Will Gold Maintain Its Uptrend as Markets Brace for the Fed? Market Sentiment and Trade Strategies [Weekly XAU/USD Analysis + Forecast]

Hello, fellow traders!

Gold prices jumped almost 3% this week, ending at their highest level since late October, around $2,780. The rise was driven by safe-haven buying as worries about U.S. trade policies and global tensions grew.

On Tuesday, U.S. Treasury yields fell below 4.6%, giving gold a further boost. Later in the week, weaker U.S. economic data, like Friday’s softer PMI numbers, helped Gold stay steady near its highs.

Now, markets are looking ahead to the Federal Reserve’s policy meeting next week. Although no changes to interest rates are expected, Fed Chair Jerome Powell’s comments on inflation and further rate cuts could impact the dollar and Gold prices.

In this week’s update, I’ll:

Decode the technicals: pinpoint the hidden technical clues that could signal a sudden breakout—or a ruthless selloff.

Unpack the global data: highlight the global economic numbers making waves and where they could push Gold’s price in the mid term.

Identify strategic “make-or-break” price zones

Spot the sentiment shifts: what’s brewing beneath the surface and why this matters for Gold’s future direction.

Predict what’s next for Gold + trading setups: give away my short-term and mid-term calls for where XAU/USD is headed and offer several trading setups in the current market.

📊 Let’s look at the technical data

Last 3 months - 1h charts

Key takeaway:

While we see some bullish momentum building, there are clear signs of overextension in the short term. The rising wedge and bearish divergence in multiple indicators suggest a pullback from current 2,720 level toward 2,749 → 2,726.

That said, mid-term uptrend structure is intact; dips are likely buying opportunities for those who missed out earlier.

Short-term pullback likely: Gold appears stretched in the short term.

Expect a pullback or consolidation toward key Fibonacci levels:

2,749 (0.382) is the first target, followed by

2,726 (0.618) if bearish momentum accelerates.

Momentum fading: PPO shows bearish crossover and volume is decreasing slightly during the recent uptrend, hinting at weakening bullish conviction. If a sharp spike in selling volume occurs near the wedge's breakdown, it would confirm bearish sentiment.

Watch the 200-EMA (~2,726): If Gold bounces there, it’ll

confirm that buyers are still stepping in on dips. The uptrend will likely resume, targeting 2,800 → 2,820. A break below with strong volume might signal a deeper correction → 2,700 → 2,680.

If you’re swing trading, consider partial profit-taking near wedge resistance ~2.780. Re-enter long positions closer to the 200-EMA or Fib retracement levels with tight risk management.

Last 30 days - 30min charts

Key takeaway:

On a short-term chart, Gold is bearish. Momentum oscillators and short-term signals are leaning bearish/neutral. There is also a potential for a short-term bounce due to overbought conditions.

2,766 level is the first line of defense for bulls.

Negative momentum building: Gold is currently trading below VWAP. Plus, multiple indicators (ChandeMO, Parabolic SAR, BoP, MACD) show that bears are gaining strength.

Bounce possible:

Stoch RSI oversold and the price is nearing lower Keltner band, suggesting a brief bounces might happen before further downside.

Gold might dip toward 2,765–2,750 zone and bounce back briefly toward the top Keltner Channel ~2,780–2,790.

Though the chances of the bounce are slim if bulls lose 2,750.

Last 14 days - 15 min charts

Key takeaway:

On the 15-minute charts, Gold is in a consolidation/correction phase.

Indicators suggest the market is oversold, which often leads to bounces—but a bounce alone won’t shift the narrative unless price recaptures key short-term MAs (~2,770 - 2,772) and maintains them.

Keep an eye on 2,750 (strong volume zone) and the 2,706 target zone for deeper support.

Rising wedge: Recent breakdown from the wedge at the top signals a possible channel test or break. The HMA 9 (2,770) and the midline of the channel (~2,766) might offer some short-term support and slow the decline temporarily.

Volume clusters: Significant volume nodes at 2,760–2,750 zone and 2,706 may act as catch points if selling accelerates.

Lack of buyers now: The higher timeframe suggests ongoing accumulation, but short-term chart shows a flat to slightly declining trend, signaling no fresh surge in buyers. MFI also leans bearish.

Intraday bounces: Williams %R and CCI are oversold, so quick pops are possible. But watch if they fail at short-term resistance (~2,770 - 2,772) - the broader bearish setup shows limited upside until buying pressure returns.

👁️ Key levels to watch

Resistance

2,780 – 2,790

Recent local highs, near the top of short-term channels (Keltner, Donchian).

Price has struggled to close firmly above this band.

2,800 – psychological mark

A round-number barrier where traders often place key orders.

2,820

Next upside target if bulls regain momentum.

Support

2,770 – short-term support

2,760 – 2,750

Major volume profile node, plus overlapping short-term Fibonacci retracements.

Gold has repeatedly paused or bounced near this area.

2,726 – 2,730

Confluence of the 200-EMA on 1h chart, plus key Elliott Wave retracement zone (~0.618 Fib).

If the price pulls back this far, it’s a key area where buyers might step in to defend the larger uptrend.

2,706

High-volume node.

Acts as a potential “magnet” if price really sells off.

📰 Key economic updates

🇺🇸 The United States

Jobless Claims - ↑ 223,000, higher than the forecast

Unadjusted claims dropped to 284,222, although certain regions like California saw increases.

The U.S. labor market remains tight with employers hesitant to increase hiring due to economic uncertainty.

Continuing unemployment claims rose to 1.899 million, the highest since November 2021.

Layoffs are still low, but a slow pace of hiring means it's harder for workers who lose jobs to find new employment.

Events like California's wildfires and Southern storms are causing short-term distortions in unemployment data.

These events could push claims higher temporarily but don’t indicate systemic economic issues.

Existing Home Sales - ↑ 4.24M, a 10-month high

The record-high median home price of $407,500 reflects strong demand but highlights affordability struggles, especially with mortgage rates at nearly 7%.

First-time buyer activity increased slightly (31% of purchases, up from 29% last year), but entry-level housing remains scarce.

For many prospective buyers, particularly first-time buyers, elevated rates and low inventory are significant barriers.

Housing inventory fell 13.5% to 1.15 million units, with supply still 30% below pre-pandemic levels. Inventory levels remain insufficient, with the housing market needing 30-40% more homes to meet demand.

Potential impact on Gold → range-bound short-term, midly bullish mid-term

Gold could face consolidation or mild downside pressure due to the Fed's focus on higher-for-longer rates and a strong labor market.

But given the combination of a softening housing market, persistent inflation concerns, and limited affordability for consumers, Gold could gain from safe-haven demand if economic conditions deteriorate further.

🇨🇦 Canada

Inflation Rate YoY - ↓ 1.8%

The temporary GST tax break has played a significant role in lowering the inflation rate, reducing prices on restaurant food, alcohol, and children's clothing.

Without the tax break, the inflation rate would have been 2.3%. So when the full impact of the tax cut is no longer in effect, inflation might tick back up.

Housing prices are still a concern, with rents rising even though the overall pace of price increases slowed down - 4.5% vs November's 4.6%.

The Bank of Canada has cut its key policy rate by 175 basis points from June to 3.25%.

While economists predict a further gradual cut in rates, the situation could change if external factors, like tariffs from the U.S., impact the economy.

Potential impact on Gold → mildly bearish to neutral

The Gold market might experience subdued movement as inflation fears ease in Canada and the Bank of Canada cuts rates slowly and gradually. The stronger U.S. dollar could put pressure on XAU/USD.

Gold could see more favorable conditions if inflation starts to rebound and tariffs impact the global economy. A weaker Canadian dollar and potential easing of U.S. rate hikes could benefit Gold over time, but the overall market sentiment will depend on broader economic and geopolitical developments.

🇩🇪 Germany

ZEW Economic Sentiment Index - ↓ 10.3, significantly below forecast

Germany's economy contracted for the second consecutive year in 2024, with fading recovery confidence driven by weak domestic demand and political challenges.

Low private spending and poor construction performance reveal structural issues, making a near-term rebound unlikely.

Despite a record trade surplus with the U.S. in 2024, potential U.S. tariffs on exports like automotive and machinery could severely impact Germany's export-dependent economy.

The HCOB Flash Composite PMI - ↑ 50.1, a seven-month high

HCOB Manufacturing PMI Flash - ↑ 44.1, slower contraction

In January, Germany's private sector activity stabilized after six months of contraction, driven by the services sector’s strong performance (52.5 PMI), reflecting increased demand, possibly from easing inflation or higher consumer activity.

Manufacturing continued shrinking but at its slowest pace since mid-2024.

The decline in new export business eased, as manufacturers faced less international competition and more cautious but steady customer demand.

Future confidence improved, particularly in manufacturing, where optimism hit a nearly three-year high.

Potential impact on Gold → bullish

Despite these gains, Germany's economy remains weak, with two consecutive years of GDP decline signaling deep structural issues.

Manufacturing struggles persist, and political uncertainties add to instability, potentially increasing Gold's appeal as a safe-haven asset in the mid-term.

🇬🇧 The UK

Unemployment Rate - ↑ 4.4%

Vacancies have been dropping steadily, and December alone saw a reduction of 47,000 employees, the sharpest decline since November 2020.

Private-sector pay (excluding bonuses) grew by 6.0% in the three months to November, the highest growth since February 2024.

With the labor market cooling (e.g., rising unemployment, falling vacancies), the BoE may feel justified in cutting interest rates to support economic activity. The expected 0.25% rate cut in February is likely the start of a cautious easing cycle.

However, the persistent wage growth complicates this because lowering rates too quickly could reignite inflation.

GfK Consumer Confidence - ↓ -22, the lowest level in over a year

All five components of the GfK index fell, signaling broad pessimism in consumer sentiment.

The rise in the savings index indicates a shift from spending to saving, likely to slow economic growth and negatively affect key sectors like retail, services, and housing.

The October 30 budget, which raised business taxes, has likely reduced household disposable income and hurt business profitability, further weakening economic sentiment.

While the BoE is expected to cut interest rates in February to ease financial pressure, the impact may take time to materialize.

Composite PMI - ↑ 50.9, marginal growth

Global Manufacturing PMI - ↑ 48.2, contraction for the 4th consecutive month

Global Services PMI - ↑ 51.2

The UK economy is growing marginally, but this improvement is too weak to counter rising inflation and unemployment.

Job losses over the past two months have been the fastest since the 2009 global financial crisis (excluding COVID), while business optimism has dropped to its lowest since late 2022, reflecting heightened concerns about economic prospects.

Rising input costs and selling prices are keeping consumer prices elevated, limiting the BoE’s ability to cut rates aggressively.

Investors expect 2–3 BoE rate cuts in 2025, with the first likely in February, reducing rates from 4.75% to 4.50%. However, persistent inflation could slow the pace of cuts after February.

Potential impact on Gold → bullish

Gold is expected to gain support from UK and global uncertainties. Stagflation risks, falling consumer confidence, and lower UK interest rates make it an attractive hedge for wealth preservation.

The UK’s economic struggles could weaken the pound, creating currency market uncertainty. This may further drive investors toward Gold as a safe haven, especially as global inflation remains high.

🇯🇵 Japan

Trade Balance - ↑ trade surplus of 130.9B yen

Exports increased 2.8% year-over-year.

Exports to China and the U.S., Japan’s largest trade partners, fell by 3% and 2.1%, respectively.

The weak yen is acting as a temporary buffer, boosting export value despite volume reductions.

A strong demand for chipmaking equipment in Taiwan contributed to export value.

Imports rose by 1.8%, lower than the 2.6% forecast, yet improved from a 3.8% decline in November.

Companies are worried about potential U.S. tariffs under trade protectionism policies, which could disrupt global trade.

A slower recovery in China, Japan’s key trade partner, could weigh on future export performance.

Inflation Rate YoY - ↑ 3.0%, the fastest pace in 16 months

The increase was mainly due to:

Phase-out of government subsidies that previously helped control utility bills.

High food prices driven by persistent cost pressures.

A weak yen, which kept import costs elevated.

Excluding fresh food and energy costs, the "core-core" inflation index rose 2.4%, unchanged from November.

Inflation is now well above the BOJ’s 2% target, signaling sustained price pressures.

Domestic demand appears strong, but elevated import costs and energy prices continue to strain consumers.

BoJ Interest Rate Decision - ↑ 0.5%, the highest level since 2008

This marks the second hike under Governor Kazuo Ueda, following the first rate increase in July 2024.

The BOJ’s gradual rate hikes indicate a shift from its decades-long ultra-loose monetary policy, showing confidence in achieving sustainable inflation.

Raising rates to 0.5% moves closer to the 1% neutral rate, but it remains accommodative for now.

BOJ’s cautious approach likely means rate increases will occur every six months or so, as analysts predict.

Potential impact on Gold → bearish short-term, mildly bullish mid-term

The BOJ’s rate hike and inflation-fighting stance, combined with global dollar strength, could put short-term pressure on Gold prices.

If Japan’s economy stabilizes and the yen strengthens further, the relative appeal of Gold may decrease.

However, persistent inflation risks globally (including Japan), trade uncertainties, and potential slowdowns in China could drive demand for Gold as a hedge.

If central banks, particularly the Fed, begin to signal further cuts, the dollar could weaken, providing tailwinds for Gold prices.

🎭 Market sentiment

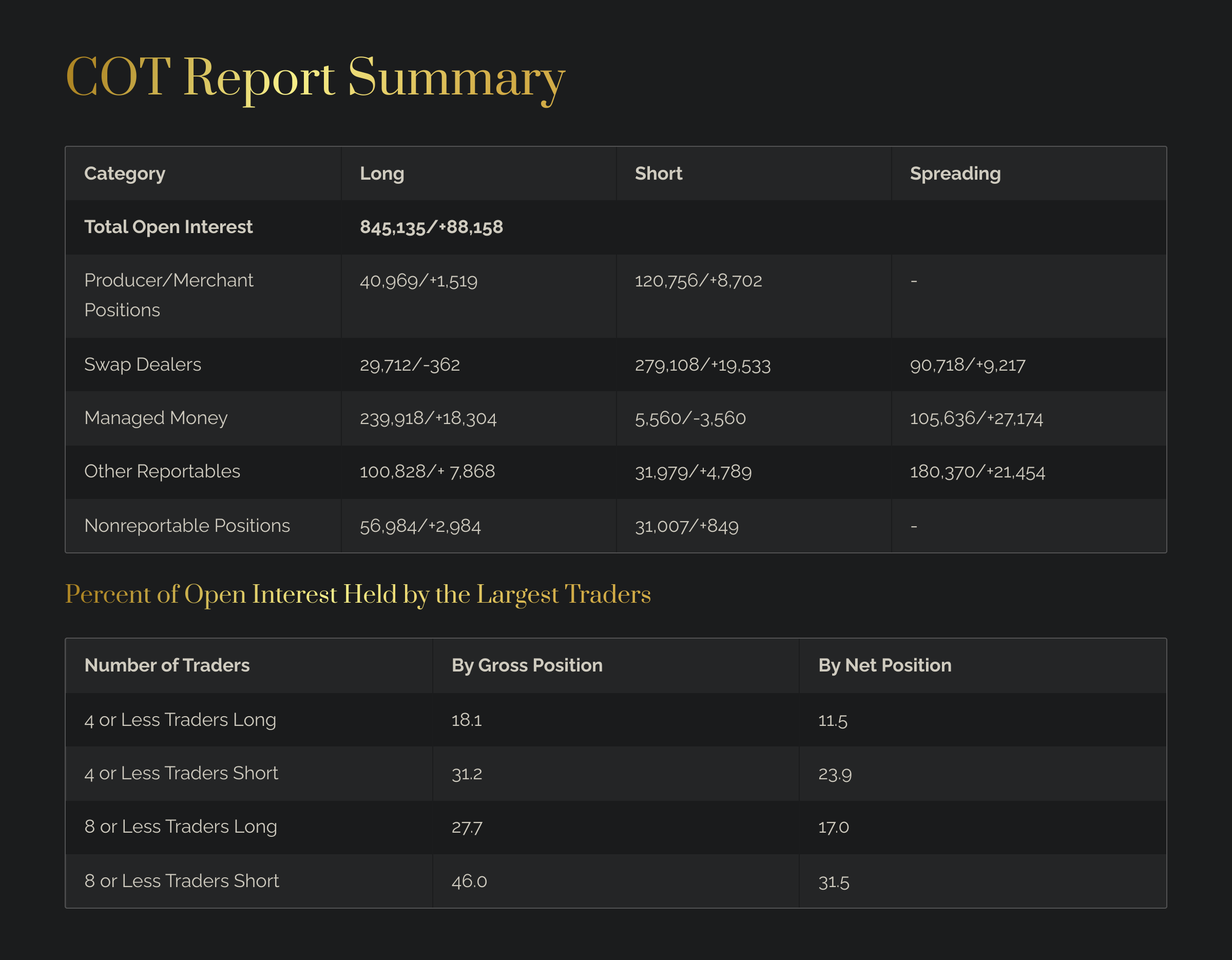

The Commitments of Traders (COT) report

Key Takeaways

Speculative interest rise: Open interest is up sharply, driven by managed money piling into longs. This indicates growing bullish sentiment, which can push prices higher—at least in the short term—because fresh buying can push the market up.

Producers and swap dealers increasing shorts: This isn’t necessarily “bearish,” because commercials (producers/merchants) are always net short. But the size of the increase suggests they see current prices as good for hedging or are supplying the demand from speculators. Continued commercial selling can slow a rally.

Spreading activity rising: This jump in spreading across multiple categories (especially swap dealers and managed money) often goes hand in hand with higher volatility. Traders are setting up more complex positions, possibly anticipating bigger price moves or wanting to protect themselves from sudden swings.

Watch out for volatility: A climb in open interest means more liquidity, but also potential for sharper, faster price moves. With big short positions out there, major news (like central bank actions or inflation data) could cause sudden market whipsaws.

Short-covering potential: If Gold edges higher and short-sellers feel pressure, they could rush to buy back positions, potentially fueling a quick upside move.

👀 What to expect

Technical outlook

Next few hours/days:

Price might test the 2,760–2,750 zone (rising wedge breakdown, weak ADX, bearish MACD crossover).

If buyers step in and momentum flips (e.g., short-term oscillators get oversold and bounce), Gold could bounce back toward 2,780 - but resistance here is strong.

If price fails to hold above 2,750, we could see a sharper drop toward the 2,730–2,727 region.

Next days:

Gold’s overall structure is still bullish on higher timeframes, but the short-term is in a corrective phase.

If buyers defend 2,726, the price could start climbing back toward 2,780–2,800 in the next few days.

Failure to hold 2,726 could send Gold deeper, potentially testing 2,706 - 2,700 → 2,680.

Trading Ideas

1/ Short-term dip buy (5-15m charts):

Setup: Look for bullish reversal signals (e.g., oversold Williams %R, bullish divergence on RSI/CCI) in the 2,750–2,760 area.

Take a small, “aggressive” buy closer to 2,750–2,760 if you see bullish signals (like a strong bounce candle, oversold indicator) before the HMA9/SMA13 is reclaimed.

Then, add more to your position if/when price closes above the HMA.

Target: partial take-profit around 2,780, possibly extend to 2,790 if momentum is strong.

2/ Short scalps on wedge breakdown (5-15min charts)

Setup: If price clearly fails around 2,770–2,780 and turns down on strong volume, indicating momentum is shifting downward. Wedges often lead to rapid, short bursts of selling once the lower boundary breaks (or once a retest fails).

If price breaks down without elevated volume, you might wait—lackluster volume can cause choppy, false breaks. Also check with MACD, CCI or Williams %R flipping from positive to negative.

Stop-Loss: Just above the failure point (e.g., 2,780–2,785). Or look for local pivot highs (like a quick bounce candle that fails). A stop 3–5 ticks above that pivot can maximize R/R.

Target: ~2,750 - a nearby round-ish number plus a known volume profile node.

Overall outlook - range-bound short-term/mildly-bullish mid-term

Gold is likely to stay choppy and range-bound in the short term due to higher interest rates and a firm dollar dampening immediate upside.

However, mid-term sentiment leans bullish due to several factors:

We’re seeing weaker manufacturing numbers, a slowing housing market in some places, and overall cautious consumer confidence. Germany’s ongoing economic struggles and the UK’s mix of rising unemployment + still-high inflation underscore broader European weakness.

As jobless claims inch up in the U.S. (even if some of that is weather-related), and layoffs remain on watch, recession talk could return. Canada and Japan have their own concerns about external shocks (like tariffs from the U.S. or a softening China).

Inflation, while easing in certain regions, still remains above comfortable levels in many countries. And even in areas where it’s cooled off for now (e.g., Canada with its temporary tax breaks), there’s a good chance inflation ticks higher again once those effects fade.

Combine that with rising speculative interest and the potential for short covering, and Gold has a decent shot at trending higher over the next few months.

Safe trading,

and remember: All that glitters is not Gold,

Joe

Disclaimer:

The information provided here is for educational and informational purposes only. It does not constitute financial or trading advice, and it should not be taken as such. You should conduct your own independent research and consult with a qualified financial professional before making any trading or investment decisions. All forms of trading and investing involve risks, and past performance is not indicative of future results.