Why are countries slowly ditching dollars for Gold? [The long read]

Could the era of U.S. dollar dominance be coming to an end?

2024 so far is the year of the modern-day Gold rush.

Central banks around the world are continuing to set records with their Gold purchases. In the first quarter alone, they added a net 290 tonnes, surpassing the previous Q1 record set in 2013.

Gold and the dollar have always had an inverse relationship, and this buying spree could signal a major shift in global economic power.

Could the era of U.S. dollar dominance be coming to an end?

Let's jump back to the 1940s - the time when the dollar became King

After World War II, the global economy was in shambles. Major powers like Britain and France were drowning in debt.

Britain, for instance, saw its debt-to-GDP ratio skyrocket from 25% in 1914 to an insane 270% by 1942.

UK national debt 1900-2012

Other big nations like France and the Soviet Union weren’t doing much better either.

Amidst all this chaos, the United States stood strong.

They profited big by supplying war-torn countries with goods, and when the war ended, they held a whopping 75% of the world’s monetary Gold. Their Gold reserves shot up from around 2,000 tons in 1910 to nearly 20,000 tons by 1940.

In 1944, delegates from 44 countries gathered in Bretton Woods, New Hampshire, to set up a new global financial system. This was known as the Bretton Woods Agreement.

Under this system, currencies were tied to the U.S. dollar, which itself was tied to Gold at a fixed rate of $35 per ounce. Basically, countries could confidently trade using the U.S. dollar, knowing they could swap those dollars for Gold if needed.

This agreement led to the creation of the IMF (International Monetary Fund) and the World Bank, both of which were set up to keep the global economy stable and help countries rebuild after the war.

From Gold to oil: the rise of petrodollars

Fast forward a few years, a new game-changing commodity came into play: oil.

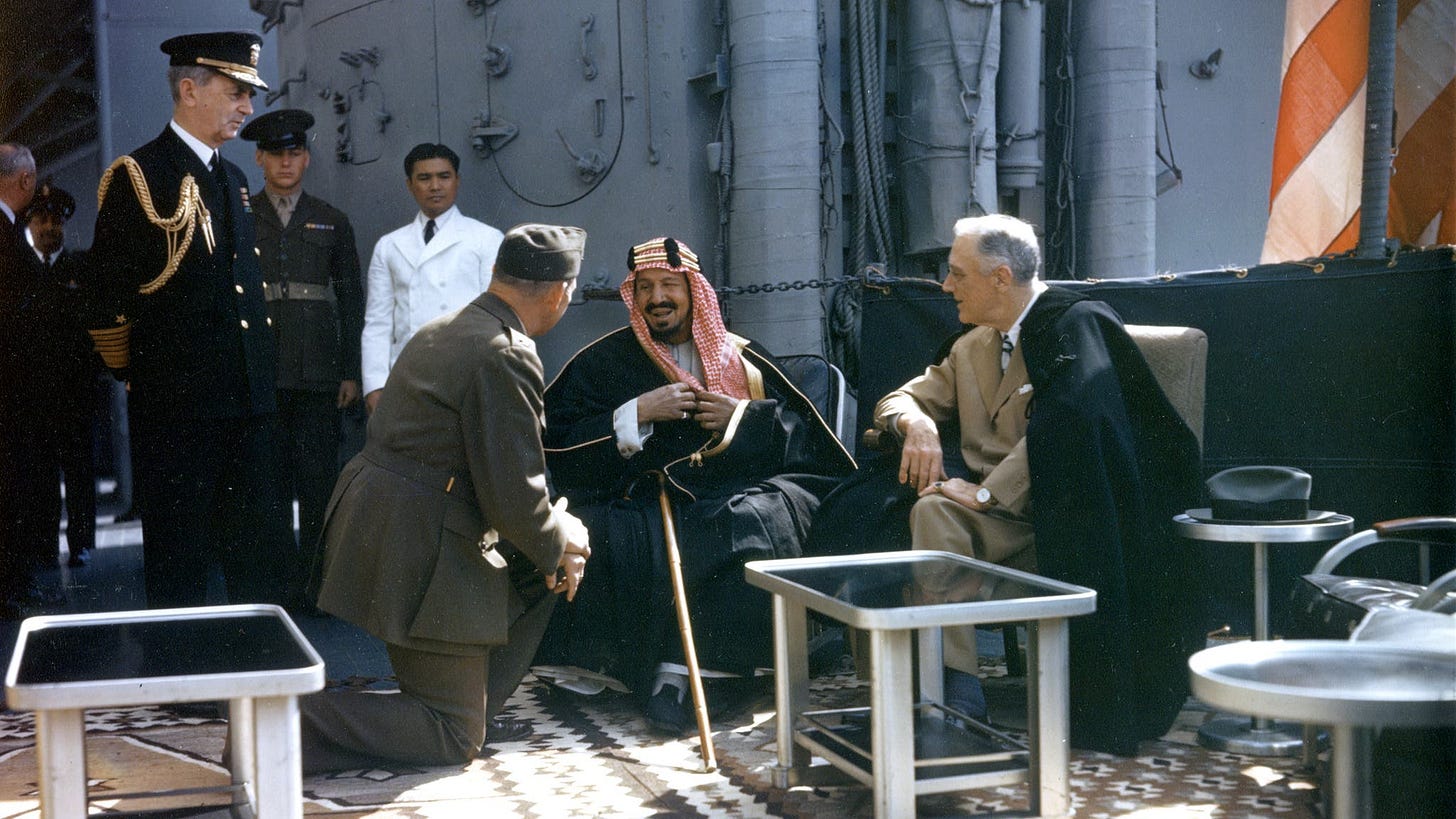

In 1945, the U.S. struck a pivotal deal with Saudi Arabia, agreeing to protect the kingdom militarily in exchange for making sure all oil sales were done in U.S. dollars.

This deal essentially locked the dollar into the global oil economy, and soon, other oil-producing nations followed suit. Thus, the "petrodollar" was born, further solidifying the dollar’s dominance.

The Nixon shock and the end of the Gold standard

By the 1970s, cracks were starting to show in the fixed exchange rate system.

The U.S. had been overspending—thanks to the Vietnam War and other economic pressures—and their Gold reserves were shrinking fast, dropping from 22,000 tons in 1950 to just 10,000 tons by 1970.

So, in 1971, President Nixon pulled the plug on the dollar’s convertibility to Gold. The U.S. dollar was no longer backed by Gold, kicking off a new era where its value was determined by market forces and the overall strength of the U.S. economy.

Why the Dollar still rules: a global safe haven

Even without the Gold backing, the U.S. dollar remained the go-to currency for global trade, especially in oil.

Countries began stockpiling dollar reserves and, instead of holding cash, they invested in U.S. Treasury bonds—a super-safe asset backed by the U.S. government.

Why do countries love U.S. Treasuries?

They earn interest – Instead of just sitting on cash, they get a return on their investment.

They’re liquid – U.S. Treasuries are easy to buy and sell in large amounts without messing up the market.

They make trade easier – Holding dollars helps countries engage smoothly in international trade.

This is why countries like Japan, China, and the UK hold massive amounts of U.S. debt, with Japan holding over $1 trillion, China around $776 billion, and the UK roughly $728 billion in U.S. Treasury bonds.

The shift: four key reasons countries are hoarding Gold

In recent years, there’s been a noticeable shift.

More and more countries are stocking up Gold instead of relying solely on U.S. dollars and bonds.

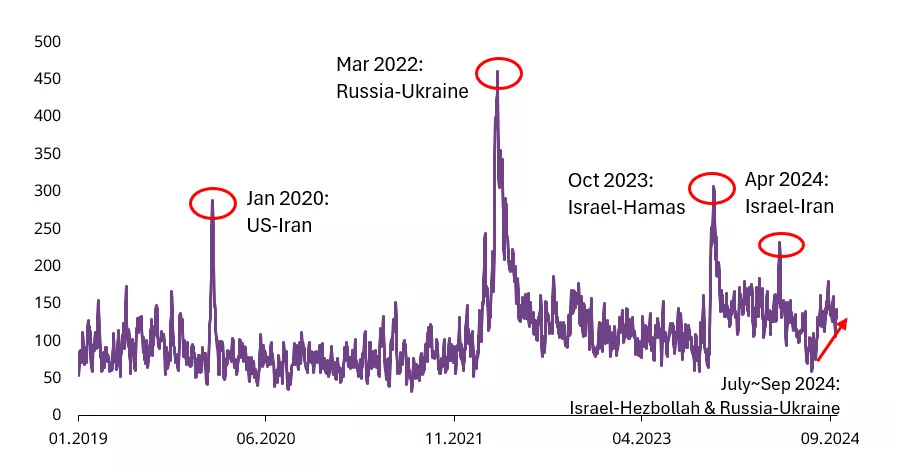

#1. Geopolitical risks and sanctions

Countries like China and Russia are worried that holding too many U.S. dollars could backfire.

If political tensions rise, they fear their dollar reserves could be frozen or restricted, as happened to Russia after the Ukraine conflict. By boosting their Gold reserves, they’re diversifying their assets and reducing their reliance on the dollar.

#2. Concerns over U.S. Monetary Policy

The U.S. has been printing money like crazy, especially during financial crises like the 2008 recession and the COVID-19 pandemic.

In 2020 alone, the Federal Reserve printed about $4 trillion to support the economy.

While this helps the U.S. economy, it can lead to inflation, which erodes the value of other countries' dollar reserves.

For example, if China holds $3.2 trillion in reserves and the dollar weakens due to inflation, the real value of those reserves decreases. By shifting some reserves into Gold, countries can protect their wealth from the eroding effects of U.S. monetary expansion.

#3. Economic instabilities

The global markets have been shaky, and countries are looking for a stable place to park their wealth.

In China, for instance, the real estate market has been facing a bubble burst, and the Shanghai Stock Exchange has shown sluggish growth, appreciating only about 6% over the past five years compared to nearly 94% for India's Sensex.

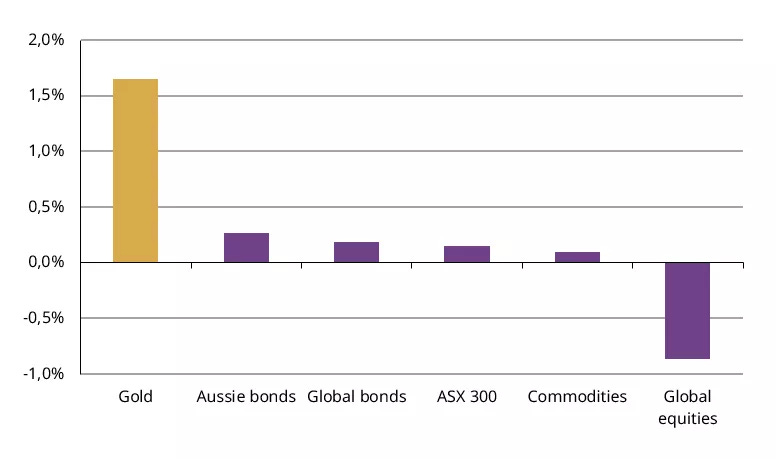

Compared to the stock market or other assets, Gold tends to rise during economic and geopolitical troubles.

1973 Oil Crisis: The S&P 500 dropped by about 13%, while Gold prices soared by approximately 87%.

2008 Financial Crisis: As the S&P 500 plummeted by around 37%, Gold prices increased by about 16%.

2020 Pandemic: Despite the S&P 500's initial drop, Gold prices rose, offering investors a buffer against volatility.

2022 Russia-Ukraine Conflict: While the S&P 500 declined by nearly 20%, Gold's value remained relatively stable, decreasing by only about 2%.

#4. Cultural Significance

In countries like India and China, Gold is deeply ingrained in the culture. People buy Gold for jewelry, investments, and as a hedge against inflation.

In 2023, Chinese consumers bought around 959 tons of Gold, while Indian consumers purchased about 774 tons. These figures surpass the combined Gold purchases of the next ten countries.

What all of this means for investors

The U.S. dollar has been a cornerstone of the global financial system for decades. But its dominance might be slowly waning.

In the 70s, the U.S. dollar accounted for approximately 70% to 85% of global foreign exchange reserves. Looking at the recent data, the U.S. dollar now accounts for around 59% of global foreign exchange reserves (as of 2022).

The ongoing diversification we’re seeing globally suggests a slow movement toward a more multipolar currency system, where other currencies and assets like Gold play more significant roles.

As investors, we now have to recognize that changes in the dollar's status can affect exchange rates, investment returns, and economic conditions worldwide.

While we can’t control the global macros, we can control our portfolios and how we mitigate the potential risks. Diversifying into multiple currencies and assets now is a must.

Gold, in its turn, offers a safety net. As a neutral asset that isn't subject to the policies of any single country, it provides stability in uncertain times and offsets losses in other asset classes during downturns.