Hello, fellow traders!

My custom Gold Spotter indicator is designed to predict potential Gold price reversals 3–5 days ahead of traditional charts.

But let’s be real: a single indicator, no matter how good, isn’t enough to give you that extra shot of confidence in your trade.

That’s why I always cross-check bullish Gold Spotter signals with other markets. I’ve already covered how to combine it with DXY & Bond Yields here.

Today, let’s talk how to use crude oil and major stock indices alongside Gold Spotter to back up your Gold trades.

Why Check Other Assets?

Gold doesn’t move in isolation.

It often reacts to big-picture shifts in market sentiment and the global economy.

If you want to fully grasp why and when Gold might swing up or down, you’ve got to keep tabs on other major markets that can influence it.

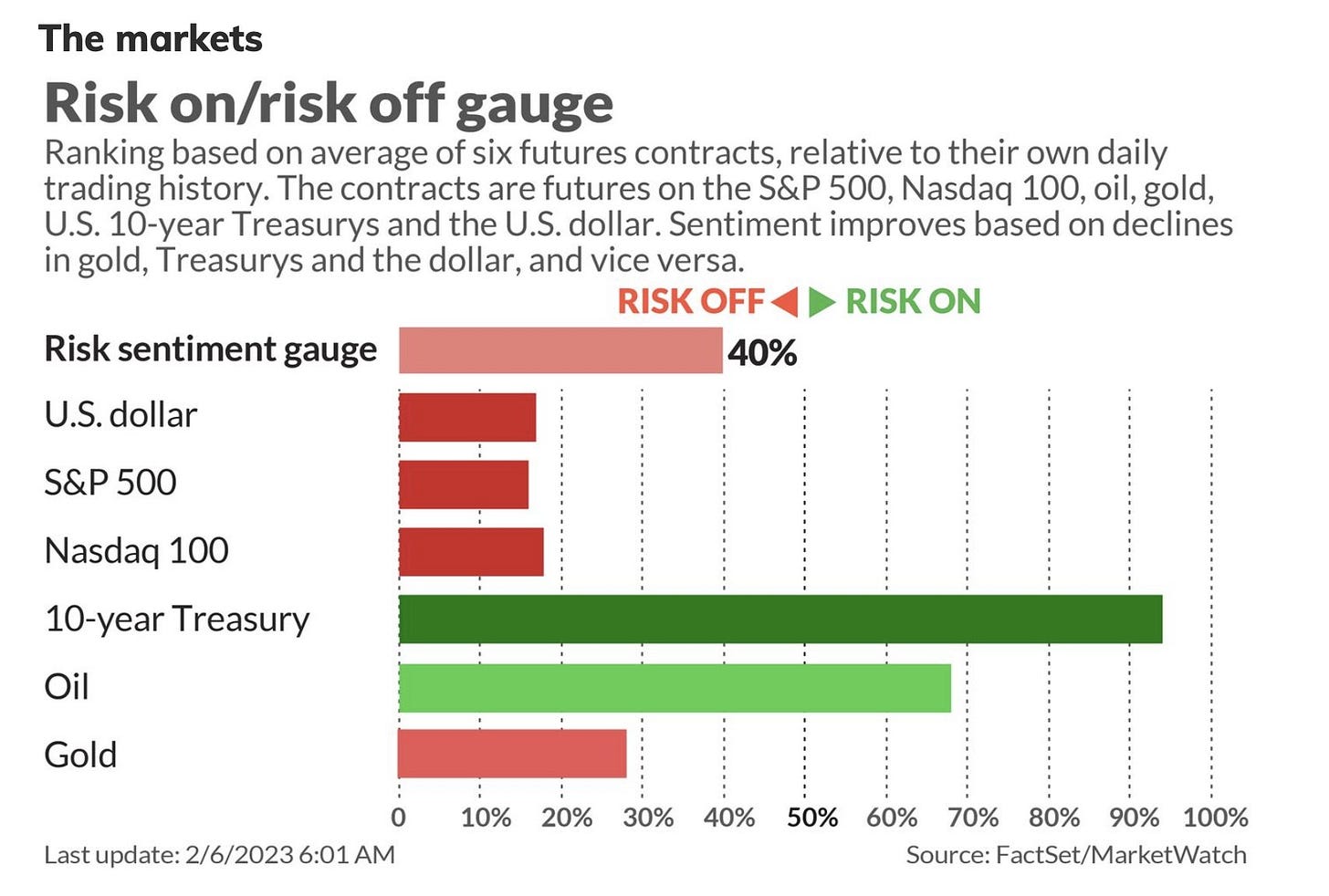

Equities: gauging risk appetite

🚀 Risk-on: When stocks are soaring (due to solid earnings, low interest rates, or loose monetary policy), Gold can still climb—especially if people are worried about inflation or a weak U.S. dollar.

⚠️ Risk-off: When fear or uncertainty grabs the market (recession concerns, geopolitical crises), equities usually take a hit. In these environments, many investors flock to Gold for its safe-haven status.

📖 Example → 2008 Crisis:

Before the 2008 crash, credit spreads widened and volatility crept up, even as equities hovered near highs.

Traders who spotted these early warning signs—like widening junk bond spreads and falling financial stocks—could have gone long on Gold ahead of the major risk-off move.

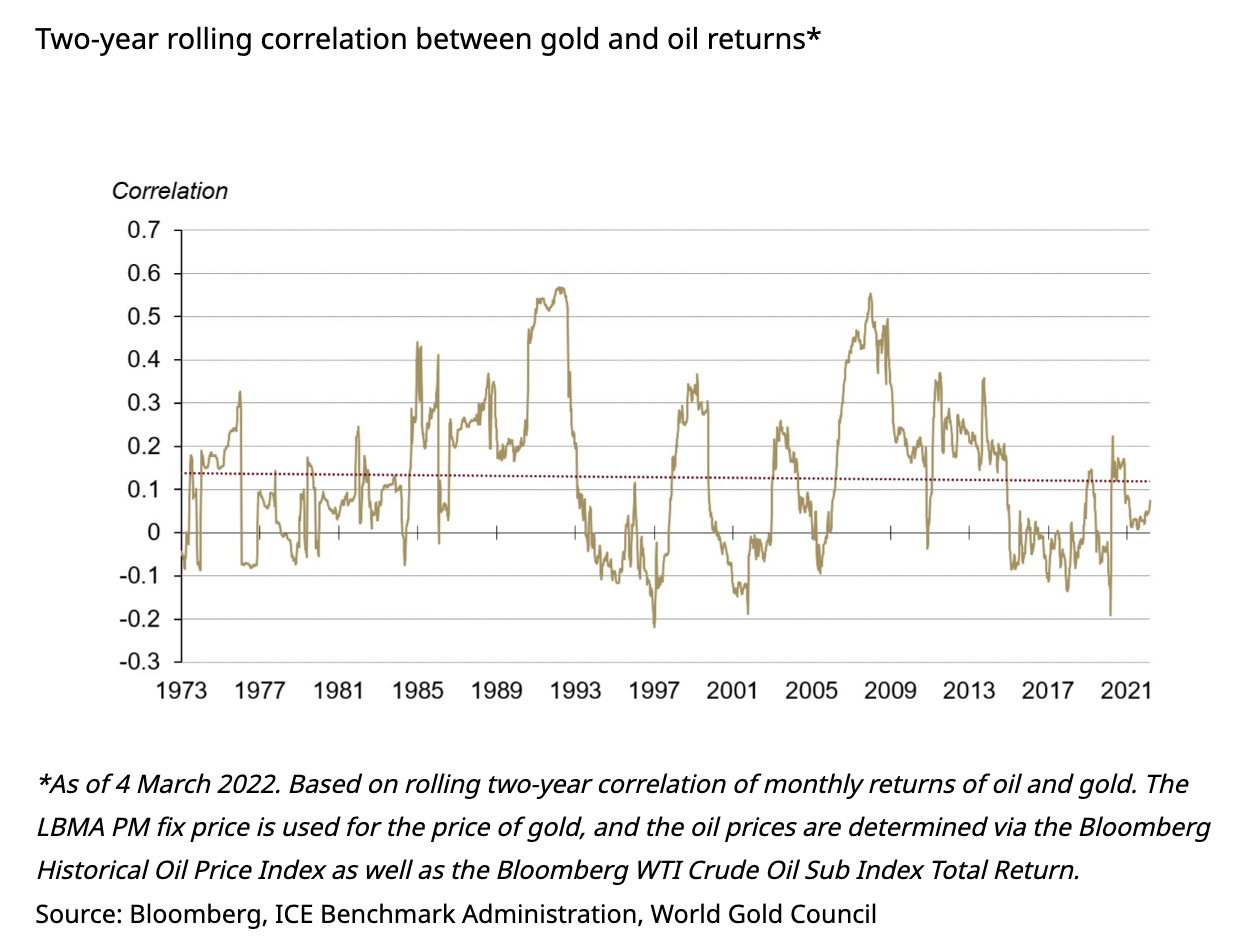

Crude oil: inflation & geopolitical bellwether

There’s no strict “oil up = Gold up” rule—sometimes their correlations are all over the place.

But in general, strong oil prices can stoke inflation fears, which often boosts Gold demand.

That doesn’t mean Gold automatically soars every time oil ticks higher. It’s more that the same drivers (geopolitical tensions, supply cuts, robust global demand) that lift oil also tend to fuel inflation concerns.

Important to mention - if oil tanks later, it doesn’t instantly doom Gold.

Thanks to its deep liquidity and safe-haven appeal, Gold often holds up even when oil tumbles. Some traders might bail, but long-term investors still hold Gold for diversification.

📖 Example → 2022 Russia-Ukraine war:

Oil often reacts before Gold fully prices in a major event.

Before the Russia-Ukraine conflict escalated, oil was already climbing on fears of supply disruptions. Equities were shaky, but not in full panic mode yet.

Sharp traders spotted the early signals—rising oil + nervous equities—and jumped into Gold ahead of the crowd, anticipating the bigger market reaction later.

Bottom line

Paying attention to crude oil and major stock indices offers a quick macro “reality check.”

If oil and stocks both suggest a shift in the market’s mood, Gold is likely to feel it too.

How the Gold Spotter Fits In

The Gold Spotter indicator processes various currency-basket signals, smooths them, and then offers a dynamic “final output” about where Gold prices might go in the coming days.

It’s essentially tracking money flows into or out of Gold by focusing on Gold’s momentum vs. specific currency baskets.

If Gold Spotter flashes bullish and you also see:

✅ Oil trending higher → Supports the inflation narrative, reinforcing Gold demand.

✅ Equities trending lower → Classic risk-off move, pushing investors into Gold.

it’s a big thumbs-up for your Gold trade. Multiple markets are echoing the same sentiment.

What if there’s a mismatch?

A bullish Gold Spotter reading with no supporting moves in oil or stocks doesn’t kill the signal—it just means the bullish driver might be more niche, like currency flows or a local event. You could still go long but manage your risk a bit tighter.

Overall, the Gold Spotter doesn’t just ignore the rest of the world—its underlying design naturally tracks many of the same macro undercurrents that show up in oil or equity market trends.

4 Practical Steps for Using Multi-Asset Confluence

1️⃣ Quick trend checks

Crude Oil (CL1!)

📈 Uptrend → Suggests inflationary pressure or strong growth, which often supports Gold.

📉 Downtrend → Could signal an economic slowdown, but that might still benefit Gold if markets shift into risk-off mode.

Major Stock Indices (SPX, NDX, DJI)

📈 Stocks rising → A risk-on signal, but Gold can still climb if inflation fears or weak real yields are in play.

📉 Stocks dropping → A classic risk-off move, often pushing investors into safe-haven Gold.

2️⃣ Match up the narratives

You can’t just look at raw price moves; you need to understanding why these markets are moving.

When Gold Spotter turns bullish, keep these factors in mind:

Supply & demand dynamics

Crude Oil (

CL1!):Watch OPEC decisions, U.S. shale output, and geopolitical risks.

Supply cuts (e.g., OPEC reducing output) → Oil prices rise → Inflation concerns → Gold demand increases.

Production surges or weak demand → Oil falls → Could signal economic slowdown → Potential Gold upside from risk aversion.

Watch the futures curve (contango vs. backwardation). A shift from contango to backwardation signals tight supply or strong demand, both of which can fuel inflation fears and boost Gold.

Equities:

Look beyond index levels—check market internals.

If only a few mega-caps are rallying but most sectors are weak, risk appetite might be lower than it looks.

Cyclical sectors (industrials, discretionary) lagging while defensives (utilities, staples) outperform? That’s a risk-off signal, often bullish for Gold.

Monetary policy

Dovish Fed/ECB → Supports both risk assets & Gold (weaker dollar, easy money).

Hawkish Fed tightening aggressively → Can shake equities & oil. Gold may still hold up if markets panic and shift to safe havens.

Geopolitics

Oil-producing region tensions → Oil spikes → Inflation fears → Gold benefits.

Trade wars, sanctions, conflicts → Equities suffer, Gold rises.

Investor sentiment & flows

Hedge funds, pension funds shifting from stocks to Gold? A strong safe-haven signal.

Watch ETF inflows—if Gold ETFs see huge demand while stocks look shaky, that’s confirmation of risk-off behavior.

If oil is rallying because of a bullish global growth outlook, equities might also be up on the same optimism. Gold could gain if inflation or currency weakness is a secondary fear in the background.

Extreme divergences

Oil surging on supply issues but equities crashing on recession fears? Gold could go either way.

Which macro story is stronger - inflation or stagnation? Look at bond yields and the U.S. dollar for clues. A falling USD can support Gold even if risk sentiment is mixed.

3️⃣ Multi-Timeframe Check

Look at weekly/monthly charts of oil & equities alongside your shorter-term Gold analysis.

✅ If higher timeframes align with your Gold Spotter signal, that’s a confidence boost.

⚠️ If they contradict, expect choppy price action.

4️⃣ Sentiment & Positioning

VIX (Equity Volatility) spiking? That’s fear in the stock market, which typically benefits Gold.

Crude Oil Volatility climbing? It can signal broader market stress—again, possibly good for Gold.

ETF Flows into Gold or big short bets on equity indexes? Another clue that investors are rotating into safe havens.

Your Confluence “Cheat Sheet”

When Gold Spotter signals long, run through this quick checklist:

✅ Gold Spotter bullish?

✅ Crude oil trend supports inflation or risk-off?

✅ Equities align with safe-haven or inflation narrative?

✅ Monetary policy, geopolitics, & sentiment confirm the setup?

✅ Multi-timeframe trends back it up?

If all check out, high conviction trade.

If not, adjust risk accordingly.

Multi-asset confluence isn’t about overcomplicating—it’s about trading with clarity.

By analyzing crude oil and equities alongside Gold Spotter, you avoid blind trades and align with macro trends, making your Gold entries stronger and risk management sharper.

Safe trading,

and remember: All that glitters is not Gold,

Joe