Gold had an incredible year in 2024.

The price jumped over 28% in U.S. dollar terms, hitting 40 all-time highs along the way. On top of that, quarterly global demand for gold surpassed the $100 billion mark for the first time ever.

But that might just be the beginning.

Could we see gold reach $3,000 or even $4,000 an ounce by 2025?

Let’s take a closer look at:

what’s been driving this rally in 2024

why demand might stay strong

and what key factors to watch as we move into 2025.

A quick look back: How Gold got here

To understand why so many traders are buzzing about gold’s potential to reach—or even exceed—levels like $3,000 or $4,000 in the near term, let’s look back at gold’s journey over the past few years.

Early 2024: What the banks predicted

At the start of 2024, major banks like Goldman Sachs, UBS, Citi, and JPMorgan were cautiously optimistic about gold. Their forecasts were fairly conservative, predicting prices would climb to around $2,100–$2,200 per ounce by late 2024 or early 2025.

These estimates were based on the idea that inflation would stay moderate and the Federal Reserve could guide the U.S. economy to a “soft landing.”

But as we’ve seen, things didn’t go quite as planned.

By Q2 of 2024, gold had smashed through $2,400 per ounce—way above what anyone had predicted. This forced many of those same banks to adjust their forecasts upward, sometimes more than once in a single quarter.

It was a classic case of underestimating the metal’s sensitivity to geopolitical tensions, lingering inflation, and a wave of demand from central banks seeking safe-haven assets.

Late 2024: Parallels with 2016

Toward the end of 2024, gold took a 5% dip, which reminded some traders of what happened in 2016.

Back then, when Donald Trump was first elected, gold saw a sharp 12% drop from a local high before stabilizing. That pullback eventually set the stage for a strong rally over the following months.

If Trump’s policies return in 2025 under a new administration, we could see similar economic and monetary dynamics play out—potentially creating conditions for another gold rally.

Competition from cryptocurrencies

In recent years, gold has faced some competition from cryptocurrencies like Bitcoin. Many investors see these two assets as alternatives, both offering protection against inflation.

When crypto prices soared, gold often slowed down. But whenever cryptocurrencies went through a significant correction, demand for gold as a “traditional” safe haven surged.

This pattern highlights gold’s enduring appeal. While some investors might experiment with crypto, large, conservative players—like central banks and pension funds—continue to favor gold during uncertain times. This consistent demand has helped solidify gold’s place as a core asset for long-term investors.

Why Gold could Climb toward $3,000 or beyond in 2025

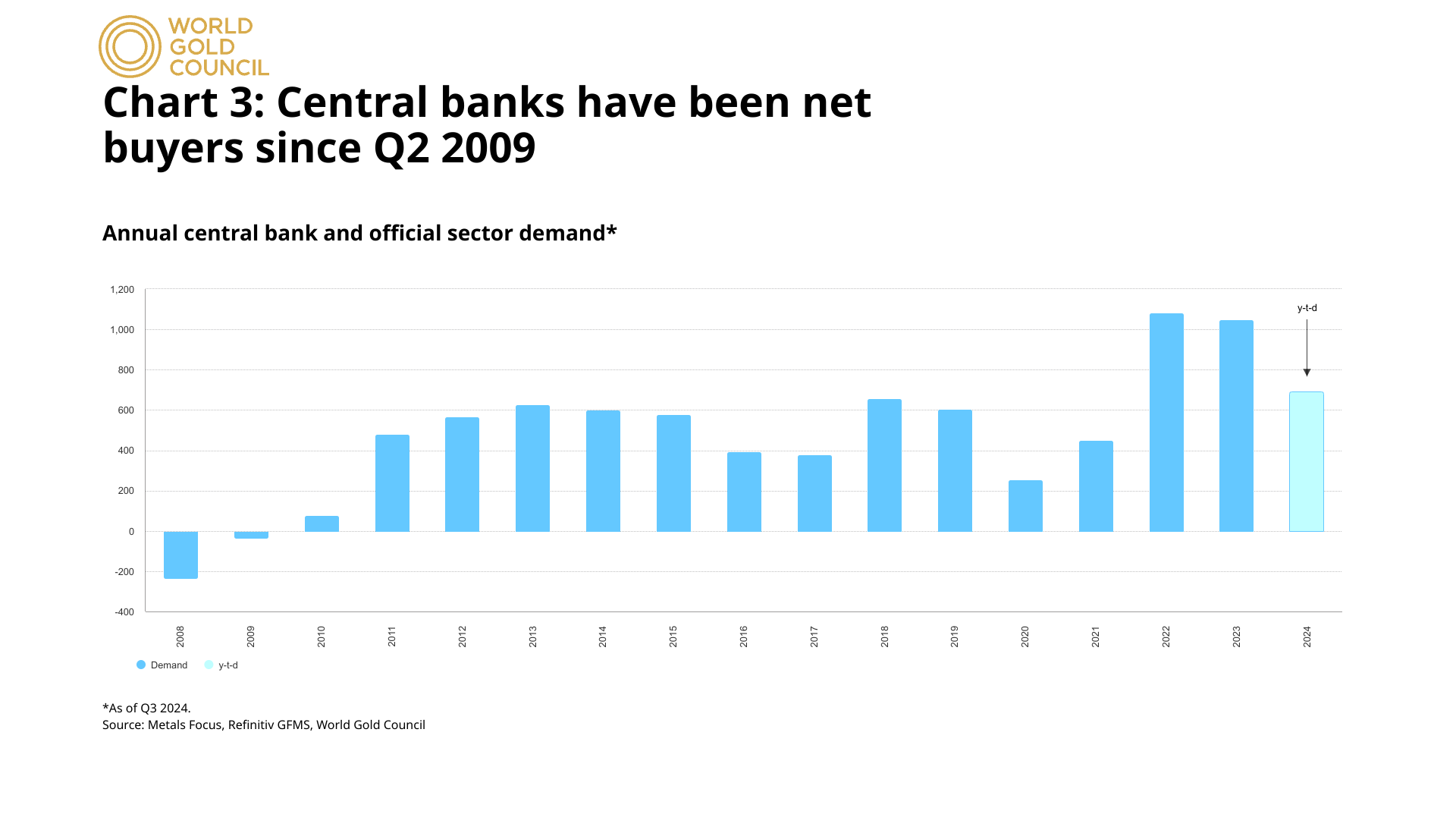

1/ Central Bank Buying

Central banks buy gold for several reasons:

To strengthen their foreign exchange reserves

To hedge against currency devaluations

To signal long-term confidence in gold’s value

When central banks—especially from major economies like China, Russia, India, and key Middle Eastern countries—accelerate their gold purchases, it creates a strong price floor and gold prices are less likely to fall significantly.

On top of that, increased central bank demand amplifies price movements upward when retail or institutional investors start buying as well.

2/ Fed rate cuts and the inverse Dollar-Gold relationship

From 2022 to 2023, the Federal Reserve raised interest rates aggressively, pushing the federal funds rate to its highest levels in nearly 20 years. Despite this, inflation in the U.S. and parts of Europe stayed stubbornly above target levels.

By 2024, as the economy started to cool, the conversation shifted to when—not if—the Fed would begin lowering rates.

The relationship here is straightforward:

Falling Rates → Weaker Dollar

Lower rates often make the dollar less attractive as investors seek higher returns elsewhere. Since gold’s price typically moves inversely to the dollar, a weaker or stable dollar tends to make gold more appealing.Rising Inflation → Fear Trade

If the Fed cuts rates while inflation remains elevated, it could trigger a "fear trade," with institutional investors pouring into gold as a hedge against economic uncertainty.

The Fed is aiming for a target rate of 4.5–4.75%, but the market expects about 100 basis points of cuts by the end of 2025, assuming inflation keeps easing.

If inflation falls below 2% or economic growth slows more than expected, rates could drop further—potentially to 3% by the end of 2025.

Gold could push notably higher in that environment, propelled by a softer dollar, lower real yields, and renewed safe-haven inflows if growth fears intensify.

3/ Geopolitical storms

Geopolitical tensions are a key driver of safe-haven assets like gold. When uncertainty rises, markets panic, and investors often turn to gold for stability. Even small escalations can shake up currencies, stocks, and commodities, pushing gold prices higher.

Right now, several global hotspots are making waves:

Eastern Europe: The conflict in Ukraine has dragged on, leading to new alliances and sharp rifts between Russia and Western nations. Any escalation or new dimension to that conflict could spark a safe-haven rush.

U.S.–China Rivalry: Though there have been talks of détente, the tech war (e.g., restrictions on AI chips), issues over Taiwan, and trade barriers remain serious flashpoints. Any misstep here could disrupt global markets.

Middle East: Ongoing tensions in the region have ramifications for energy markets and investor sentiment. Heightened conflict or sanctions can spur flight-to-quality trades, of which gold historically reaps a significant share.

If there’s a diplomatic breakthrough—like a ceasefire in Ukraine or unexpected cooperation between the U.S. and China—gold’s “risk premium” might dip temporarily.

But major financial institutions, including Citi and Bank of America, are still optimistic about gold’s long-term prospects. They point to deeper factors like supply-demand imbalances and continued central bank buying, which are likely to keep supporting prices even if tensions ease.

4/ Stock market corrections

One topic that doesn’t get enough attention is the massive size of the U.S. stock market compared to the country’s GDP.

By some estimates, the market cap has hit historic highs—over $13 trillion in new stock market wealth was created in 2024 alone. To put that into perspective, that’s nearly half of the U.S. GDP in fresh wealth added in just one year.

Historically, when valuations reach such extreme levels, corrections or even bear markets often follow—and they can happen very quickly.

If the U.S. stock market experiences a typical 10% correction or worse, it could lead to a significant flow of capital into gold.

5/ Sovereign debt loads

The U.S. debt-to-GDP ratio is nearing historic highs, with deficits growing even during times of what many considered solid economic growth. This isn’t just an issue for the U.S.—many countries in Europe and Asia are also grappling with heavy debt burdens.

When debt levels get this high, governments usually have three options to manage it:

Cut spending – Often politically difficult and unpopular.

Raise taxes – This can hurt economic growth and lead to public backlash.

Debase the currency – Essentially printing more money (through measures like quantitative easing) to make debt easier to pay off. This approach often leads to higher inflation over time.

If governments turn to large-scale money printing or even smaller versions of quantitative easing, gold tends to benefit. That’s because as fiat currencies lose value, investors often shift toward gold as a safer, tangible store of wealth.

6/ Supply constraints in physical Gold

Gold is found all over the world, but opening new mines is a slow and costly process. Most of the easily accessible gold has already been mined, so new projects are more challenging to develop.

It can take 10 years or more to move from discovering a gold deposit to actually producing gold, especially with stricter environmental and social regulations in place.

The mining industry is also feeling the effects of rising costs. Prices for labor, energy, and equipment have gone up, and if inflation stays moderate or high, the costs for miners to stay profitable will rise too. This creates a kind of unofficial "floor" for gold prices, since miners won’t sell below their break-even costs.

Could Gold really hit $4,000?

Some well-known analysts, including top strategists at Bloomberg Intelligence and prominent hedge fund managers, have suggested that gold could reach $4,000 within the next two years.

While this might sound ambitious, it’s worth remembering that similar predictions were once dismissed as overly optimistic—until gold broke through $2,000 in 2020 and again in 2023.

Here’s the reasoning behind their projections:

Major stock market correction: If equities experience a significant downturn, investors may flock to safe-haven assets like gold, driving up demand.

Rate cuts and a weaker dollar: Lower interest rates typically weaken the U.S. dollar. Since gold is priced in dollars, a weaker dollar often leads to higher gold prices.

Geopolitical tensions: Ongoing or escalating global conflicts can boost gold’s appeal as a safe haven, further increasing prices.

Bitcoin competition levels out: If cryptocurrency markets face a major correction, some investors might rotate capital back into gold, stabilizing its position as a preferred store of value.

For gold to hit $4,000, it would likely require multiple factors working together rather than just one or two.

But when you consider how these events could align, the possibility doesn’t seem so far-fetched after all.

Macroeconomic factors: Inflation vs deflation

Many people assume gold only thrives in inflationary times, but that’s not entirely true.

Historically, gold has done well during both inflation and deflation, especially when there’s fear or instability in the markets.

In inflationary periods, the reasoning is simple: as paper money loses value, people turn to gold as a stable, tangible store of wealth. But in deflationary times—especially severe ones—gold can also shine if confidence in the financial system starts to crumble.

For example, in a deflationary crisis, real interest rates might drop into negative territory if nominal rates fall faster than inflation. When that happens, the “opportunity cost” of holding gold becomes much lower.

On top of that, central banks often push for aggressive monetary stimulus to combat deflation, which can weaken paper currencies and make gold even more appealing.

Looking at today’s market, some draw comparisons to Japan’s deflationary spiral or the Soviet Union’s collapse.

For instance, China’s shrinking bond yields (around 1.7% on 10-year government bonds) suggest that deflationary pressures in Asia could spread globally. If that happens, central banks like the Federal Reserve might have to pivot back to looser monetary policies, which historically benefits gold.

The threat of stagflation

Another scenario to watch out for is stagflation—when economic growth stalls, but inflation stays high. Imagine a slowdown or mild recession in the U.S. paired with stubborn inflation, possibly due to supply-chain disruptions or energy shortages.

Stagflation hits hard: it erodes consumer purchasing power, squeezes corporate profits, and leaves central banks in a tough spot. They can’t easily stimulate growth without making inflation worse.

Gold has a strong track record in these situations. Take the late 1970s and early 1980s, for example. During those years of stagflation, gold prices surged to record highs.

With inflation risks still looming and recent employment data showing cracks in the economy, we could see a similar pattern play out again.

Politics and policy in 2025

A new (returning) presidential administration

The U.S. political landscape after the 2024 elections is one of the biggest uncertainties right now. When President Trump returns to office, it could lead to significant changes in fiscal and trade policies.

Trump’s historical pressure on the Fed: In his first term, Trump was vocal about wanting the Federal Reserve to lower interest rates. If he renews that stance, we could see further rate cuts, weakening the dollar and lifting gold.

Trade wars and tariffs: Trump’s policies in the past included escalating trade tensions, especially with China and the EU. If similar measures return, they could disrupt supply chains, leading to either higher inflation or slower economic growth. Both scenarios tend to support higher gold prices—either as a hedge against inflation or as a safe haven during economic uncertainty.

Global political shifts

At the same time, countries like Brazil, India, and others in the Middle East are strengthening their trade relationships with China and Russia, moving away from relying solely on the U.S.

If this trend reduces the dollar’s dominance in global trade, gold could gain importance in these nations’ foreign reserves.

This might not happen overnight, but it’s a long-term positive for gold demand.

Why are countries slowly ditching dollars for Gold? [The long read]

2024 so far is the year of the modern-day Gold rush.

Europe’s role in the equation

Europe might not grab as many headlines, but it plays a crucial role. The European Central Bank (ECB) faces its own struggles with inflation and deep-rooted structural challenges.

If the ECB continues easing monetary policy, the euro could weaken further against the dollar.

Paradoxically, this might prompt global investors to view all fiat currencies as riskier, especially if political divisions within the Eurozone grow. In such a scenario, gold could gain appeal as a safer alternative to paper currencies.

Risks to the bullish case for Gold

Let’s be realistic—gold’s price isn’t guaranteed to climb nonstop. There are a few potential roadblocks we need to keep in mind:

Continued U.S. stock market optimism

If the stock market stays strong, it could steal some attention from gold.

For example, a more “pro-business” political administration or ongoing stock market euphoria might push investors toward riskier assets instead of safe havens like gold.

De-escalation

If major conflicts ease faster than expected, it could reduce the appeal of gold as a safe haven.

A sudden resolution to the Ukraine crisis, improved U.S.–China relations, or breakthroughs in Middle East diplomacy could all lower global risk aversion, weakening demand for gold.

Weaker demand from Asia

China and India drive over 50% of the world’s annual gold demand, so any slowdown in these regions can have a big impact.

In 2024, Chinese investors led gold’s rally in the first half, followed by India after import duties were lowered. However, if consumer spending in Asia slows down or trade tensions rise, demand from these key markets could drop.

Fed rate hikes

If inflation heats up again or the Federal Reserve becomes more concerned about financial stability, we could see interest rates pushed back up to 5.5% or even higher.

This “higher for longer” scenario would likely strengthen the U.S. dollar and bond yields, increasing the opportunity cost of holding gold and putting downward pressure on prices.

Resurgence of Bitcoin

If Bitcoin stages another explosive rally—maybe fueled by regulatory breakthroughs or central banks holding it as a reserve asset—some capital might flow away from gold, at least temporarily.

However, gold’s institutional base, including large central banks, has historically remained loyal even during crypto booms.

Trading Gold in 2025: Strategy tips for day and mid-term Gold traders

1/ Integrate macro drivers into your trade plan

Monitor Fed policy

Interest rate futures: Keep a close eye on Fed Funds Futures or interest rate swap spreads to detect shifts in rate-hike or rate-cut expectations. Rapid changes here often precede XAU/USD breakouts

FOMC events: Reduce or build positions before Federal Reserve announcements. You can hedge risks using COMEX Gold options or over-the-counter (OTC) options while keeping your trade open for potential gains.

Track dollar and bond yield correlations

Dollar Index (DXY): XAU/USD tends to move inversely to USD strength. Watch for divergences—if the DXY is rising but gold refuses to fall, it may signal hidden demand and an upcoming breakout.

Real Yields: Follow 5-year or 10-year Treasury Inflation-Protected Securities (TIPS). Falling real yields often boost gold, while rising yields can pressure it.

Event-driven risks

Escalating trade wars, unexpected geopolitical developments, or credit stresses can trigger flight-to-safety flows. A pre-planned “macro risk” template can help you quickly execute trades or hedge exposures.

2/ Use advanced positioning and execution tactics

Layered position sizing

Partial entries/exits: Scale into positions in increments—for instance, build up or pare down in 25–50% tranches—based on technical signals (e.g., moving-average crossovers or breakouts above prior pivot highs).

Volatility positioning: If implied volatility for gold options is low, it can be cheaper to buy calls or puts as part of a directional play. When volatility is high, consider vertical spreads or ratio spreads to reduce premium costs.

Optimize your execution

Smart order routing: Use an execution platform that minimizes slippage, particularly during high-impact news. If you trade COMEX futures, watch liquidity levels to avoid poor fills.

Time-based exits: Set a time horizon (e.g., 48–72 hours) for day-to-mid-term trades. If the setup hasn’t worked out, check if conditions or catalysts have changed.

3/ Hedge and spread your risk

Intermarket spreads

Gold vs. Silver or Gold vs. Platinum: While the primary focus is gold, traders sometimes use spreads against other precious metals to exploit relative mispricings. Though not always correlated, price divergences between these can offer clues for gold’s next move.

Currency hedges: If you’re long XAU/USD, and the dollar is strengthening, partial hedges via short DXY futures or short EUR/USD positions can protect gains if gold lags.

COMEX Calendar Spreads

If you expect short-term volatility but anticipate a return to “fair value” later, you can trade calendar spreads (long near-dated futures, short longer-dated or vice versa) to benefit from term structure shifts without full directional exposure.

Options strategies around events

Straddles or strangles: Before high-impact events (e.g., major central bank meetings), buying straddles on XAU/USD or COMEX Gold can profit from large swings in either direction. This is especially potent if implied volatility is underpricing the potential move.

Bull or bear spreads: Use vertical call or put spreads when you have a directional bias but want to cap premium outlay.

4/ Analyze sentiment, positioning, and momentum

COT (Commitments of Traders) reports

For COMEX Gold, check the weekly COT data to see how commercial hedgers, managed money, and retail traders are positioned. Extremes in net long or net short levels can precede reversals in XAU/USD.

ETF Inflows/Outflows

Large gold ETFs (e.g., GLD) often mirror broader market sentiment. Sudden spikes in inflows might signal institutional fear or safe-haven interest, giving you early hints of a potential bullish momentum shift.

Momentum triggers

Moving average cross: Watch for short-period MAs (e.g., 20-day) crossing above long-period MAs (e.g., 50-day) with above-average volume. Such a “golden cross” can trigger algorithmic buying in both XAU/USD spot and futures.

Price action patterns: Bullish engulfing candles near key support zones or breakouts above multi-week consolidation levels often accelerate momentum trades. Failing to break resistance can signal short opportunities.

5/ Flexibility is key

Be ready to pivot from short-term scalps to multi-week trend rides if the macro environment transitions rapidly.

Keep a watchful eye on the interplay between real yields, currency flows, and global risk sentiment—any sudden shift can unleash powerful gold moves that reward the prepared.

The story of gold in 2025 goes beyond just the numbers—it's about the intersection of powerful forces that have been building over time. Factors like soaring government debt, weakening trust in fiat currencies, rising geopolitical tensions, and the actions of the Federal Reserve are all playing a role.

One thing is clear: gold is no longer just a niche asset. It's becoming a key focus for central banks, hedge funds, and everyday investors, especially when the global financial system feels shaky.

Right now, the market seems relatively steady, with cautious optimism. But as we’ve seen in recent years, gold has a way of outperforming expectations when the world takes an unexpected turn.

As always, trade responsibly and remember that no single forecast can capture the complexity of modern markets. Keep your risk management tight, stay curious, and don’t be caught off-guard if gold surprises everyone—yet again.

Safe trading,

and remember: All that glitters is not Gold,

Joe

![Why are countries slowly ditching dollars for Gold? [The long read]](https://substackcdn.com/image/fetch/$s_!kBgZ!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa88f7871-74db-45b2-879a-1cd8edf49e25_1312x736.webp)