Look, I get it.

Suggesting you allocate over a third of your portfolio to Gold probably makes me sound like I spend weekends in a bunker hoarding canned beans and ammo.

But hear me out.

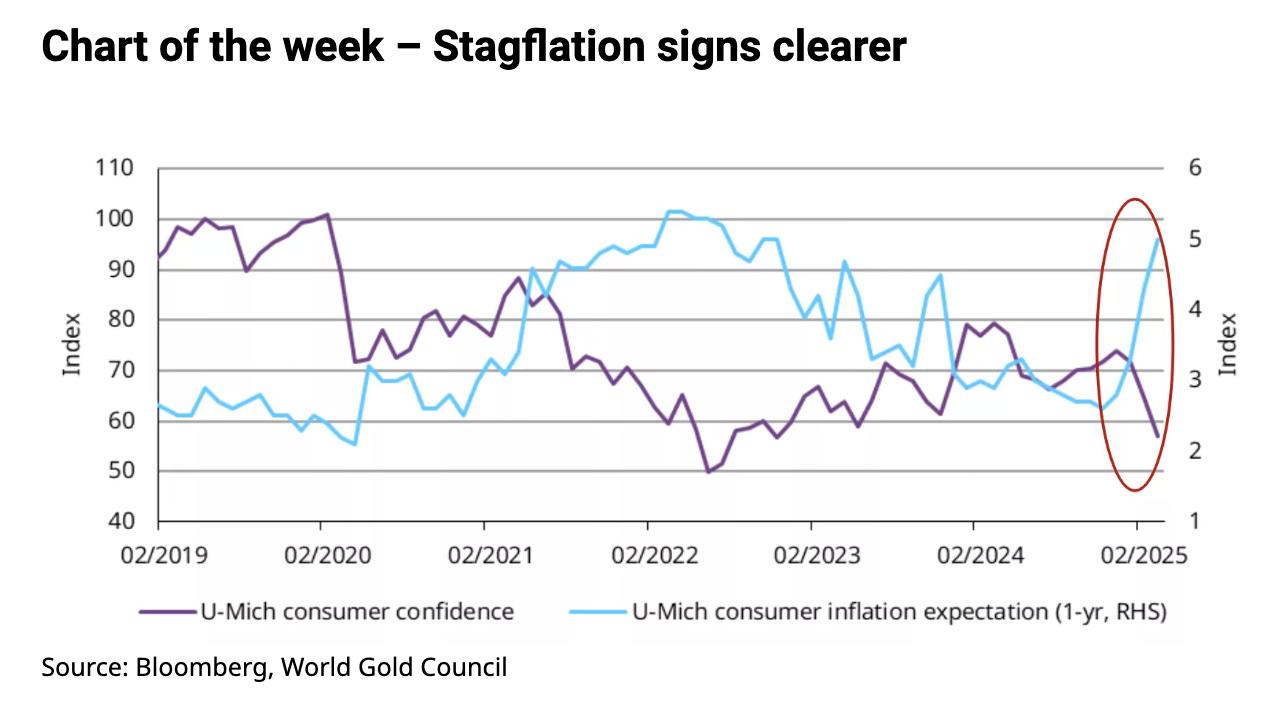

Stagflation—that dreaded “S-word” no investor wants to hear – seems to be making a comeback.

And historically, when stagflation arrives, stocks and bonds tend to fall flat on their faces. Meanwhile, Gold is suddenly the coolest kid in class.

Let’s take a closer look at why it's time to get a little radical with your Gold allocation—and no, I don’t own a tinfoil hat (yet).

Understanding Stagflation: What It Means for Investors

Stagflation = stagnant growth + high inflation.

It’s basically the economic version of getting fired while your rent doubles.

In normal times, if growth slows, the Fed cuts rates and markets bounce.

But in stagflation, inflation ties the Fed’s hands, and both stocks and bonds tend to tank—no safe haven, just pain.

We’ve seen this before.

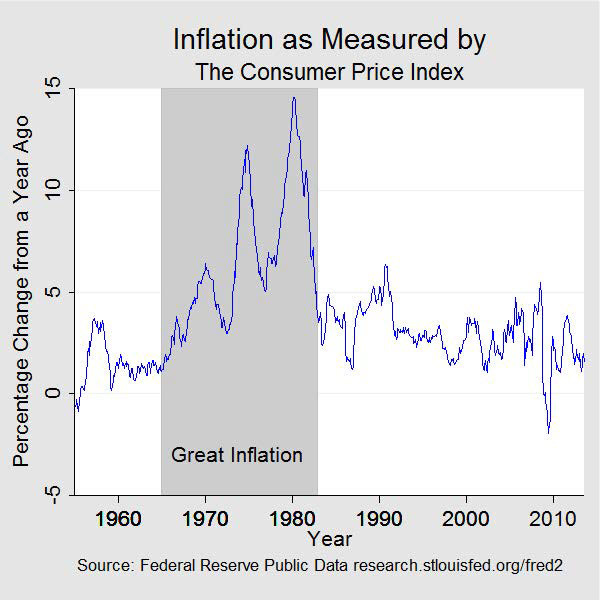

In the 1970s, the OPEC oil embargo triggered energy price spikes, sending inflation soaring. U.S. inflation hit 11% in 1974 and cracked 13% by 1979—while unemployment climbed.

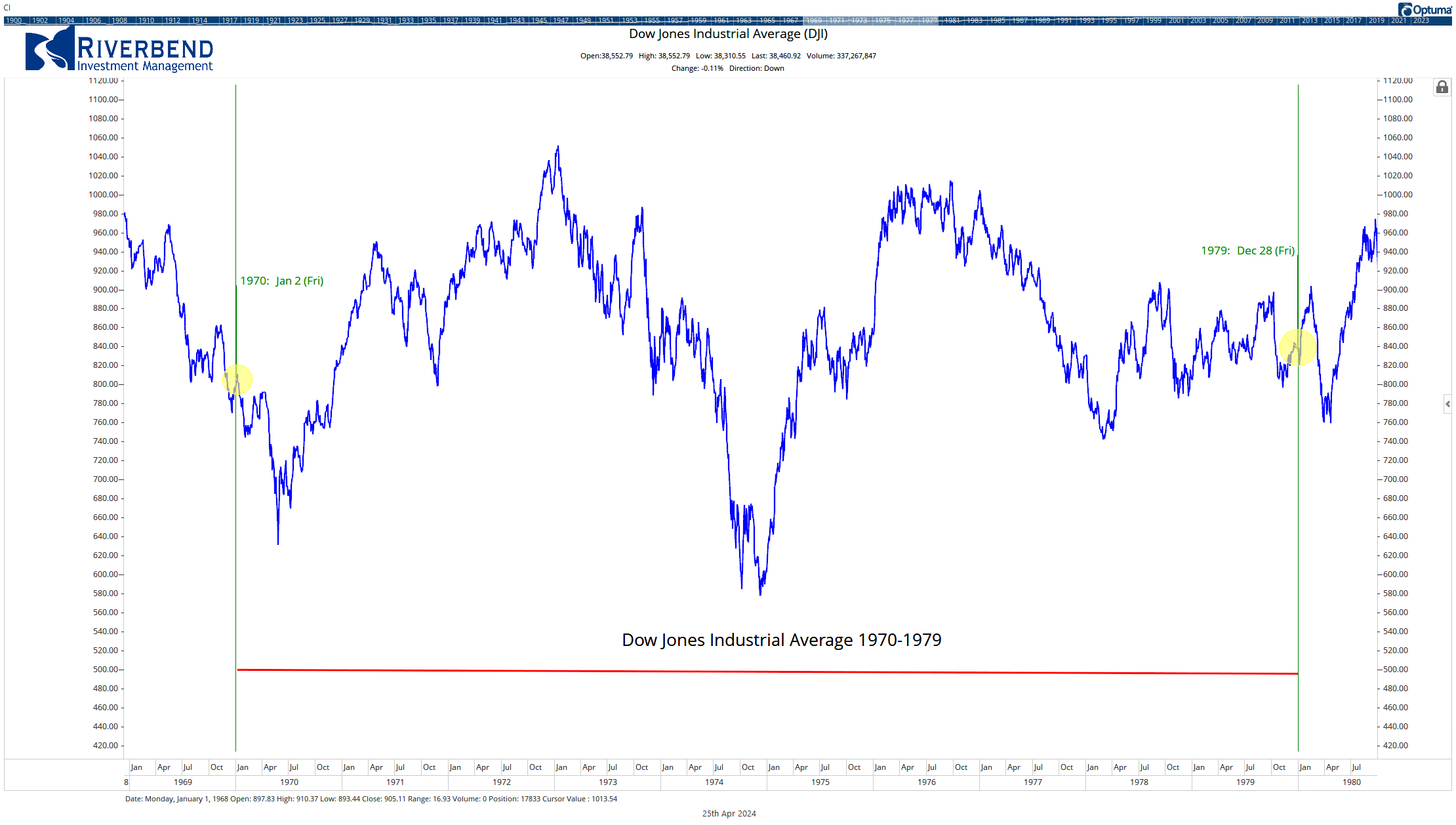

During that decade, the Dow Jones crawled to just a 5% total gain that entire decade. Adjusted for inflation, investors lost about 49% in real terms by 1980.

Are we headed for stagflation 2.0?

Stubborn inflation? ✅ Still running hot: CPI YoY at 2.8%, Core CPI at 3.1%. The Fed’s 2% goal looks more like wishful thinking.

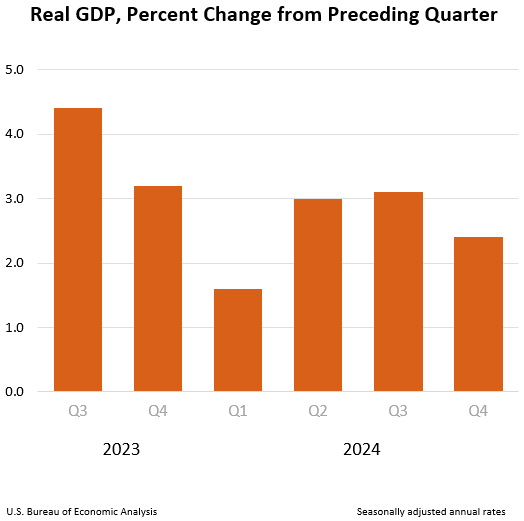

GDP slowing? ✅ Growth is decelerating as consumers burn through savings and high rates hit home. As of March 28, the Atlanta Fed projected –2.8% GDP for Q1. That’s not a slowdown—that’s contraction.

Rising costs? ✅ In early 2025, the U.S. slapped 25% tariffs on steel and aluminum. Then just now, Trump added a 10% blanket tariff on nearly all imports and 25% on cars. Add in ongoing supply chain snags and geopolitical-driven de-globalization, and companies are eating higher costs—and passing them on to consumers. (Check out this CBS price tracker for groceries, cars, and supplies).

Crashing sentiment? ✅ The University of Michigan’s Consumer Sentiment Index just fell to 57.0 in March, down 11.9% in a month and 28% year-over-year. Two-thirds of Americans expect rising unemployment—the worst outlook since 2009. When Main Street is this pessimistic, spending slows—and so does the economy.

Policy paralysis at the Fed

Stagflation traps central banks.

Raise rates to kill inflation → Growth gets crushed.

Cut rates to save growth → Inflation takes off again.

The Fed’s rate hikes in 2022–2023 slowed housing and tech but haven’t cracked inflation. Now they’re stuck: cut too soon and risk another price surge; stay tight and risk triggering a recession.

That’s bad news for traditional portfolios.

Stocks suffer from weak earnings. Bonds get hammered by rising yields. Cash melts under inflation.

But Gold? Gold doesn’t care.

Whichever way the Fed moves, Gold benefits:

Stay hawkish? Recession risk climbs. Eventually, they’ll need to pivot = bullish for Gold.

Ease early? Inflation expectations spike = even more bullish for Gold.

Position right, and stagflation isn’t a death sentence—it’s a profit opportunity.

Gold in a Stagflation: The Ultimate Hedge

If stagflation was the villain of the 1970s, Gold was the hero swooping in to save investors’ purchasing power.

Gold wasn’t just a safe haven—it was the best-performing asset of the entire decade.

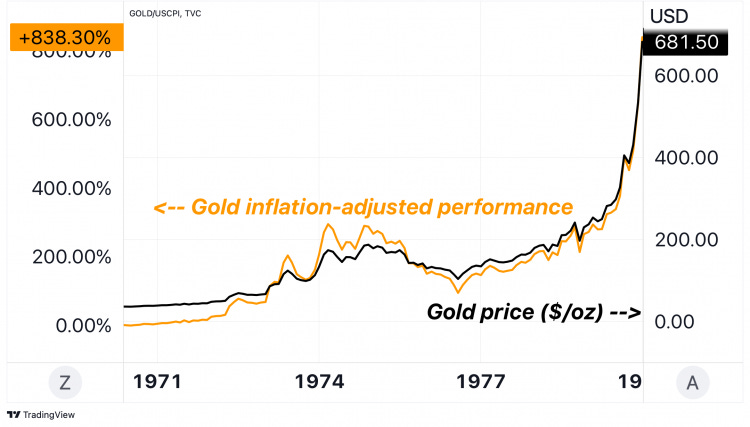

At the start of 1970, `Gold traded around $35/oz. By January 1980, it hit $680/oz (briefly spiking to $850 intraday). That’s a 20x gain in nominal terms.

Even adjusted for inflation, Gold delivered a real return of over 800%.

Compare that to the S&P 500:

$100 in Gold turned into ~$1,000 by 1980.

The same $100 in the S&P - about $200 (and with much less purchasing power).

In real terms, equities left investors 49% poorer by decade’s end.

Gold, on the other hand, didn’t just preserve wealth—it multiplied it.

History is clear: when inflation surges and growth stalls, Gold shines

Since 1973, during stagflationary periods, Gold has returned +32% annually on average.

U.S. equities? –11% per year. Even Treasuries only managed low single-digit gains.

The World Gold Council breaks it down: of the four main economic regimes—boom, reflation, stagflation, and deflation—stagflation is the most bullish for Gold and the most brutal for stocks.

Recent history echoes the trend:

2002–2006: Oil spiked, growth slowed. Gold rose ~120%.

2010–2011: Inflation hit 3%+, the economy limped. Gold soared to $1,900/oz.

2022: Inflation surged. Stocks and bonds flopped. Gold held its ground, briefly breaking $2,000/oz.

Globally, the same pattern holds. Whether it's Latin America in the ‘80s or emerging Europe in the 2010s, high inflation + weak growth = investors turning to Gold.

All this sets the stage for today.

If we are entering a new stagflation cycle, history suggests you want a lot more Gold in your portfolio.

I’d argue for a 35% allocation or more—far above the typical token amount most portfolios hold today. In stagflation, Gold isn’t just a diversifier. It’s the hedge that actually works when nothing else does.

Why 35% Gold? Rethinking “Diversification” in a Stagflation World

Most financial advisors will tell you to cap your Gold exposure at 5–10%. It’s considered a hedge, not a growth engine.

That advice works in normal times.

But we’re not in normal times.

In stagflation, the classic 60/40 stock-bond portfolio falls apart. Stocks sink with earnings, bonds get wrecked by inflation, and “diversification” becomes a myth.

That’s why I’m making the case for 35% in Gold—not as a fringe hedge, but as a core position.

60/40 crashed in the ’70s. Gold didn’t

From 1970 to 1979, a 60/40 portfolio actually lost real purchasing power. $10,000 in 1970 shrank to about $9,200 (inflation-adjusted) by 1979.

Meanwhile, Gold went from $35/oz to $680/oz—a 20x increase in nominal terms.

A 30–35% Gold allocation would’ve not just offset stock and bond losses—it would’ve supercharged your returns.

Even 20% in Gold back then would’ve likely flipped an otherwise negative portfolio into strong real gains.

What does the data say?

According to the World Gold Council, adding just 5–15% Gold boosts risk-adjusted returns across most environments.

But in stagflation, the game changes. Volatility spikes, correlations flip, and WGC says: “The higher the risk in the portfolio, the larger the required allocation to gold.”

In crisis regimes, history shows that 20–30% Gold can cut deep drawdowns and smooth out returns. It’s about cushioning the worst-case scenario—something traditional portfolios can’t do anymore.

Why 35%?

Think of it as a proactive overweighting for a high-conviction scenario.

If stagflation is your base case, then you want more than token exposure.

In the 1970s, even 12% Gold wasn’t enough to rescue portfolios; it took more. By dialing up to ~35%, we’re tilting the portfolio to thrive in stagflation at the cost of some performance in a benign scenario (a trade-off many are willing to make when faced with stagflation’s severe erosion of wealth).

Also, consider that bonds today may not offer the same relief they eventually did in the 1980s (when Volcker’s rate hikes made bond yields very attractive by 1982, rescuing fixed-income investors).

In a scenario where central banks cannot hike as aggressively (due to debt or political constraints), bonds might remain mediocre.

That’s one way to justify ~35% – it’s partly replacing where we’d normally rely on bonds for safety.

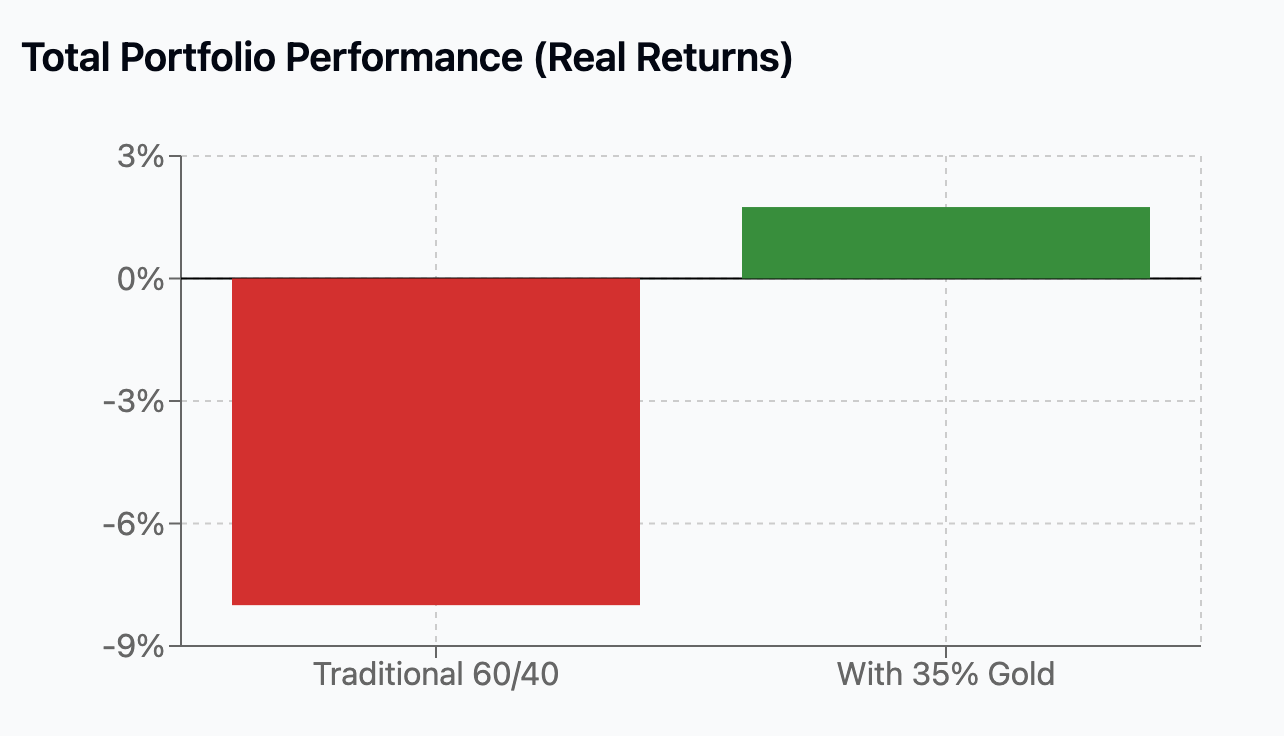

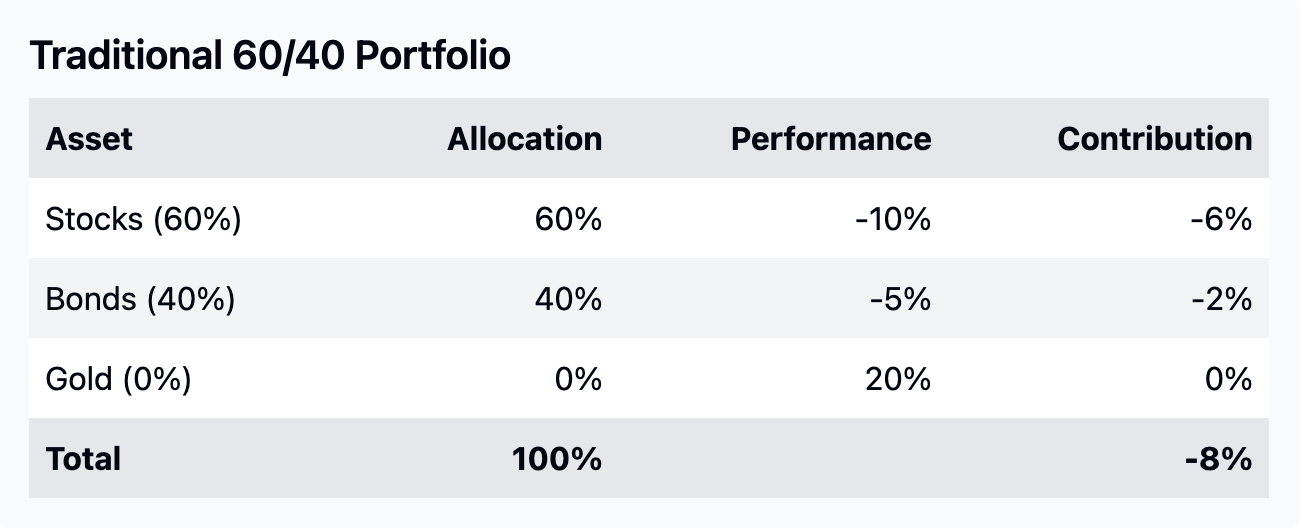

Say stagflation hits and we get a repeat (on a smaller scale) of the 1970s dynamic: stocks down, bonds down, gold way up.

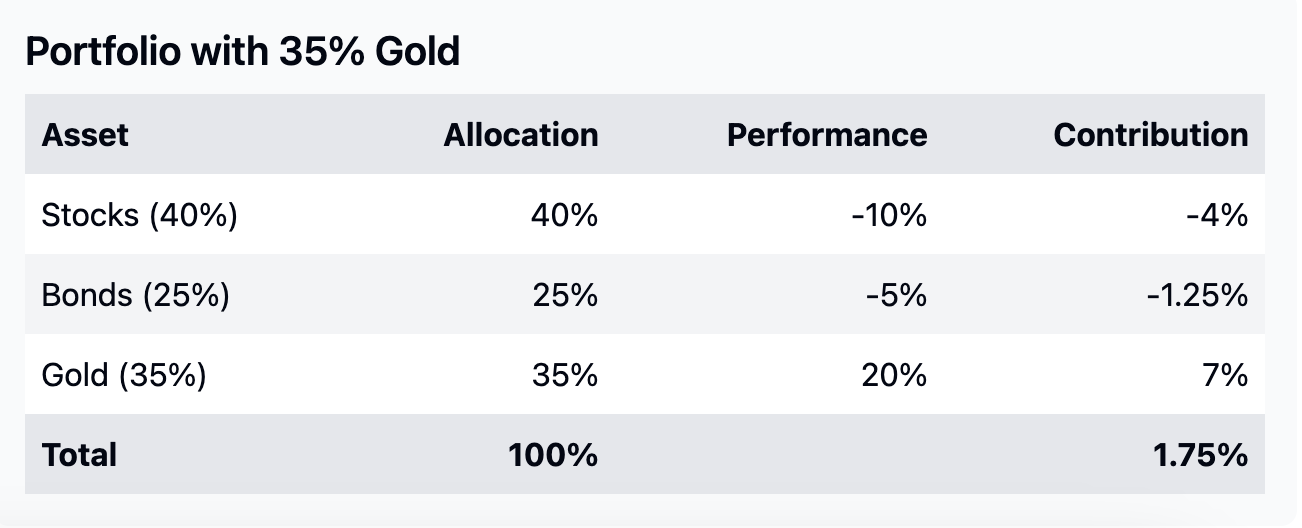

Let’s do the math:

Stocks: –10%

Bonds: –5%

Gold: +20%

In a 35% gold / 40% stocks / 25% bonds portfolio:

Gold adds +7%

Stocks subtract –6%

Bonds subtract –1.25%

Net result: basically flat → compare that to a traditional 60/40 with minimal Gold.

Of course, these are hypothetical figures – reality will vary. But the point is, gold can carry a lot of weight when it’s one of the only assets in the green.

This isn’t forever

This isn’t about holding 35% Gold permanently. It’s a tactical overweight for a specific macro regime. When the storm clears, you rebalance.

But during stagflation, Gold needs to do the heavy lifting.

What about other inflation hedges?

Sure—commodities, real estate, even energy stocks could play a role similar to Gold. A broad commodities index also did well in the 1970s (oil, metals, agriculture all up).

But they come with friction: volatility, complexity, illiquidity. Real estate, for example, can hedge inflation too, but in stagflation the combination of high interest rates and unemployment can hurt real estate values in real terms.

Gold, on the other hand, is simple, liquid, globally recognized. That purity as an unyielding asset is a feature, not a flaw.

Risks of a Gold-Heavy Portfolio (and How to Manage Them)

Before you go all-in on Gold, though, let’s address the elephant in the room: the risks.

Gold is not a guaranteed one-way ticket. It has its downsides, especially if you overweight it.

Here’s what can go wrong and how to protect yourself:

1/ Gold is volatile too

Gold may be defensive, but it’s not always calm. And it doesn’t always go up in a straight line (just ask anyone who panic-bought at an interim top).

After peaking at $850/oz in 1980, it crashed to $253/oz by 1999—a ~70% drop from its inflation-adjusted peak.

From 1980–1984, Gold lost ~10% per year in real terms as Volcker’s rate hikes restored confidence in fiat.

The lesson? If the macro script flips (e.g. inflation is decisively crushed), Gold can suffer significant drawdowns.

More recently, Gold fell ~40% between 2011 and 2015. Short-term swings can test your nerves—especially if you pile in at once.

Mitigation:

Use dollar-cost averaging to scale in. Don’t buy your entire position at once.

Rebalance if Gold runs too hot—if it hits 50% of your portfolio, trim. Manage risk actively.

2/ Liquidity in a crunch

Gold is normally liquid—ETFs, futures, and bullion markets trade heavily. But during market panics, weird things can happen.

In March 2020, for example, Gold prices initially dropped sharply – not because it wasn’t a safe haven, but because panicked investors sold Gold to raise cash (to cover margin calls elsewhere).

There’s also a slight liquidity risk if you hold physical Gold or certain Gold funds – you can’t sell a bar of Gold at 3am as easily as clicking to sell a stock.

Generally this is a minor concern (Gold is pretty much always tradable somewhere globally), but if you needed to liquidate a large Gold position quickly, market impact could be a factor.

Mitigation:

Use liquid instruments like GLD, IAU, or futures in addition to bullion.

Don’t go all-in on obscure Gold miners. Spread exposure across different vehicles.

3/ No yield = real opportunity cost

Gold pays zero income. In fact, if you store physical Gold, it can have carrying costs (storage fees, insurance).

In a 4.5%+ interest rate world, that’s a steep opportunity cost. If inflation unexpectedly falls and you’re left with a bunch of zero-yield metal while others are earning yield, that hurts.

Mitigation:

Accept that this is a strategic bet, not an income play. You’re trading yield for crisis performance.

You can add dividend-paying Gold miners or royalty stocks to inject some yield without abandoning the theme.

4/ Concentration risk

35% in one asset is a lot.

While Gold itself is not a credit risk or something that can go bankrupt, a sudden reversal in Gold’s fortunes would heavily impact your portfolio.

Additionally, if you access Gold via proxies (like mining stocks, ETFs, etc.), those introduce their own risks (management risk, tracking error, etc.).

Mitigation:

Diversify within the 35%. Try:

25% Gold

5% silver

5% miners or royalty companies

Still 35% total, but not all in identical assets. Silver, for example, often outruns Gold in inflation spikes (though with more volatility).

Gold mining stocks provide leverage to Gold prices – when Gold rises, miners’ profits can rise even more. Royalty firms like Franco-Nevada or Wheaton offer Gold upside with lower operational risk—they finance mines in exchange for a cut of production, so they benefit from Gold prices with less operational risk, and many pay steady dividends.

5/ Psychology and timing

Watching Gold fall while CNBC tells you inflation is “done” will test your conviction. Stagflation trades are bumpy and slow-moving—but within them Gold will have corrections.

The risk is you panic-sell at the wrong time.

Mitigation:

Define clear exit conditions upfront. For example:

Hold 35% Gold until core inflation < 3% and real rates turn significantly positive

Or until Gold hits your target price

Having objective criteria helps override emotional reactions.

Build gradually—don’t force a full allocation all at once.

Know when to exit

This part’s crucial: Have an exit plan.

If inflation breaks down or growth picks up, the stagflation trade is over. If a deflationary bust hits first (think Fed-induced recession), Gold may drop short-term—like it did in 2008. That’s your chance to take profits and reload lower.

Watch key macro signals—real rates, inflation trends, growth recovery. When they flip, start rotating into assets poised for the next regime: stocks, real estate, maybe long-duration bonds.

Remember, you’re not locked into Gold forever. You’re profiting from it during the regime where it works best. Then you move on when the macro narrative changes.

Safe trading,

and remember: All that glitters is not Gold,

Joe