Moody’s Downgrade: Why The Ratings Drop Matters More Than It Seems [Is This Gold’s Big Moment?]

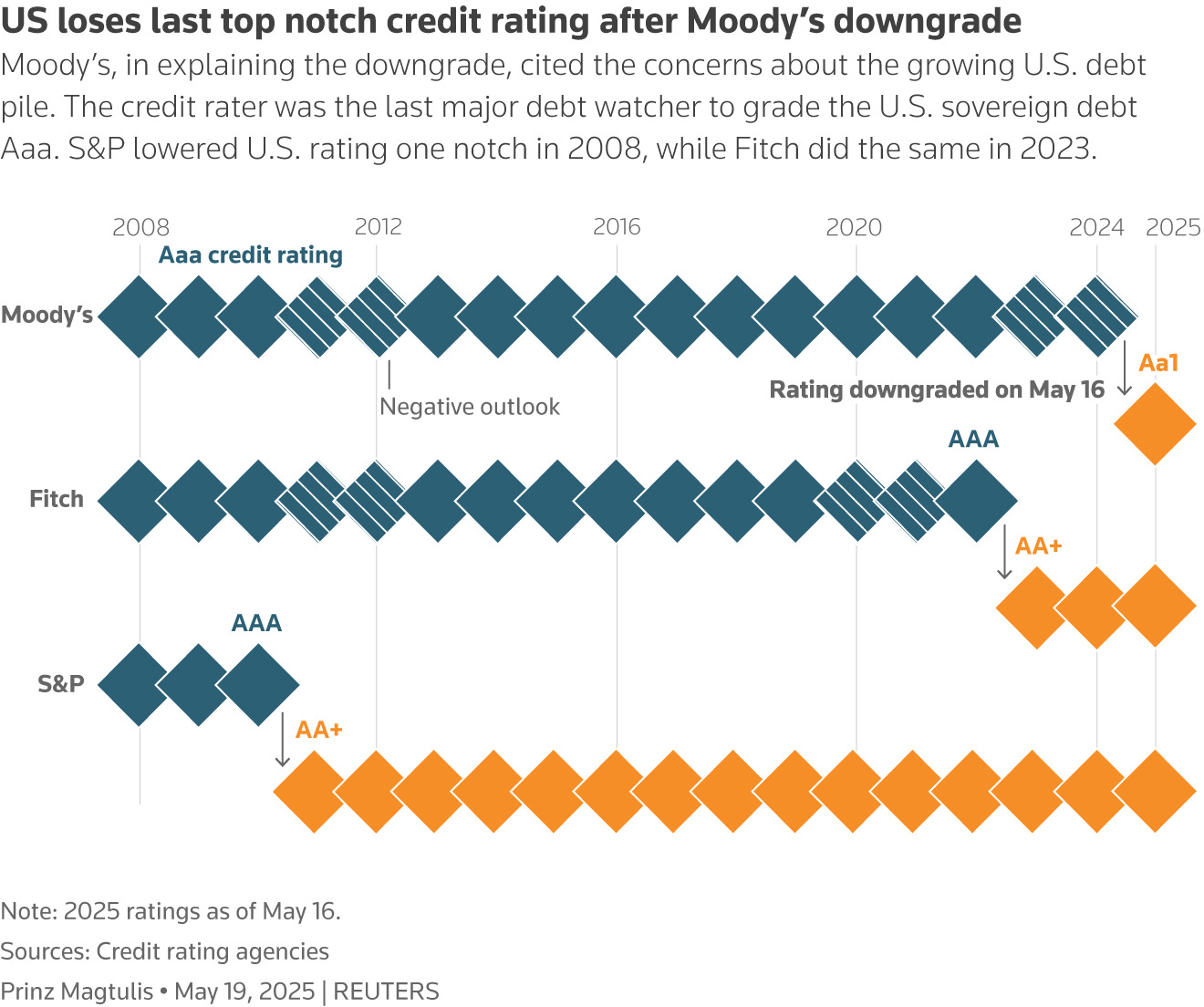

Moody’s decision to strip the U.S. of its last AAA credit rating might feel like déjà vu — after all, S&P and Fitch made similar moves years ago, and the world didn’t end.

But this downgrade is different.

This time, it comes amid soaring deficits, rising interest costs, and a political landscape with little appetite for fiscal restraint.

While some investors shrugged off the news, markets didn’t:

Treasury yields jumped

The dollar slid

Gold caught a bid.

This isn’t just about a lost rating — it’s about shifting market psychology.

Let’s break down why the Moody’s downgrade could mark a subtle but significant turning point — and why it may open up a fresh window of opportunity for Gold investors.

Quick Snapshot of the Chaos

Late Friday, May 16, Moody’s became the final major credit agency to downgrade U.S. sovereign debt, officially stripping the country of its last AAA rating.

This wasn’t exactly out of the blue.

S&P downgraded in 2011

Fitch followed in 2023

And now Moody’s — the last one holding the line — just folded.

Moody’s rationale was blunt: Huge deficits, ballooning debt, and a political class that can’t get anything done.

According to their projections, the U.S. fiscal deficit could jump from 6.4% of GDP today to nearly 9% by 2035, as interest payments swell, entitlement spending rises, and tax revenue fails to keep up.

Meanwhile, Trump’s new tax package is set to add $5.2 trillion to the national debt over the next decade, according to the Committee for a Responsible Federal Budget.

So no — this isn’t just about a letter grade. It’s about a growing structural imbalance in how the U.S. funds itself.

Markets reacted immediately

30-year Treasury yields jumped past 5% for the first time since late 2023.

Stock futures slid 1–2% overnight.

Dollar index dropped 0.7%, giving gold a solid boost.

Gold, after getting beat up last week, bounced back as investors rushed into traditional safety nets.

Japanese yen strengthened too, highlighting a clear risk-off mood across the globe.

"Sell America" trade is back

The Moody’s move brought back a familiar reaction: the “Sell America” trade.

Dump Treasurys

Short the dollar

Rotate out of U.S. equities

Pile into Gold and other safety plays

We’ve seen this before.

In August 2011, when S&P downgraded the U.S., markets cratered — the S&P 500 dropped 6.6% in a single session, and Gold spiked nearly 20% over the following weeks.

This time, the reaction was milder — but the message was the same:

Credit ratings might be symbolic (or as Treasury Secretary Scott Bessent put it "essentially meaningless"), but they still shift sentiment.

Losing the last AAA rating won’t cause an immediate fiscal collapse.

But it sends a clear message: America’s fiscal outlook isn’t getting prettier, and investors are paying attention.

Why Moody’s Downgrade Is a Big Deal for Gold Investors (Even If Wall Street Pretends It’s Not)

Moody’s downgrade might look like old news — especially if you remember S&P’s downgrade back in 2011 — but this time, the stakes are higher.

Skeptics will say credit ratings don’t matter.

And to some extent, they’re right — the U.S. isn’t about to default tomorrow, and yes, it prints the world’s reserve currency.

But the downgrade isn’t the point.

The reasons behind it are.

This feels familiar… but worse

Let’s rewind to summer 2011.

S&P stripped the U.S. of its AAA rating

Washington was paralyzed over the debt ceiling

Investors rushed into Gold, pushing it past $1,900/oz — a record at the time

By September, the Fed responded with Operation Twist, easing policy again.

That downgrade didn’t trigger a collapse — but it validated real concerns about the U.S. fiscal path. And Gold surged.

Now compare that moment to where we are today:

Deficits are structurally worse

Rates are far higher

Inflation is sticky

And there’s zero political appetite for course correction.

In other words, the backdrop is more fragile — and the stakes are bigger.

The real problem: fewer good options

Moody’s isn’t just flagging a downgrade — it’s warning that the U.S. is running out of good choices.

Without a serious course correction, the U.S. will be forced down one of two paths:

Painful fiscal tightening → Higher default risk, slower growth, more demand for safe-haven assets

Debt monetization + persistent inflation → Currency debasement, lower real yields, stronger case for Gold.

Neither is pretty.

But both are historically good for Gold.

When rating drops, money moves

Downgrades don’t need to cause panic to have real consequences.

Their true power is psychological — they reset how investors view risk.

U.S. debt isn’t invincible

Treasurys aren’t risk-free

Fiscal stability isn’t guaranteed — especially when dysfunction is baked into policy.

The message here is: Fear alone can move markets.

Even with Treasurys often exempt from strict mandates, downgrades do force action:

Institutional investors often have rules limiting exposure to downgraded sovereigns

Foreign central banks pay attention to credit shifts

China, for example, has steadily reduced its U.S. Treasury exposure — while simultaneously boosting Gold reserves as a reserve hedge.

We saw this dynamic after Fitch’s 2023 downgrade, when yields rose steadily — signaling that markets were already pricing in more risk.

Now, Moody’s could amplify that trend:

Yields climb further

Dollar weakens

Gold finds renewed tailwinds.

Rising Yields vs. Gold: The New Dynamic

One immediate consequence of the downgrade has been rising U.S. borrowing costs. That’s expected — but the implications for Gold are less straightforward.

Rising yields are usually a headwind for Gold. As a non-yielding asset, it tends to underperform when real interest rates climb.

That played out clearly in 2022: As the Fed hiked aggressively and 10-year real yields swung from -1% to +1.5%, Gold dropped ~15% from its highs.

But this time, context changes everything.

The “why” behind rising yields matters

There are two very different yield scenarios — and only one is bad for Gold.

Yields rising due to strong growth + higher real rates

→ Bearish for GoldYields rising due to inflation and fiscal stress

→ Neutral or bullish for Gold

When markets start doubting whether the U.S. will ever restore fiscal discipline, they begin demanding a credit premium on Treasurys.

This is how you get “stagflationary” rising yields — higher rates not because the economy’s booming, but because debt, inflation, and uncertainty are rising.

Think late 1970s:

Bond yields soared, but inflation surged faster.

Gold hit record highs.

What’s really behind rising yields in 2025

In 2023–2024, the Fed drove real yields higher via fast, front-loaded hikes. That capped Gold's upside, but it still held strong near $1,900–$2,000, a sign of solid underlying demand.

Now, in 2025, with the Fed likely done hiking, further upward pressure on yields is coming from a different place like

Massive debt issuance

Rising inflation risk

Eroding fiscal credibility.

Just think about it:

The U.S. is currently running trillion-dollar deficits — not during a recession, but during a period of low unemployment and solid GDP growth.

And when the next downturn hits, deficits will likely blow out even further.

What happens when the U.S. needs to keep funding this kind of shortfall? - It floods the market with Treasurys.

And here’s the key point: even if the Fed stands still, bond prices can fall — pushing yields higher — simply due to oversupply.

And once again, investors start looking for alternatives.

2025 is no longer a story of central bank tightening. It’s about market-driven repricing — and that has different implications for Gold.

Institutional Rethink Underway

The old logic — “Why own Gold when you can earn 5% on T-bills?” — is starting to sound weaker now that those T-bills are backed by a government with a deteriorating credit profile.

Even a small rotation from bonds into Gold by large allocators can move the needle significantly. The Gold market is liquid, yes — but it’s tiny compared to global bond markets.

This dynamic matters — especially when combined with:

A weaker dollar

Rising volatility

Clean ETF/futures positioning

Persistent central bank demand

A backdrop that’s bullish, but not euphoric

It’s not often that you get to buy Gold with a fundamentally bullish backdrop while some doubt lingers.

Counterarguments — or Why I’m Still Bullish on Gold

No thesis is bulletproof and there are legitimate counterpoints to the bullish case for Gold.

That said, none of them, in my view, outweigh the powerful forces currently stacking in Gold’s favor.

Let’s walk through the top objections — and why I remain constructive.

1/ Wasn’t the downgrade already priced in?

The argument: Moody’s downgrade was just catch-up. S&P and Fitch had already cut the U.S. rating, so this was basically old news. Markets didn’t crash — So why should anyone care now?

My view: That argument misses the bigger picture.

Yes, Moody’s was the last holdout. But bond and currency markets did move — yields jumped, the dollar slipped. That tells us something wasn’t fully priced in.

More importantly, the downgrade is just a headline — the real story is what’s underneath:

Exploding deficits

New tax cuts that could blow the fiscal hole even wider

Rising CDS prices (credit default swaps on U.S. debt are climbing — that’s real money pricing in risk)

So no, I don’t buy that it was fully priced. If anything, pre-downgrade complacency makes the current setup more bullish — because sentiment was lukewarm, and now investors are re-evaluating.

And we’ve seen this before: In 2011, S&P’s downgrade didn’t cause panic immediately, but it lit the fuse for a strong multi-month Gold rally. I think Moody’s move could play a similar role.

2/ What if we hit a deflationary recession? Gold might drop.

The argument: If we get a 2008-style liquidity crunch or a deflation scare, Gold might sell off like everything else.

My view: That risk is real… but short-lived.

History shows those selloffs don’t last:

In 2008, Gold bottomed before equities and surged once policy kicked in

In 2020, Gold rebounded quickly and hit new highs within months

Even if we do get a short deflationary shock, the likely policy response would be:

Emergency rate cuts

More QE

Yield curve control

Maybe even direct debt monetization.

That’s a Gold-friendly environment.

So yes, Gold could dip in a deflation panic — but I’d view it as a buying opportunity, not a reason to abandon the trade.

Also, I don’t see deflation as the base case. Inflation is still above target. Central banks aren’t in a position to preemptively slash rates without reigniting inflation.

If anything, the risk is more stagflation than deflation — and in that case, Gold typically performs well.

3/ Real yields are rising. That’s bad for Gold.

The argument: If the Fed crushes inflation and keeps rates high, real yields go up. That makes non-yielding assets like Gold less attractive.

My view: True — in theory. But let’s look at the real-world constraints.

Getting and sustaining high real yields today would likely require:

A deep recession (to kill inflation)

A Fed willing to tolerate serious economic pain

A political system willing to accept the fiscal fallout from higher debt servicing costs

That’s unlikely.

Each 1% increase in rates now costs the U.S. government hundreds of billions in added interest. There’s a real limit to how far policymakers can go.

So yes — if we got sustained 2–3% real yields like in the Volcker era, Gold would be in trouble. But today’s environment is very different. Back then, debt/GDP was under 40%. Today, it’s 120%+.

I think the Fed’s tightening path is capped by math and politics. Real yields might stay mildly positive — but unless inflation collapses, we’re not headed for the kind of regime that kills Gold.

4/ The dollar could rebound and pressure Gold.

The argument: The U.S. economy is still stronger than most. What if the dollar rips higher?

My view: This is the cleanest bear case for Gold — and probably the most credible in the short term.

Yes, the dollar could bounce.

Rate differentials still matter

The U.S. economy has been relatively resilient

A global risk-off move could create temporary dollar strength.

But I think the structural trend is now against the dollar:

The DXY peaked in 2022 and has since rolled over

Central banks are quietly diversifying away from USD assets

Other economies (like Europe) aren’t necessarily in worse shape anymore.

I’d expect occasional dollar rallies, but not a full-blown return to 2022 highs.

Also worth noting: Gold in non-dollar terms often rises even when USD Gold stalls. That’s why it’s always useful hold part of your Gold exposure in EUR and JPY Gold terms — it helps hedge localized currency moves.

Most Investors Still Don’t Get It: This Is the Window

When bond prices collapse and yields surge, it’s easy to chalk it up to interest rate expectations or economic data. But something deeper is happening.

What’s breaking down isn’t just the bond market — it’s confidence in the broader fiscal system.

That’s why Gold is climbing. Not in spite of bond market stress — because of it.

Contrarian opportunities don’t come with press releases. They come when the data is obvious, but the crowd is distracted. → Right now, we’re in one of those moments;

Gold isn’t cheap, but it’s far from overbought

ETF flows are lukewarm — retail isn’t chasing

Fiscal deterioration is accelerating, but still being shrugged off

Inflation is cooling, but not done — and yet markets are pricing it like it is

Media headlines are locked on AI stocks and Fed micro-guidance

Meanwhile, Gold is climbing quietly.

No euphoria. No retail mania.

That’s usually the kind of move that lasts — the ones that build slowly, under the radar, before becoming obvious in hindsight.

This isn’t the bottom — it’s the middle

I’m not calling this a bottom. We’ve already had that moment.

This is the middle.

The price isn’t screamingly cheap, but it’s also not expensive relative to where things are likely headed.

If history is any guide this level might look like a gift when the next phase kicks in.

Safe trading,

and remember: All that glitters is not Gold,

Joe