AI is Changing the Gold Game—What It Means for Prices & How to Trade It [5 Key Strategies to Stay Ahead]

Welcome to the world of Artificial Intelligence and Gold

We used to mine Gold with pickaxes—now, it’s all about data and algorithms.

AI is transforming the Gold market in ways most people don’t even realize.

From advanced tech that helps find new Gold deposits to automation that could increase supply, these changes could have a big impact. For traders, AI might shake up the strategies that have worked for years.

Let’s break down:

AI-driven Gold discoveries: will they flood the market and pressure prices?

Mining automation & cost trends: efficiency vs. higher margins for miners.

Gold’s role in AI-powered tech, which is quietly providing a baseline of Gold demand.

5 Insider trading angles and strategies: how to profit from exploration hype, M&A trends, and hidden demand signals.

AI-Powered Gold Discovery: Finding Gold Like Never Before

One of the hardest parts of Gold mining is knowing where to dig.

Traditional prospecting relies on geological surveys, historical mining data, and intuition built over decades of experience. Even with modern geological modeling, mining companies often drill in the wrong places.

The process was expensive, time-consuming, and often fruitless.

AI is now changing that:

✅ Machine learning algorithms quickly sift through enormous data repositories—sometimes billions of lines of geological records—hunting patterns that mere human eyes might miss.

✅ Predictive analytics can forecast not just where the Gold might be, but at what depths and in what concentrations. This is a massive leap from the trial-and-error approach of old.

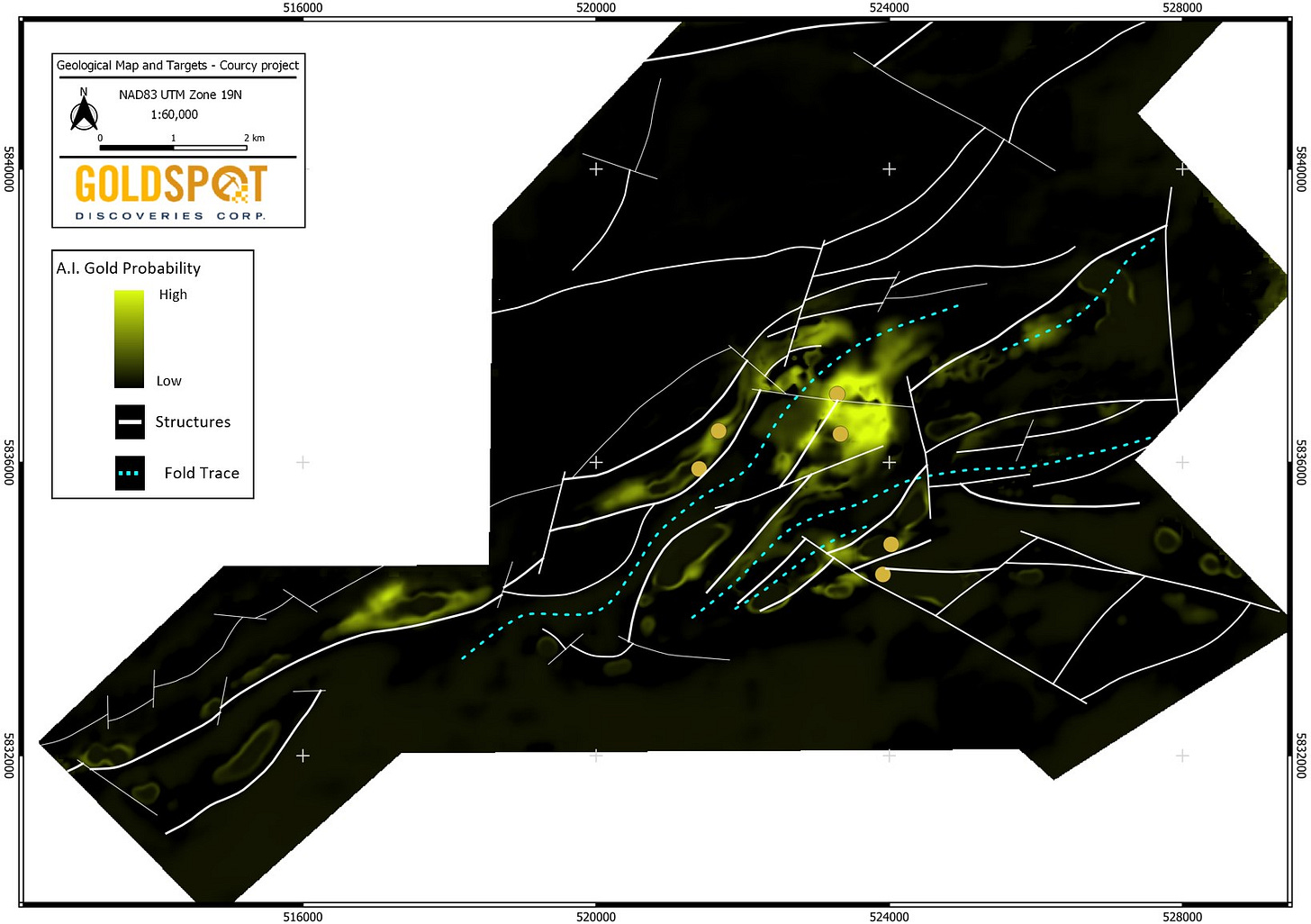

Companies like GoldSpot Discoveries have already used AI to pinpoint high-probability Gold deposits. In one case, GoldSpot’s AI model was able to accurately pinpoint 86% of known Gold deposits in Québec’s Abitibi Gold belt by analyzing just a small fraction (4%) of the area’s data.

In other words, the AI could find almost all the Gold targets while searching only a tiny slice of the terrain – a remarkable increase in efficiency.

This kind of machine-guided targeting can help junior miners compress years of guesswork into months of data analysis and dramatically cut the risk and cost of exploration.

The cumulative effect of all this automation and data-driven insight is a more productive and cost-effective Gold mining industry.

By making exploration and extraction cheaper and more efficient, AI has the potential to unlock massive amounts of previously uneconomical Gold.

But does that mean Gold prices will crash under an avalanche of new supply?

Not necessarily.

More Gold = Lower Prices?

In theory, yes—big new discoveries could weigh on prices, especially if they come online rapidly.

But reality is different.

✅ Development lags: Discovering a deposit is only the first step. From discovery to production, a typical Gold mine takes 10–20 years to develop. Permitting, financing, environmental reviews, and infrastructure all take time.

✅ Rising production costs: The easiest Gold has already been mined over centuries. New finds might be deeper, in more remote locations, or locked in complex ores requiring advanced metallurgical processes. Many AI-discovered deposits may never become viable due to environmental, political, or economic constraints.

✅ Investor demand and monetary policy: Gold isn’t solely driven by supply and demand fundamentals like copper or iron. Geopolitical tensions, inflation, or a sovereign debt crisis can send Gold prices soaring, overshadowing supply trends.

The direct correlation between new discoveries and price pressure is not as simple as it appears.

Historical peaks in Gold production haven’t always triggered a sell-off. Consider how Gold soared above US$1,800/oz in the early 2010s even with abundant mining activity.

Long story short: automation amplifies production potential, but the Gold market remains heavily swayed by macro forces.

AI and Mining Efficiency: Making Gold More Expensive to Mine?

AI isn’t just improving exploration—it’s also optimizing mining operations.

AI-driven automation is already being used to improve efficiency in areas like:

✅ Ore grade control and predictive maintenance

AI can analyze real-time sensor data to distinguish Gold-bearing ore from waste rock with extreme precision.

Instead of sending every chunk of rock to the mill, mines can use AI systems to pick out higher-grade ore and discard barren rock earlier in the process. This boosts efficiency (more Gold from less material) and saves energy.

AI models can also predict equipment failures before they happen, minimizing downtime.

✅ Autonomous vehicles

Picture a remote open-pit Gold mine where massive 400-ton haul trucks rumble along.

In the past, each truck had a driver, subject to human limitations like fatigue.

Today, companies like Rio Tinto (one of the world’s largest mining firms) have begun deploying autonomous haul trucks and drills guided by AI in places like Western Australia.

These robotic trucks can operate 24/7 without breaks, precisely follow optimized routes, and even “talk” to each other to avoid collisions.

The productivity gains are significant – more ore moved with fewer delays – and so are the safety improvements.

The problem: energy and capital costs

However, mining companies that adopt AI need to invest heavily in new infrastructure, sensors, and computing power.

That means higher capital expenditures (CapEx) in the short term, and possibly higher production costs if energy prices remain elevated.

As a result, AI-driven efficiency gains could actually raise the cost of mining, particularly if miners need to upgrade equipment and retrain their workforce.

If AI makes Gold mining more capital-intensive, that could help support higher Gold prices over the long term.

AI and the New Wave of Gold Demand

AI isn’t just reshaping Gold supply—it’s also driving new demand.

Consider that every AI application – from data centers powering AI algorithms to the latest AI-driven smartphones and autonomous vehicles – requires advanced electronics.

And guess what… advanced electronics rely on Gold.

Gold’s superior electrical conductivity and corrosion resistance make it a critical component in high-performance processors, connectors, and circuitry.

For example:

AI chips like Nvidia’s H100 use Gold in their connectors.

AI applications require massive amounts of computing power, increasing demand for Gold-coated connectors and circuit boards.

AI-powered robotics and vehicles use Gold in their sensors and communication systems.

The more we build AI hardware, the more Gold is needed.

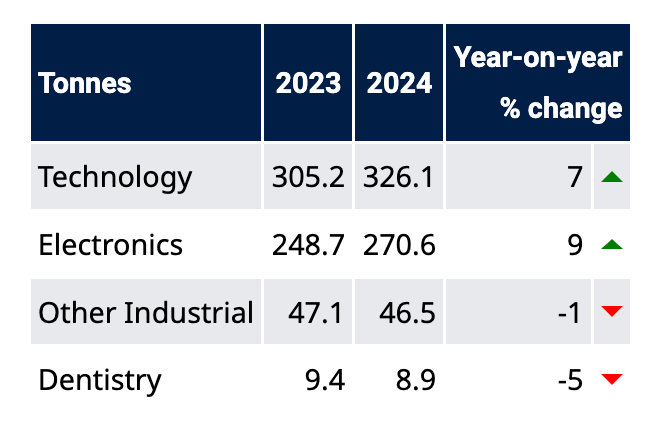

In 2024, Gold used in the technology sector (much of it for electronics) jumped by 7%, an increase of 21 tonnes year-over-year, largely thanks to the boom in AI and related tech.

This additional demand might seem small relative to the thousands of tonnes used for jewelry and investment, but it’s significant – especially because it marks a shift from substitution to resurgence.

While manufacturers have been trying to reduce their Gold usage for years, AI’s demand for ultra-reliable computing components could make it harder to cut Gold out of the equation.

Over time, if AI truly becomes as ubiquitous as electricity, the steady pull of industrial Gold demand could lend support to Gold prices, providing a sort of “floor” from the tech industry’s appetite.

AI-Driven Trading: Market Panics, and Systemic Risk

Away from the actual mining sector and electronics demand, some argue that AI can cause unforeseen instabilities in financial markets.

A wave of algorithmic trading, “black box” hedge funds, and high-frequency strategies might accelerate panic selling during market stress.

Everyone using the same large language models or identical AI-driven signals can produce herding effects. This has repeatedly spelled trouble in historical “flash crashes” and extreme volatility events.

For example, Gold experienced a sudden “flash crash” one night in August 2021, where it dropped 4.5% in a span of 15 minutes.

While that event had multiple causes (economic news and thin trading conditions were factors), the speed and severity hinted at algorithmic trading amplifying the drop once certain technical levels were breached – a reminder that AI and high-frequency algorithms can sometimes accelerate moves beyond what fundamentals alone would dictate.

If an AI-induced liquidity crunch hits the broader stock market, Gold, ironically, might benefit once the initial wave of margin calls subsides.

For Gold traders, the question becomes:

If a major AI equity bubble pops, do we see an amplified flight to Gold? Or does a broader liquidity crunch drag everything lower?

Historical precedent (think 2008–2009) suggests that, after an immediate deleveraging, Gold often finds renewed support as investors seek monetary safety.

What It Means for Gold Prices and Your Strategy: 6 Actionable Takeaways

Gold remains, by its very nature, a monetary metal first and foremost—driven by safe-haven flows, macroeconomic forces, and investor psychology.

However, AI can and will shape supply dynamics, cost structures, and industrial usage trends.

Here’s how to track those shifts and integrate them into your broader strategy.

1/ AI-driven exploration

More Gold deposits might be located, eventually increasing supply. But lengthy development timelines could keep supply muted for years.

🎯 Trading angle:

🔒 BEHIND THE PAYWALL🔒

Unlock 5 actionable trading strategies to track AI’s impact on Gold in real time and to spot hidden demand signals.

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.