I've been trading Gold for over a decade, and let me tell you—I’ve never seen the bond market this unhinged.

U.S. Treasuries are trading like risk assets.

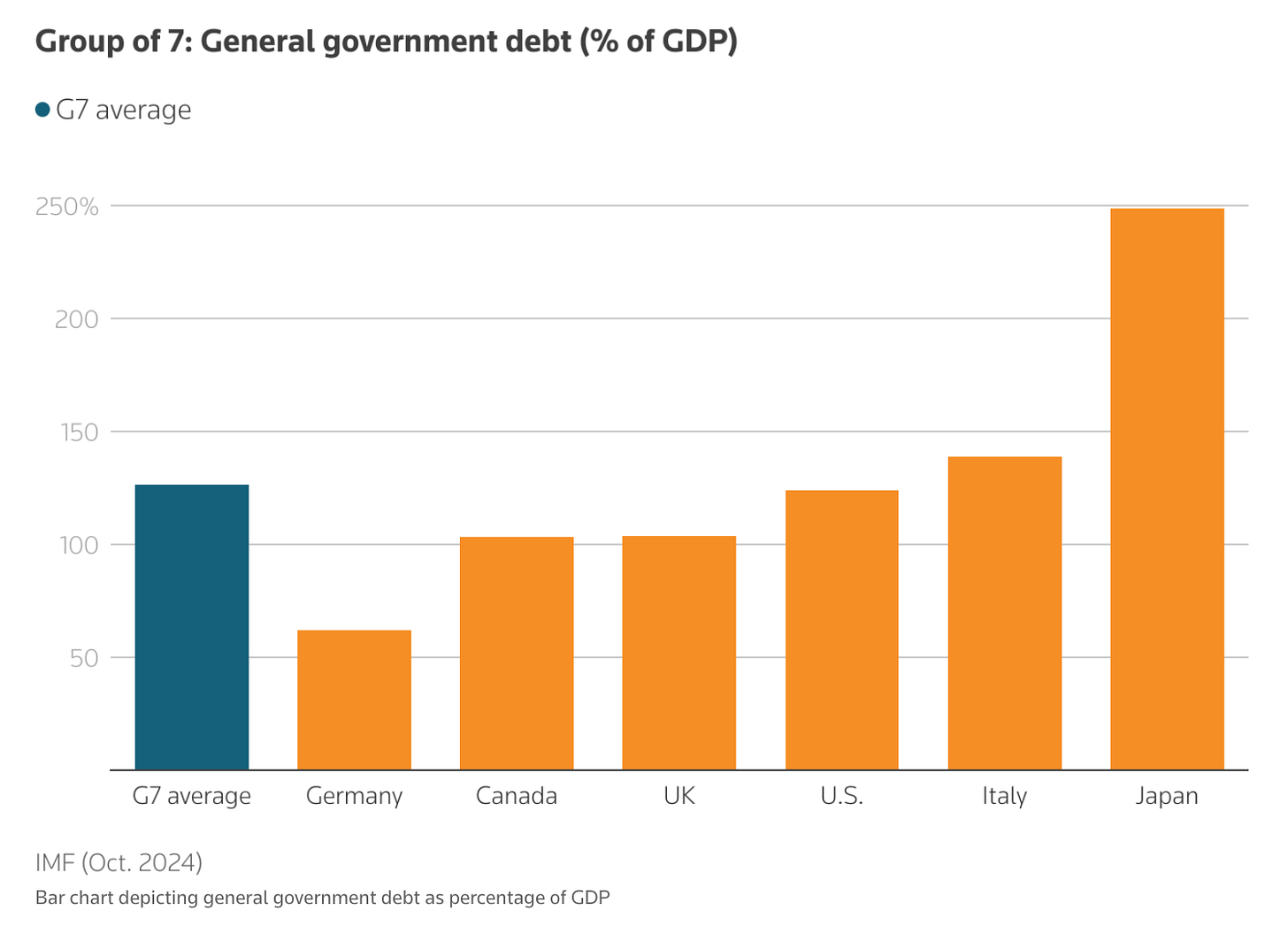

Japan’s debt situation makes the U.S. look conservative.

And across Europe, yields are ripping higher.

If history teaches us anything, it's that this level of bond market turbulence is often the first sign of bigger trouble. Just think about the 2008 financial crisis or Europe's sovereign debt debacle.

Gold traders know precious metals thrive when markets panic, but many underestimate how fast things escalate once yields hit critical levels.

So, here's my take: This might be this may be the last chance to buy Gold cheaply before everything recalibrates—and I mean drastically.

Let's break down:

what's happening in the bond markets of the U.S., Europe, and Japan,

why sovereign credit stress triggers Gold rallies,

what immediate catalysts make right now the critical moment to act.

And because theory isn't enough, I’ll provide 6 specific, actionable trading strategies to help you capitalize effectively.

Sovereign Debt Crisis—Why Everyone’s Freaking Out

If you've been paying attention to the bond markets lately (and if you trade Gold, you absolutely should be), things are looking genuinely weird.

Sovereign bonds, traditionally safe and boring, are now imploding in ways that should keep any rational trader awake at night.

America’s debt spiral

Take the U.S., for instance.

America’s debt-to-GDP ratio recently hit 120%—which, by the way, is higher than it was after World War II.

Even Treasuries—those famously "risk-free" bonds—are now demanding yields around 5%.

Imagine the world’s safest asset suddenly acting like a tech startup stock—that’s how weird things have gotten.

With interest payments ballooning, America’s budget is under immense strain.

Japan’s bond market is melting down (and it matters)

Then you’ve got Japan, a country that makes the U.S. look downright responsible.

Japan's debt-to-GDP ratio is a staggering 235%.

The Bank of Japan (BOJ) now holds half of this mountain of debt—but even their massive purchases haven’t stopped 30-year yields from hitting a disturbing 3.14%.

Prime Minister Ishiba himself admitted it’s "worse than Greece."

Recently, the BOJ even started quantitative tightening.

So here's the big question: if the BOJ is now selling, who's left to buy without demanding much higher yields?

Recent bond auctions in Japan were disasters, signaling that buyer demand is evaporating faster than anyone anticipated.

Contagion is real and spreading

This isn’t just about Japan.

When Japanese insurers started dumping U.S. Treasuries to cover their losses at home—selling off about $119 billion in one quarter—it set off a chain reaction.

German yields jumped a whopping 80%. French yields hit 4.6%.

It's like pulling one piece from the bottom of a Jenga tower—suddenly the entire structure is wobbling.

The classic 60/40 portfolio? To me, that's toast.

Why bonds are suddenly toxic

Let’s simplify the mess: decades of cheap money encouraged governments everywhere to load up on debt. And now, just when balance sheets are more bloated than ever, interest rates are climbing.

It’s a toxic combo.

Global debt ballooned from around $5 trillion in 1971 to roughly $360 trillion today—that's a staggering 75 times increase since Nixon took us off Gold.

And we're not even counting unfunded liabilities or the shadowy $2+ quadrillion derivatives market tied to all this debt.

A tipping point seems near.

Bonds could crash, banks might freeze withdrawals or force depositors into absurdly long-term bonds at zero interest. And of course, currencies, especially the dollar, could take a massive hit.

The real crisis here isn’t just financial—it's about losing trust in the entire system.

Moody’s downgrade of U.S. debt to Aa1 was a wake-up call that the $36 trillion (and rising) U.S. debt pile isn’t something markets can ignore any longer.

The ratings agency essentially echoed what bond markets were signaling: if you keep printing and spending, we will make you pay (via higher yields).

Fitch and S&P had already downgraded the U.S. years ago, but Moody's finally broke the illusion of America’s unshakeable creditworthiness.

The UK, Italy—similar stories everywhere you look.

Even the IMF is getting nervous, flagging that rising yields amid cooling inflation point to deep, structural fiscal trouble.

Historical Echoes: We've Been Here Before

If this feels overly dramatic, let’s step back for a quick history lesson:

2008 financial crisis

We remember how the 2008 subprime mortgage fiasco quickly morphed into a global bond market disaster.

During that chaos, Gold soared from around $700 to almost $1,900 per ounce, outperforming virtually every other asset as trust evaporated.

Zimbabwe’s hyperinflation

I witnessed firsthand Zimbabwe’s implosion in the late 2000s. The government’s endless money-printing led to hyperinflation so wild, you needed trillion-dollar notes to buy basic groceries.

Gold swiftly became the preferred currency—jumping from about $400 to well over $1,000 per ounce, even measured in stable currencies like the USD.

Greece’s crisis

Greece, during its 2010–2012 crisis, saw bond yields rocket above 35%.

The bailout drama pushed Gold priced in euros to record highs (over €1,300 per ounce). Meanwhile, Gold in dollars surged from around $1,100 to nearly $1,800.

History keeps repeating this simple lesson: when sovereign debt spirals out of control, currencies collapse and Gold wins.

Every previous "solution"—currency debasement, money-printing, bailouts—just reaffirmed Gold's role as genuine money.

Given the current scale (we're talking trillions in debt, major economies teetering), the next Gold repricing could be monumental.

Why Sovereign Debt Weakness Fuels Gold

So, now we’re clear on how badly sovereign bonds are freaking everyone out—let’s unpack why that’s incredibly good news for Gold.

To put this simply: when faith in governments and their ability to manage debt starts slipping, investors naturally hunt for safety and stability.

Gold checks both those boxes beautifully:

✅ It’s tangible,

✅ free from credit risk,

✅ and universally recognized as a store of value.

Here’s how the domino effect typically plays out:

Sovereign debt downgrade or fiscal panic

→ Bond prices fall (and yields spike). Investors now demand higher returns to compensate for the risk—exactly what's happening in Japan and U.S. Treasuries right now.Investor anxiety mounts

→ Losses in "safe" assets (like government bonds) scares investors. They rush into truly safe havens—assets without counterparty risk. Assets that have survived humanity’s worst financial blunders.Money flows into Gold

→ Unlike fiat currencies, Gold can't just be printed to oblivion. This makes Gold the ultimate anti-debt, anti-inflation play.

We saw this play out spectacularly between 2008 and 2011.

Back then, Gold surged even faster than the Fed could expand its balance sheet. Investors saw negative real interest rates and endless money printing, making bonds and cash look downright awful.

Treasuries bought in 2008 yielded basically nothing, with inflation quietly eating away the principal. Meanwhile, Gold investors watched their holdings rocket upward.

Modern Gold demand surge

Today, several powerful trends are pushing Gold back into the spotlight.

Take the U.S.:

The Treasury is flooding the market with bonds to finance massive deficits (now over 7% of GDP—even at full employment).

Foreign buyers like China and Japan have started stepping back, which means yields have to rise to entice private investors.

But higher yields make the debt burden even heavier—a nasty cycle.

It's no accident that Gold ETFs saw their biggest quarterly inflow in three years during Q1 2025.

Investors poured in 226.5 tonnes (a cool $21.1 billion), sensing political and economic trouble ahead.

Total ETF holdings hit 3,445 tonnes—the highest in almost two years.

Clearly, smart money Gs gearing up for stormy weather, using price dips as chances to load up on gold.

And this was all before Moody’s downgrade.

Even at COMEX, something unusual is happening: big players are demanding physical Gold delivery instead of rolling over paper contracts.

In May 2025 alone, COMEX Gold deliveries surged by an eye-popping 718% year-over-year. Over 22,500 contracts (about 70 tonnes) requested physical Gold versus just 2,750 contracts the year before.

People don't want paper promises—they want metal in their hands.

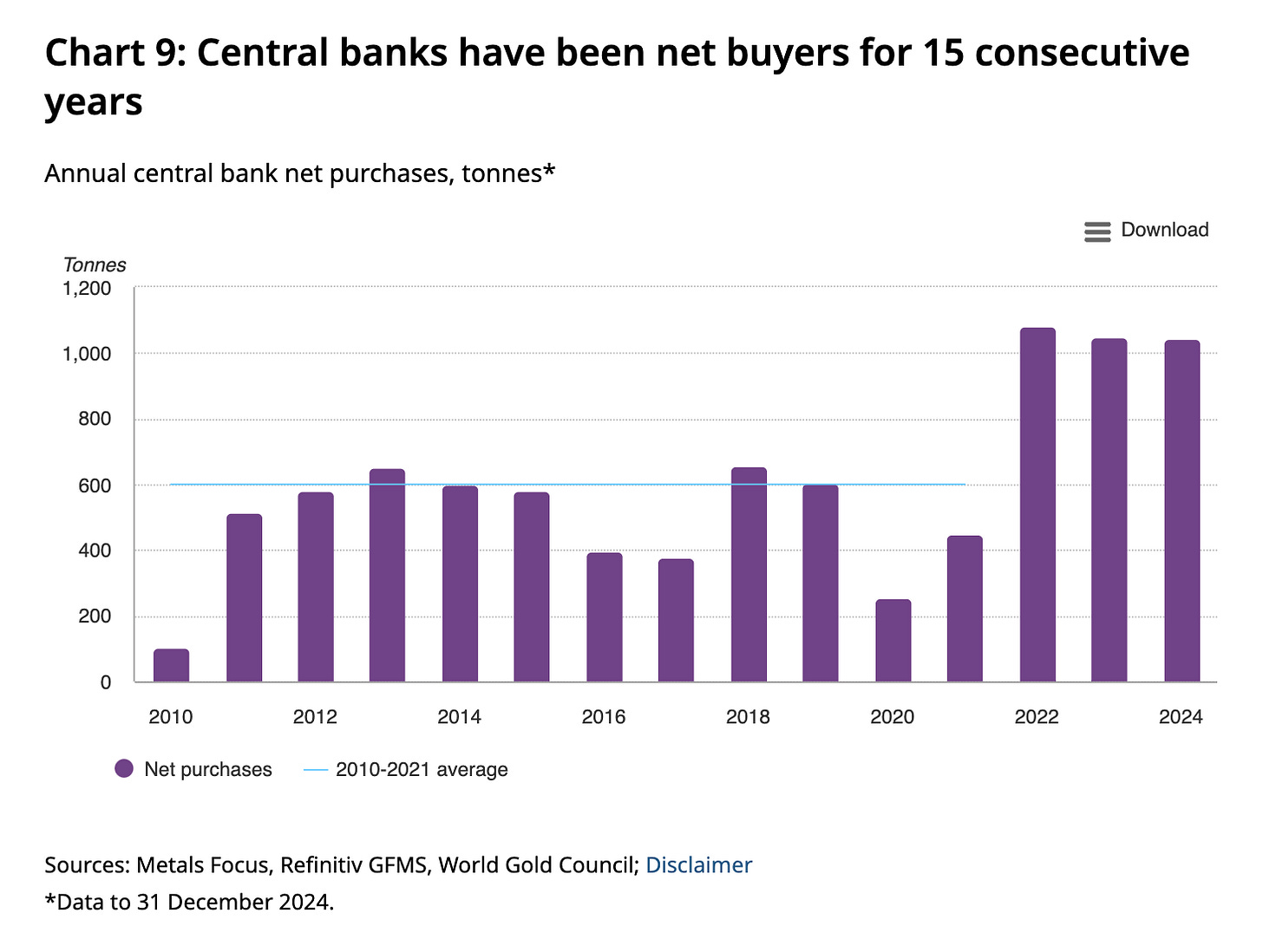

Then there’s the ultimate insider indicator—central banks.

They’ve been quietly stockpiling Gold reserves at record levels, even as prices climbed.

Gold’s nearly 27% jump in 2024 was partly driven by these central bank buys.

2022: +1,083 tonnes.

2023: +1,050 tonnes

2024: + 1,045 tonnes.

This is far beyond their average buying habits. These aren’t isolated purchases either.

Countries from Poland (buying up 90 tonnes) to various emerging markets have jumped in.

Central banks clearly know something big is brewing.

It’s not just about inflation

Interestingly, Gold isn't rallying just because people are afraid of inflation.

Inflation pressures have actually eased a bit lately.

Instead, Gold is rising because investors and central banks are worried about systemic risks. They see Gold as the only true hedge against broad financial chaos—a safe, zero-counterparty-risk asset.

As old traders like to say, "Gold is the currency of last resort."

And judging by the markets, it seems everyone is starting to remember that.

Why Now Is a Narrow Window To Buy Gold Cheaply

Gold has already moved sharply higher and you might be wondering: did I miss my chance?

My take: definitely not.

In fact, the next couple of months could offer a brief but crucial window to jump in before Gold makes its next big move.

Here's why the urgency:

1/ The June BOJ meeting—A global game-changer

Japan is basically the financial world's early warning system.

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.