-China tensions could cause short-term disruptions in Gold logistics, making immediate delivery difficult.

Central bank interventions: If a central bank, such as China’s PBOC or Russia’s CBR, suddenly purchases a large quantity of Gold, it could push up spot prices while futures remain lower.

Supply chain bottlenecks: Issues in refining, transport, or insurance (e.g., due to sanctions or financial restrictions) can briefly make immediate Gold harder to obtain.

In these cases, backwardation typically lasts a few days to weeks.

The market then normalizes as liquidity improves, arbitrageurs step in, and futures regain their usual premium over spot (contango).

Prices may experience whipsaws, where they surge in response to panic but correct once traders realize the supply chain issues are temporary.

2/ Extended backwardation

If backwardation lasts for an extended period (weeks to months), it suggests a deeper structural issue—either a loss of confidence in futures contracts or a real physical shortage. This could occur due to:

A failure to deliver Gold on time: If a major bullion bank or central bank delays deliveries, it raises concerns that paper Gold (futures and ETFs) is unreliable, forcing more investors to demand physical metal.

Rising systemic distrust: If traders doubt the credibility of futures markets (e.g., COMEX or LBMA), they might refuse to sell Gold at futures prices, keeping spot prices significantly higher.

A rush to physical ownership: As institutions prefer holding actual Gold rather than paper claims, physical metal can trade at a persistent premium, decoupling from futures.

This situation resembles a "Gold bank run", where everyone demands metal at once.

It could result in price distortions, where Gold in vaults (e.g., Zurich or Shanghai) trades at higher prices than COMEX futures.

If institutions struggle to source physical Gold, backwardation could last several months, causing Gold prices to surge well beyond typical expectations.

3/ Global market fragmentation

In a severe crisis, global Gold markets could break apart, leading to pricing discrepancies between major trading hubs. This could happen if:

London and New York are perceived as unreliable sources: If COMEX or LBMA fail to deliver, alternative markets (e.g., Zurich, Shanghai, Dubai) might establish their own price benchmarks, independent of traditional futures markets.

Nationalization of Gold supplies: Some countries might restrict Gold exports, forcing local buyers to rely on domestic pricing rather than global quotes.

A massive loss of trust in fiat currencies: If investors fear systemic collapse, physical Gold could trade at significantly higher prices than futures, especially in regions where demand for a hard asset is strongest.

In this scenario, premiums on immediate delivery could be $100–$500 per ounce higher than futures prices. The global Gold market would no longer be unified, and arbitrage opportunities would be harder to execute.

6 Key Strategies for Gold Traders in the Current Environment

Here’s how to position yourself to either ride the bull wave if shortages intensify—or protect your downside if volatility spikes in unexpected ways.

1/ Diversify among different forms of Gold exposure

In this environment, it’s wise to blend physical holdings for long-term safety and “paper” instruments (ETFs, futures) for shorter-term trading or hedges.

Physical bars and coins:

In a climate of diminishing trust in paper contracts, fully allocated physical metal in your direct control offers the strongest hedge against a systemic breakdown.

Keep in mind the added costs (storage, insurance), but also the peace of mind that in a severe supply crunch, you won’t be stuck waiting on delivery delays.

Allocated vs. unallocated:

With repatriation and vault delays, it’s critical to hold allocated Gold if you truly want bulletproof ownership.

Unallocated accounts, though cheaper, present the risk that you’ll be just another queue member if a shortage intensifies and everyone starts demanding bars.

ETFs and closed-end funds:

For traders needing liquidity or short-term exposure, ETFs (like GLD or IAU) are still useful. However, be aware these products rely on custodians (often storing Gold in London vaults) whose metal might be in high demand.

If stress in the vault system escalates, large-scale redemptions could test how much physical is actually on hand.

Sprott’s PHYS, partially vaulted outside traditional LBMA structures, is another option for those who want a fund-based vehicle with redemption-in-kind features.

2/ Watch for market stress indicators

Lease rates:

A jump in Gold lease rates means physical bars are harder to borrow—Gold holders know they can demand higher returns if they lease it out. In the current environment where London bars are being shipped to the U.S., lease-rate spikes indicate acute supply stress and are often a harbinger of further volatility.

Consider increasing exposure if lease rates spike while the spot price has yet to catch up to that signal.

Spot-futures price differentials:

If the spot price runs well above the front-month futures contract for an extended period, backwardation is in play. It can be time to scale up physical holdings—the market is effectively telling you that near-term supply is under strain.

Conversely, if COMEX and LBMA prices diverge widely, look for arbitrage opportunities (if you have the scale and logistics) or consider that a sign the system may face disruptions. Professional traders sometimes attempt to profit by delivering into whichever market has a premium, but be mindful that shipping and insuring Gold can negate gains if not planned carefully.

Increased repatriation announcements:

Watch for any new wave of countries repatriating Gold. Such news frequently correlates with higher short-term physical demand—particularly on the LBMA. If multiple mid-sized countries declare repatriation at once, it could deepen the shortage or drive spot premiums higher.

If a major holder (e.g., China or India) suggests intensifying Gold buying or moving reserves, that’s a clear bull signal for physical. Position accordingly, especially if futures prices lag behind the physical scramble.

3/ Use derivatives (but know the risks)

Hedging physical positions with options/futures:

If you already hold significant physical Gold, you can write covered calls or buy protective puts to buffer short-term downside. With spikes in volatility likely, options premiums may become more expensive—but also more rewarding if you’re selling calls.

In a meltdown scenario where physical supply is scarce, derivative markets can turn jumpy, with slippage and wide spreads. Keep an eye on liquidity: if you rely solely on paper instruments, you could be exposed if counterparties can’t deliver. That’s why balancing physical and derivatives is key.

Spreads, calendar trades, and contango plays:

Use calendar spreads if you anticipate short-term disruptions but believe the market will normalize later. For instance, short the near-month (if you believe near-term backwardation or extreme tension will unwind) and go long a further-out contract. But in severe supply crises, the usual contango might vanish, so remain agile.

In a deeply backwardated market, you could profit from rolling a long position from the near month to a cheaper future month—but only if you trust the contract’s eventual delivery.

In the current environment, use common caution caution: if backwardation signals a real physical crunch, normal strategies could backfire if you can’t get delivery at all.

Counterparty risk

With the biggest bullion banks under pressure to source metal, you must vet your clearing firms, brokers, and warehouses.

If you’re running large futures positions, consider distributing them across multiple reputable clearing partners to reduce the risk of any one entity failing to deliver.

4/ Prepare for volatility

Expect and exploit big swings:

If London’s vaults continue draining, or if the U.S. imposes any surprise trade measures on precious metals, intraday $50–$100 moves are plausible. Use wide but carefully placed stop orders or even mental stops if your broker’s slippage risk is high. Understand that “flash spikes” can occur if institutions scramble for metal at the last minute.

Consider straddles or strangles (buying calls and puts simultaneously) around major events (like Fed announcements or high-profile political news) to capitalize on abrupt Gold price lurches.

Accumulate on dips (longer-term):

If your thesis is that central bank accumulation, repatriation, and supply stress in London will drive Gold higher over months/years, add systematically on major pullbacks rather than trying to time a single perfect low.

When you see headlines of delayed deliveries or big inventory drawdowns at COMEX or LBMA vaults, that can reinforce the bullish narrative—these logistical strains often presage price rallies.

5/ Consider jurisdictional diversification

Multiple vaults, multiple countries

In a shortage scenario, you don’t want all your eggs in one basket—especially if that basket is under regulatory or political threat. Large private clients often store part of their bullion in Switzerland (Geneva, Zurich) or Singapore, known for stable regimes and strong property rights.

If your core exposure is through London ETFs, think about complementing it with allocated storage in the U.S. or Asia. This hedges against potential regional issues like extended customs holdups, local taxes, or emergency measures restricting gold flows.

Capital controls and political risk:

In an extreme crisis, governments can impose restrictions or even commandeer vault Gold. Although improbable, the risk is non-zero. Hence high-net-worth individuals and funds sometimes split physical holdings to reduce the chance that a single government action locks up all their metal.

Follow policy discussions in major Gold-holding nations. If you sense a turn toward protectionism or if a country’s central bank signals it may reclassify Gold imports, consider shifting a portion of your holdings to a safer jurisdiction.

6/ Stay informed

Real-time data sources

Make a habit of monitoring LBMA, COMEX warehouse stocks, and daily volumes.

Integrate specialized feeds (e.g., Bloomberg, Reuters, or direct exchange APIs) for Gold lease rates and EFP volumes (Exchange for Physical transactions). Spikes in EFP costs can foreshadow delivery chaos and price surges.

Follow reputable analyses and government data

Keep up with World Gold Council releases for quarterly demand/supply metrics and central bank buying trends. Regularly review Refinitiv GFMS or Metals Focus for their updated outlook on global mine supply and consumer demand.

Watch for geopolitical triggers (e.g., tensions with major commodity exporters, currency wars) and track macro drivers such as inflation prints and interest-rate signals from the Fed or ECB.

Adapt fast when the narrative changes

Gold’s role can pivot quickly—from safe-haven to liquidity source in a crisis where traders dump Gold for cash. Understand the nuance: in an immediate stock market crash, Gold might dip initially (as funds liquidate everything) before rallying strongly.

Develop a plan for each “macro shock” scenario, e.g., a big interest rate surprise or official Gold confiscation rumors. Having a prepared playbook helps you react decisively rather than freeze.

Final Thoughts

While Gold inventories have declined from their peak in 2021, there is still a substantial amount of metal in the system. Even after recent withdrawals, London continues to hold hundreds of thousands of troy ounces in reserve.

But that doesn’t mean traders should be complacent.

Massive outflows, tightening supply chains, and increasing demand from central banks signal that we are in the midst of a fundamental shift in the Gold market.

When physical supply starts to feel constrained—even if there's still Gold left—pricing mechanisms can become volatile, and liquidity risks can emerge.

For smart traders, this is a moment to stay ahead of the curve.

Ensure your positions are protected, monitor physical delivery times, and be aware of the growing divergence between paper and physical Gold markets.

If the current trends continue, we could be heading toward a period where owning actual, deliverable Gold becomes far more valuable than holding paper contracts.

The market isn’t empty—yet. But in Gold trading, forewarned is forearmed.

Safe trading,

and remember: All that glitters is not Gold,

Joe