Don't Get Chopped Up: Your Survival Guide for U.S. CPI Week [Gold Market Movers: Sep 08 - 14]

How amateurs will lose money this week (and how we won't)

The amateur looks at the calendar this week and sees 10+ "high impact" events. They'll spend hours debating European interest rates and German trade data.

Not us. Not here.

After 13 years of trading this market for a living, I've learned the most expensive lesson: the market week isn't a democracy. All events are not created equal.

This entire week is a prelude to two events:

China's CPI data on Wednesday

U.S. Core Inflation print on Thursday.

One will set the "fear" tone for the global market, and the other will dictate the Fed's next move.

Everything else is designed to pull money from impatient traders.

We will walk through this this calendar event-by-event, and I will show you exactly where the money is, and where the traps are.

Let the rest of the market chase the distractions. We have a plan.

Let’s get to work.

🗓️ TUESDAY, SEP 09

🇦🇺 Australia Westpac Consumer Confidence + NAB Business Confidence

CONSUMER CONFIDENCE Forecast: — | Previous: 98.5 (+5.7%)

BUSINESS CONFIDENCE Forecast: — | Previous: 7

TLDR: not major trading events, unless numbers come out with a truly catastrophic readings. Watch AUD/USD along with XAU/USD chart.

💥 Impact:

These numbers tell us if Australian consumers and businesses are feeling optimistic or pessimistic about their own future.

Gold is driven by global factors, primarily U.S. monetary policy (what the Fed is doing), the strength of the U.S. Dollar, and major geopolitical risk. What a few thousand Australian consumers think about their job prospects is not on the Fed's radar, and therefore, it's not on ours.

The only way this data could affect Gold is indirectly: strong Australian report → stronger AUD → weaker DXY → Gold support. But the scale for major impact is completely wrong.

Trading insight:

The shock numbers that will make us pay attention:

Consumer confidence falling below 80.

Business confidence printing -10 or lower. This level of pessimism is a classic leading indicator of a recession.

If we see both reports hit these shock numbers simultaneously, the probability of a significant market reaction increases dramatically.

The tactical plan:

Open a 5-m AUD/USD chart.

Look for sharp drop, at least 40-50 pips that breaks key support level.

A true panic move will break this level without hesitation. If the price stalls and holds at that support, the "shock" was not shocking enough for the big players.

As the AUD/USD is falling hard (risk-off signal), what is the price of Gold doing?

Scenario A (No trade): If Gold also falling → the U.S. Dollar is simply very strong, not a specific safe-haven signal → do nothing.

Scenario B (The signal): If AUD/USD is plummeting, but Gold is either holding its ground flat or, even better, starting to creep higher, this is our signal. This divergence means capital is flowing out of risky "commodity currencies" (like the AUD) and into the perceived safety of Gold.

🇺🇸 The U.S. Non-Farm Payrolls Annual Revision

Forecast: — | Previous: -818K

TLDR: The market has already priced in the past; our job is to price in the future. Ignore unless it prints shock numbers.

💥 Impact:

The market has already reacted to, digested, and moved on from each of the last 12 monthly jobs reports. This revision simply corrects the historical record.

For a Gold trader, our focus is squarely on the Federal Reserve's next move. The Fed makes decisions based on the latest, incoming data—like this week's inflation report—not on a correction to data from a year ago.

Therefore, this revision has virtually no direct impact on the factors that drive the price of Gold today.

Trading insight:

The only reason to watch this release is if the revision is so monumentally large that it challenges the integrity of the data itself.

The shock negative number in this case: greater than negative 2M (-2,000,000).

A revision of that magnitude is no longer just a statistical adjustment. It would be a confession that the government's primary method for measuring the labor market was fundamentally flawed for an entire year.

The market's reaction would not be about the jobs. It would be about a sudden crisis of confidence in the U.S. government's ability to produce reliable economic data. If the jobs data was that wrong, is the inflation data also wrong? Is GDP wrong?

This level of uncertainty is a catalyst for a fear-driven trade.

The tactical plan:

Watch the U.S. 10-Year Treasury yield. In a "loss of faith" scenario, investors would question everything and rush to the safety of bonds, causing yields to fall sharply.

If Gold bids higher at the same time, a flight-to-safety is underway.

Enter long, not because of the old jobs data, but because of the brand-new uncertainty injected into the market.

The shock positive number: more than positive 1.5 million (+1,500,000). A revision of this size is extremely rare. It would suggest that the U.S. economy was absolutely booming in a way that the initial data completely missed.

The tactical plan:

Watch U.S. 2-Year Treasury Yield. This is the market's most sensitive gauge of near-term Fed policy expectations.

Expect the 2-Year yield to spike sharply higher and DXY to strengthen, pricing in hawkish Fed.

If Gold responds with a dip, tighten your stop-losses and consider taking profits on open positions.

You have a choice this week

You can try to piece together the rest of the puzzle yourself...

...or you can get the the complete intelligence briefing, including:

🇨🇳 The China CPI Trade Plan: I'll show you why deflation in China is the market's biggest fear and the single most bullish trigger for Gold. I'll lay out the exact scenarios I'm watching that will signal a "panic bid" into Gold.

🇺🇸 The U.S. Inflation Scenarios: Forget the headline number. The only figure that matters is Core MoM. I have clear scenarios mapped out.

🇪🇺 The ECB Non-Event Trap: I'll explain why Thursday's ECB rate decision is a red herring and how I plan to use the resulting volatility as a potential entry point for our primary U.S. inflation trade.

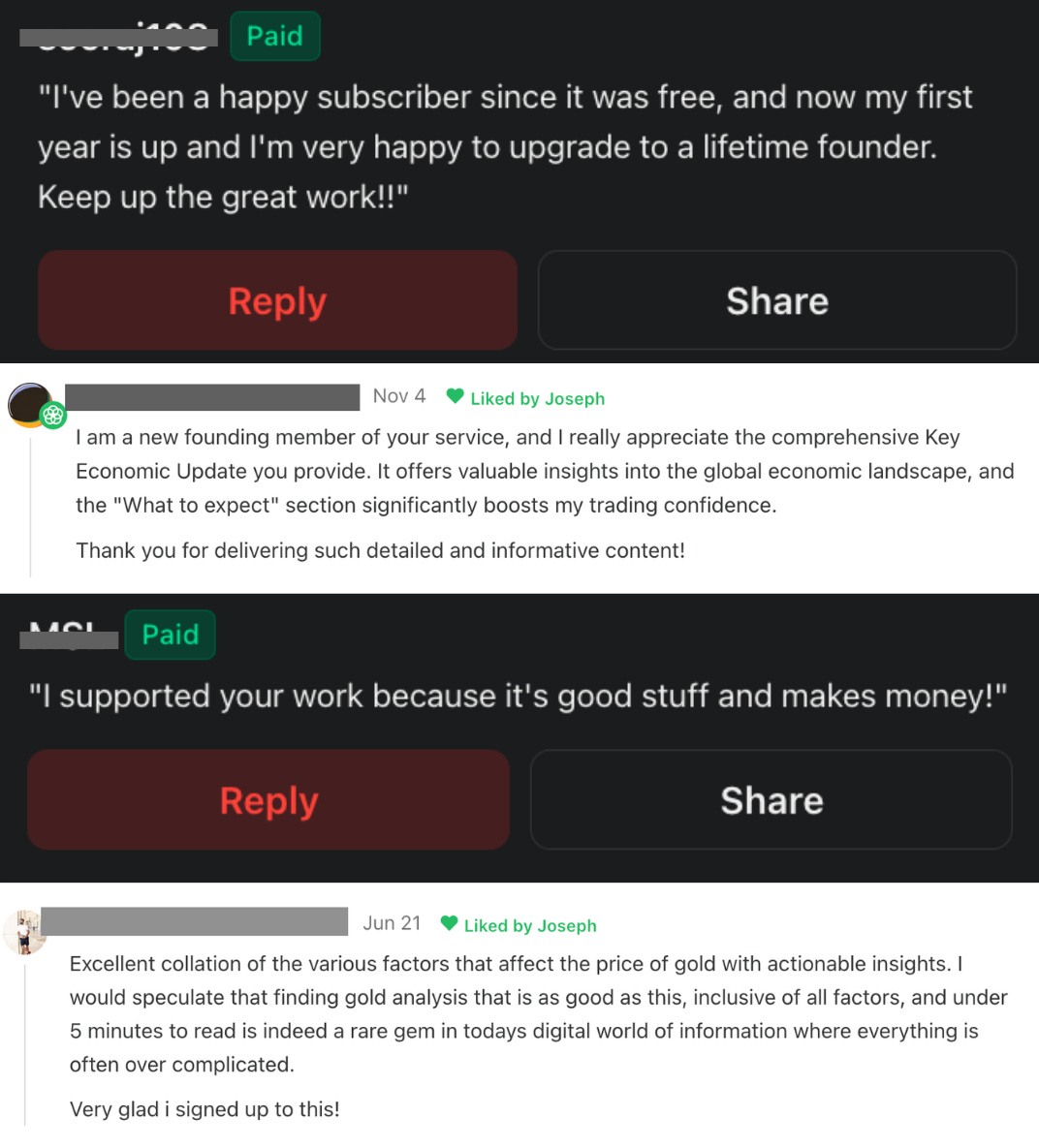

When you subscribe, you also get access to my entire professional toolkit:

Real-time trade alerts: Delivered straight to your Telegram - with exact entries, exits, and stop-loss levels. No guesswork.

The Gold trend-shift indicator: My proprietary warning system for TradingView that helps you see major trend shifts before the crowd.

My weekly roadmap and exact battle plan - get unmatched clarity on what’s ahead.

You don’t need more news. You need a plan.

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.