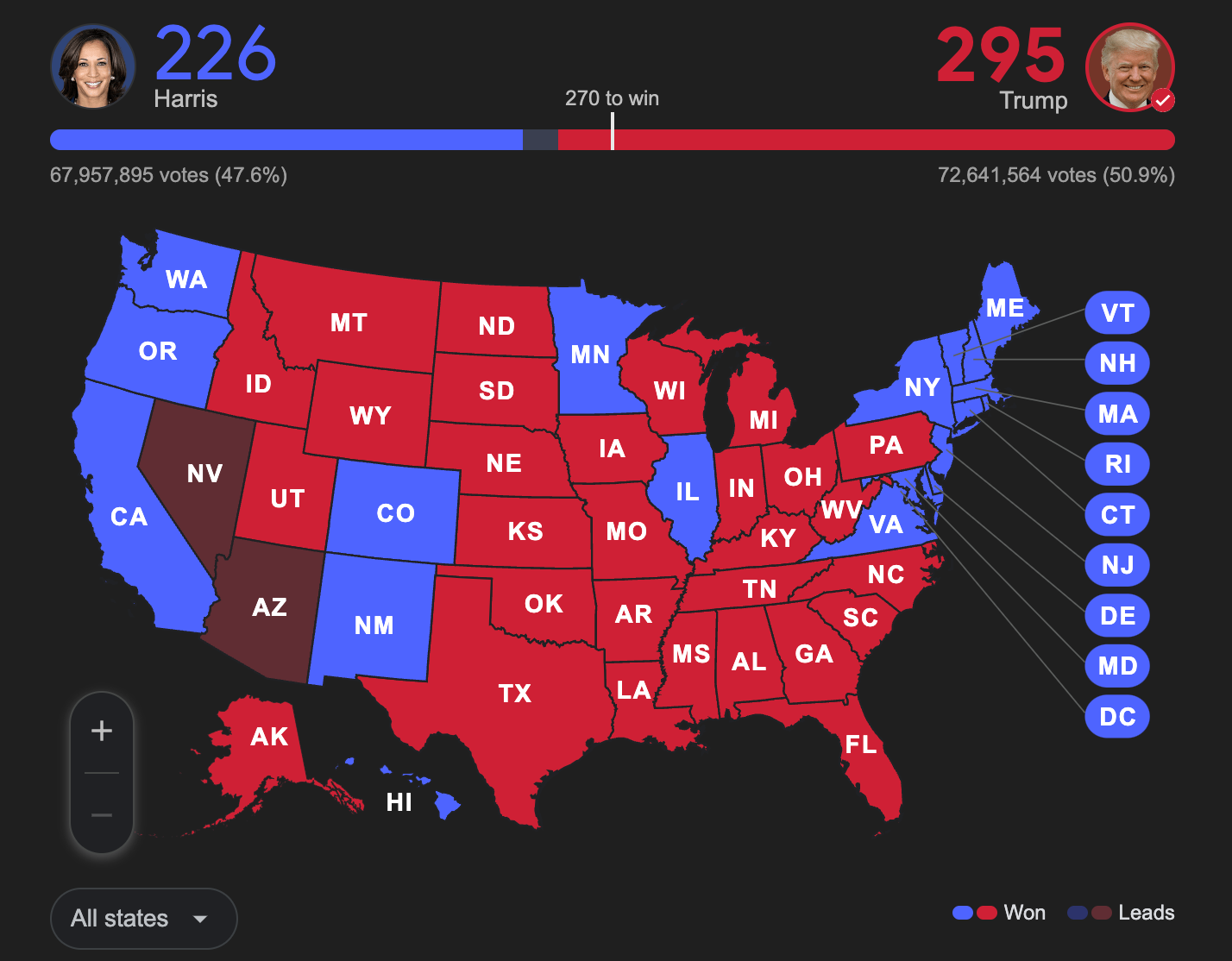

Well, here we are—Donald Trump has officially won the presidency again. The big question on everyone’s mind now is what his comeback means for markets.

Remember Trump's first term? His “America First” vibe, those hefty tax cuts, and the tough tariffs, especially on China, made major waves. And Gold felt the impact big time.

When he took office in 2016, Gold took a short dip but quickly rebounded, riding up nearly 48% by the end of his term. Now, with Trump promising even bigger moves on trade and fiscal policy, there’s a good chance Gold could soar again.

Let’s break down why this could happen and how high Gold might climb.

Gold under Trump: what happened the first time

To get a sense of what’s ahead, let’s look back at what happened with Gold during Trump’s first term.

Right after the 2016 election, Gold dipped about 5.4%. But once he started rolling out his policies, things turned around, and Gold began to climb. Trump’s big 2017 tax cut—lowering corporate taxes from 35% to 21%—gave the economy a quick boost, but it came at the cost of a ballooning deficit.

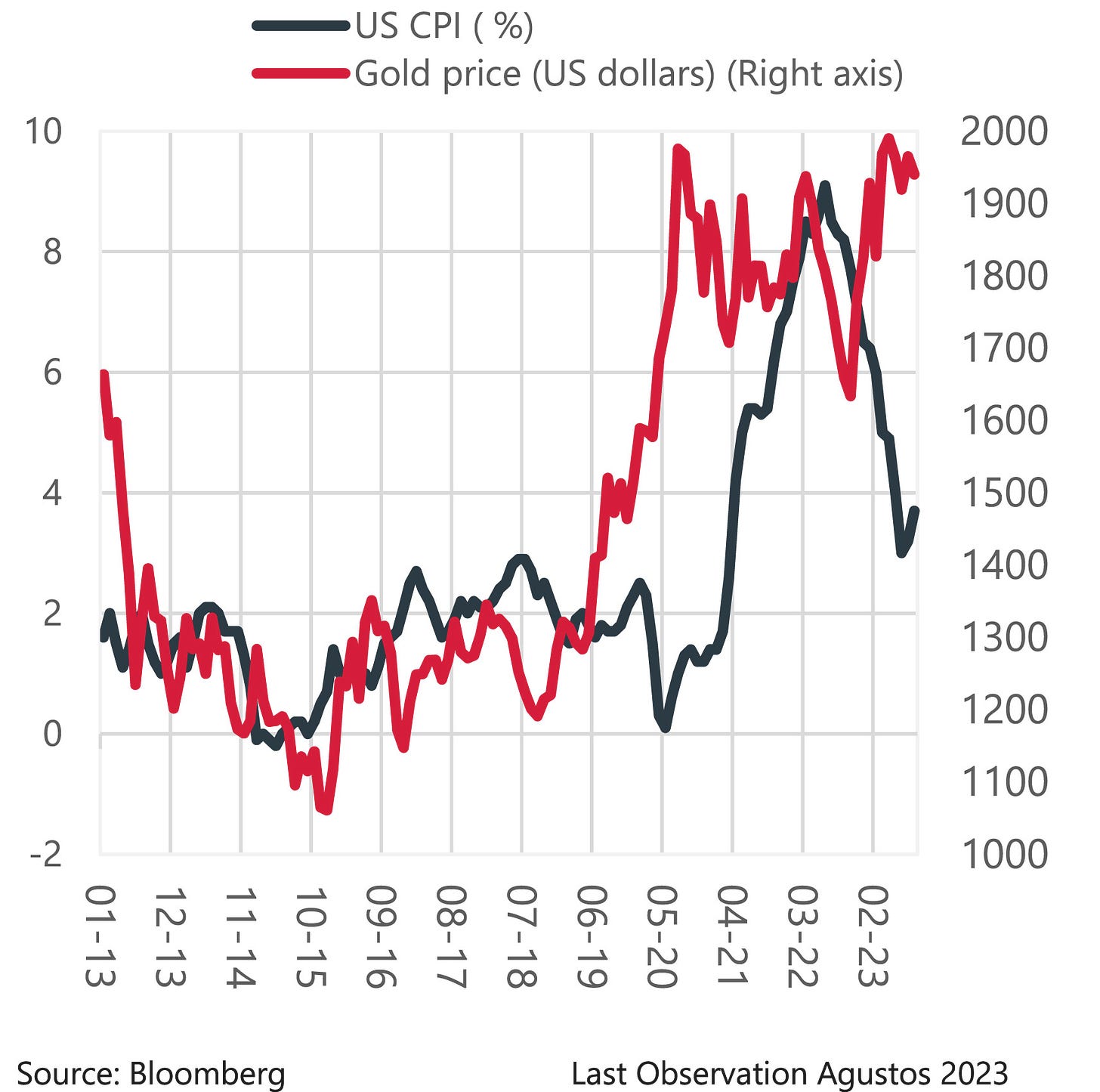

Then came the tariffs on imports from China and other countries, which pushed up inflation by making goods more expensive. Suddenly, Gold was in high demand as people looked for ways to hedge against rising prices and all that uncertainty.

By the end of his four years, Gold had surged nearly 48%, thanks to economic turbulence, a weaker dollar, and global trade tensions. With Trump back in the game, we might just see some of those same forces at work again.

What would a Trump victory mean for Gold now

With Trump’s policies back in play, there are several key areas that could directly influence Gold prices.

Tariffs and inflation pressures all over again

Trump’s not shy about bringing back tariffs, especially on China. He’s already talked about reintroducing a 10% tax on imports, and 60% tax on goods from China.

This would almost certainly drive inflation because higher tariffs mean pricier imports, and those costs get passed down to us, the consumers.

For Gold, that inflation pressure could be a major catalyst. Historically, inflationary periods have sent Gold prices up as people look for ways to protect their purchasing power.

More deficit spending and debt

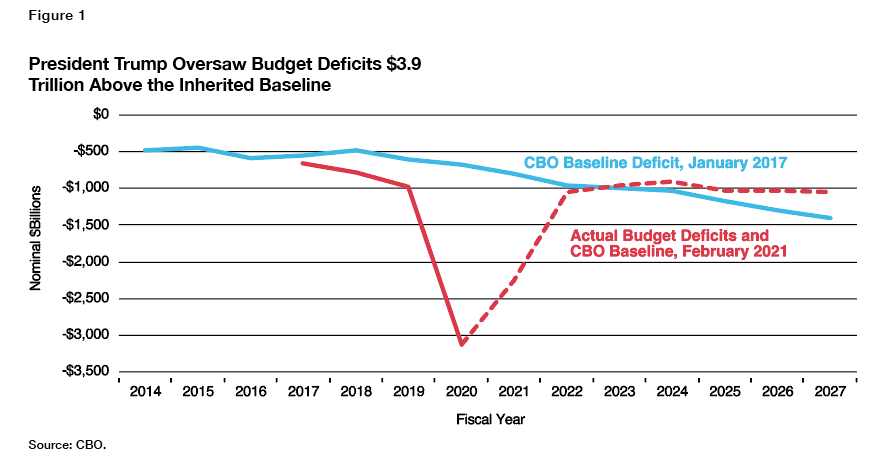

If there’s one thing we learned from Trump’s first term, it’s that he’s not afraid to run up the deficit. Back in fiscal year 2020, the deficit hit $3 trillion, and the national debt surpassed 100% of the economy for the first time since WWII.

Trump’s hinted at new tax cuts, possibly dropping the corporate rate down to 15%.

Sure, this could spur growth, but it’s likely to increase the deficit even more. More government spending and higher debt usually weaken the dollar over time, which is good news for Gold. Plus, a Trump administration would probably push for more infrastructure spending, adding to the deficit.

Historically, deficit-driven inflation has been great for Gold. Take the Obama years from 2008 to 2016, for example—government spending during the Great Recession pushed gold up by 133% in Obama’s first term.

The dollar and Fed policy

Trump’s protectionist policies might give the dollar a short-term boost, especially if investors see the U.S. as a safer bet with lower corporate taxes and higher yields.

Normally, a stronger dollar puts a damper on Gold since it makes the metal pricier in other currencies. But recent trends show that Gold and the dollar can sometimes rise together, especially during shaky economic times.

Let’s not forget the Federal Reserve, who have started their rate-cutting plan. With the Fed expected to lower rates further today, November 7, the future of rate cuts is now uncertain.

If inflation starts to climb under Trump’s tariffs and deficit spending, the Fed might be caught in a bind. They could be forced to pause rate cuts or even raise them again to combat inflation.

That said, the broader economic and geopolitical uncertainties could still provide significant support for Gold, potentially balancing out the negative effects of higher interest rates.

Geopolitical uncertainty under Trump

Geopolitical uncertainty is a huge driver for Gold prices.

Trump tends to lean towards an isolationist approach, cutting down the U.S. military presence abroad and focusing more on domestic defense. But his unpredictable moves on international conflicts—from Middle Eastern tensions to the situation in Ukraine—could stir up global markets, boosting Gold’s appeal as a safe haven.

U.S.-China relations: With Trump back, expect U.S.-China tensions to spike. He’s been talking about tougher tariffs, and he’s not afraid to restrict Chinese tech companies in the U.S. This kind of tension disrupts supply chains and hikes up consumer prices, feeding into inflation. And you guessed it—Gold loves inflation and uncertainty, so if trade wars heat up, Gold could shine.

Russia-Ukraine conflict: Trump has hinted at pulling back U.S. involvement in European conflicts and maybe even pushing for a quick peace deal with Russia. But if he goes too soft on Russia, it could shift the power balance in Europe, destabilizing markets and scaring off investors.

Middle East and oil prices: In the Middle East, Trump has historically backed allies like Saudi Arabia and Israel while trying to limit U.S. involvement in regional conflicts. If he pushes for policies that keep oil prices high—like limiting output—it could add to inflationary pressures.

North Korea: Remember Trump’s rollercoaster relationship with North Korea? One day he’s threatening “fire and fury,” and the next, he’s holding historic summits. With him back in office, we could see more of that volatility.

Looking ahead: Gold’s uptrend

Technically, Gold’s been on a strong uptrend over the last year, hitting over $2,700 an ounce.

A Trump victory would likely amplify some of the key factors that have historically pushed Gold higher: inflationary tariffs, deficit-driven spending, and geopolitical volatility.

If these inflationary policies take off, Gold could be on its way to a new major rally, hitting that $3,000 mark and shaking up the market as we know it.

So as Gold is slowly bouncing back from its three-week low of $2,640 following the election news, it could be the perfect opportunity to hop on the Gold bandwagon before the next big breakthrough.

Safe trading,

and remember: All that glitters is not Gold,

Joe