The Gold market shock: The real reasons behind the recent sell-off

Is the Gold rally over, or is this just the calm before the storm?

Gold has plunged over 4% in just a few days, catching traders off guard and sparking intense speculation.

Is this the end of Gold's bullish run, or could it be a setup for a more significant move?

To answer this, let’s took at the forces driving this unexpected sell-off and whether this sharp decline is simply a temporary blip or a sign of larger structural changes in the Gold market.

In simple words: should you sell, hold, or buy more.

Four big reasons Gold has crashed

#1. Trump's victory

The big story shaking up the markets right now is Donald Trump’s latest election win. While stocks and cryptocurrencies like Bitcoin shot to all-time highs, GLD 0.00%↑ took an unexpected dive.

This isn’t the first time Trump’s election has thrown the Gold market off balance. When he first won in November 2016, Gold prices experienced a similar pattern.

On election night in 2016, as it started looking like Trump might actually win, Gold prices shot up over 5%, hitting around $1,337 an ounce. Investors rushed to Gold as a safe haven, spooked by the unexpected turn in the race.

But that rally didn’t last long.

In the weeks after the election, Gold prices tanked by over 10%, dropping below $1,200 by mid-December.

The initial fear led to a wave of optimism around Trump’s pro-growth promises, which boosted the dollar and lifted stock markets—usually a bearish setup for Gold.

Fast forward to today, and we’re seeing a similar story. Trump’s possible return is adding fresh volatility to the Gold market, showing once again how political shifts can shake up commodity prices.

#2. The dollar's surge

With Trump’s victory, the U.S. Dollar Index (DXY) spiked.

A stronger dollar usually pushes Gold prices down since it is priced in dollars; when the dollar goes up, Gold gets pricier for buyers outside the U.S., cutting down on demand.

The DXY’s rise signals growing confidence in the U.S. economy and expectations for higher interest rates, both typically rough on Gold.

Before the election, we saw something unusual—both the dollar and Gold were rising at the same time. This break from their usual inverse pattern came from unique global economic conditions.

After the election, though, the usual correlation kicked back in. The dollar’s strength became a major drag on Gold prices.

#3. Interest rate cuts likely on pause

Interest rates are key to Gold’s value.

Right now, the yield on the 10-year Treasury note is climbing, hinting at higher inflation expectations and a strong economy. When yields rise, the opportunity cost of holding Gold goes up since the metal doesn’t pay any yield.

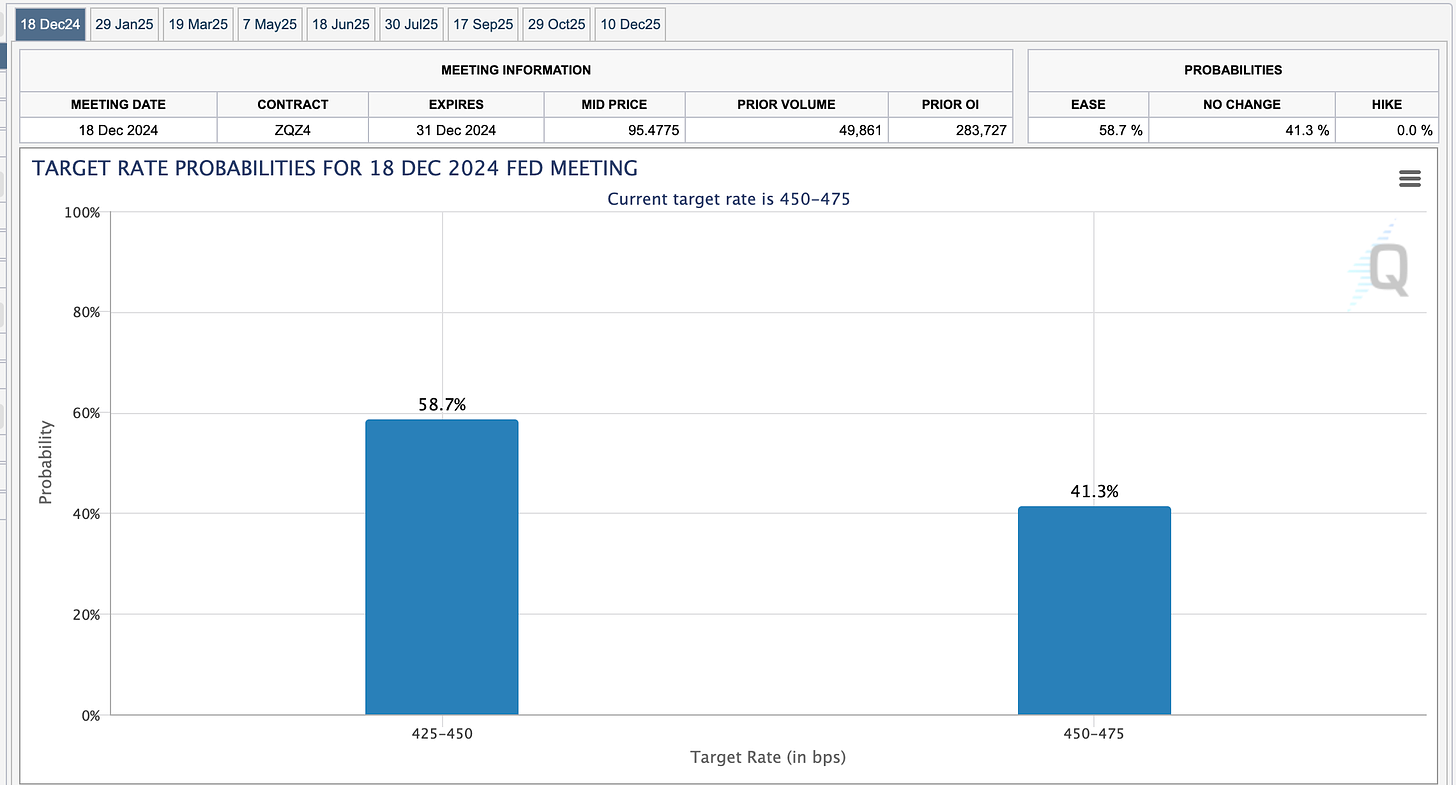

Recently, the Fed made some aggressive rate cuts, including a major 50 bps cut followed by a quarter-point reduction in November. Another cut in December is being discussed, which would bring rates down to around 3–3.5%.

But with Trump’s push for pro-growth policies—like tax cuts and big infrastructure plans—the Fed might feel pressure to stop cutting rates or even raise them to keep inflation in check. This potential shift in Fed policy could greatly impact Gold, likely weighing on prices further.

#4. Expectations of reduced geopolitical tensions

Gold is often seen as a hedge against geopolitical risks.

Trump’s promises to resolve major international conflicts—like those in Ukraine and the Middle East—have sparked hopes of reduced global tensions.

"We're going to work on the Middle East and we're going to work very hard on Russia and Ukraine. It's got to stop."

If Trump actually follows through and brings an end to these conflicts, global uncertainty could drop significantly. This would likely reduce demand for safe-haven assets like Gold.

While the market might be betting on a more stable world, the reality could be far less predictable. Resolving these complex issues is no small feat, and there’s a real chance that any wrong moves could make things worse.

Reading the charts: Gold has likely hit the bottom

Recent technical analysis points to Gold finishing the final phase of an Elliott Wave correction and suggesting that prices may have already hit a low.

Based on Elliott Wave Theory, Gold completed a five-wave impulse cycle, peaking around $2,800. Then we were seeing an ABC corrective phase:

Wave A: The initial sharp decline from the peak.

Wave B: A counter-trend rally that retraced a portion of Wave A’s drop, partially recovering some of the recent losses.

Wave C: A final move lower, which appears to have finished yesterday.

Once this ABC correction finishes, Elliott Wave theory suggests a return to the broader bullish trend.

Historically, similar corrections have marked the end of downturns and the start of renewed uptrends, reinforcing the likelihood of a support level forming here.

The fundamentals driving Gold, which I dive into next, remain strong, suggesting that any correction may be shallow and short-lived.

Supporting factors: why Gold is unlikely to dip lower

#1. The threat of stagflation

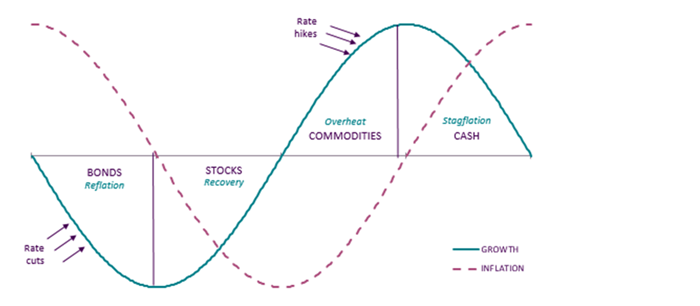

The market seems caught between two possible scenarios: reflation and stagflation.

In a reflationary period, we see both economic growth and rising inflation. If this plays out, the Federal Reserve might take a more hawkish stance to keep the economy from overheating and make Gold less attractive.

Stagflation, on the other hand, involves low growth combined with high inflation. In a stagflationary setup, Gold often shines. When economic growth stalls and inflation eats into returns on stocks and bonds, Gold becomes a preferred safe haven.

Looking at the U.S. economy right now—and knowing what we saw during Trump’s last term—I’d say stagflation is more likely than a straight-up growth surge, though we might get a mix of both.

Last time Trump was in office, his tax cuts, deregulation, and infrastructure spending did help boost the economy and push the stock market higher.

But back then, inflation was low and interest rates were rock-bottom, which made it a lot easier to get growth going.

Today? We’re in a different ballgame with high inflation and interest rates already high, giving the Fed less flexibility.

For a reflation scenario to really work, we’d need serious growth that keeps up with or beats inflation—and given today’s challenges, that feels like a long shot.

Now, stagflation—low growth with high inflation—is a real risk. Inflation’s still hot, and with supply chain issues and global tensions, those pressures might not let up anytime soon.

If Trump’s policies—like trade barriers or other economic moves—don’t create actual productivity and growth, we could end up with rising prices and a flat economy. And a rising demand for Gold.

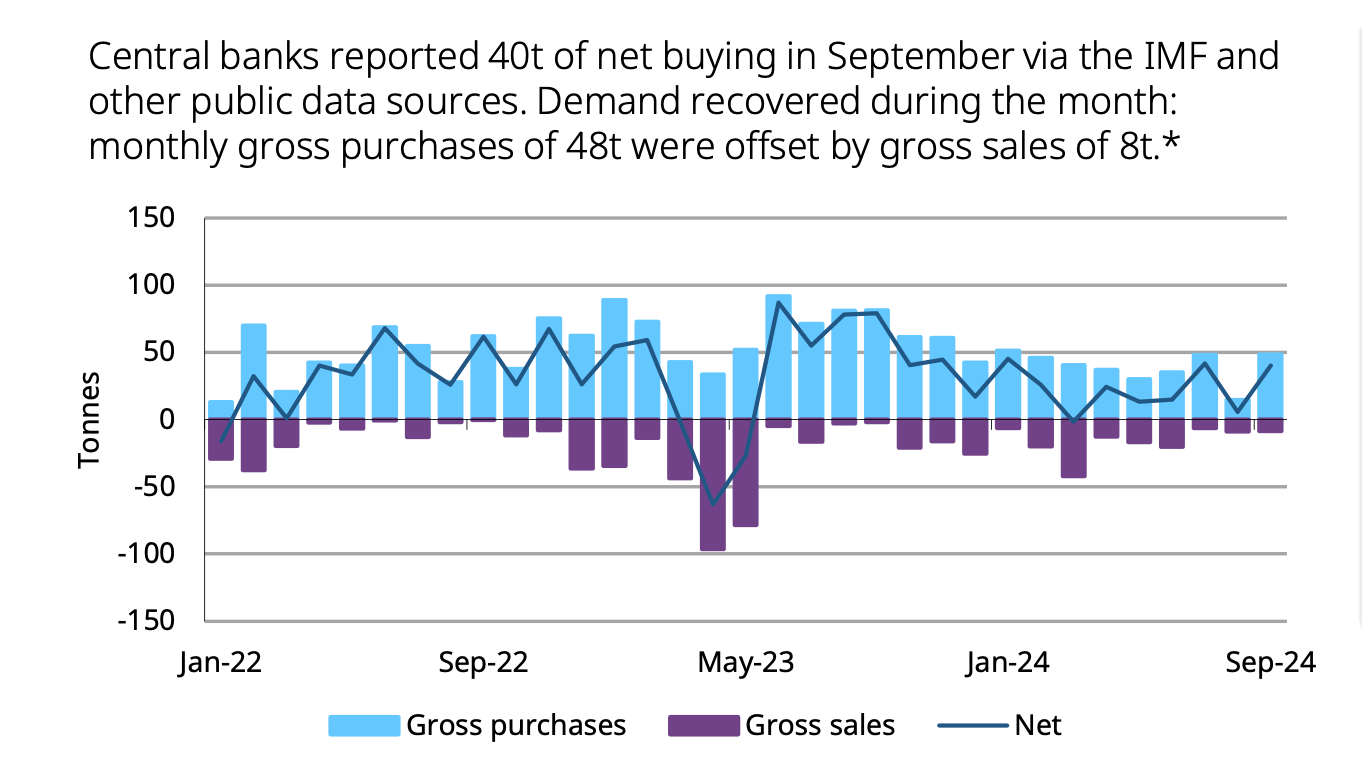

#2. Central bank demand

In recent years, central banks have been net buyers of Gold, trying to reduce their reliance on the U.S. dollar. This recent price dip might present an attractive buying opportunity for them, potentially creating a solid base of support for Gold prices.

Countries facing sanctions or heightened geopolitical risks are likely to increase their Gold reserves as a hedge against financial instability and currency risk, adding another layer of demand that could stabilize prices.

#3. Limited safe-haven alternatives

Bitcoin and other cryptos have rallied and may have pulled some investment away from Gold.

However, given crypto’s volatility and uncertain regulatory landscape, investors may still see Gold as a more stable, long-term safe haven.

Historical context: Gold patterns in the past

Gold’s history shows that major sell-offs are sometimes followed by lengthy downturns:

The 2011 peak and decline: In September 2011, Gold hit an all-time high around $1,920 per ounce during the Eurozone debt crisis and fears over U.S. debt levels. But as the global economy stabilized, Gold entered a bear market, plunging over 45% to reach a low of about $1,050 by December 2015. This period showed us that Gold can enter significant, prolonged downturns after hitting peaks, especially when fears ease and stability returns.

The 2020 pandemic rally: In 2020, COVID-19 triggered another surge in Gold, pushing it above $2,070 per ounce in August. Massive fiscal stimulus, extreme monetary easing, and global lockdowns drove investors to safe-haven assets. But as vaccines rolled out and economies reopened, Gold pulled back from those highs, showing once again how sensitive it is to shifts in economic outlook.

Even though past patterns show Gold corrections can be deep and long-lasting, today’s context is vastly different.

Gold’s fundamental drivers—high debt levels, inflation concerns, and persistent geopolitical risks—are highly likely to limit the downside this time around. In my view, these stronger fundamentals may provide a cushion for Gold even if short-term dips continue.

So what should Gold investors do?

The recent Gold sell-off has certainly stirred the market, but it's important to view this correction in context.

Market cycles naturally include pullbacks, and these dips often pave the way for future upswings.

Gold’s long-term fundamentals still look solid. Although short-term pressures—like a stronger dollar, rising bond yields, and political shifts—are weighing on prices, the core drivers of Gold demand remain: economic uncertainty, inflation concerns, and ongoing geopolitical risks are all still in play.

While Gold’s recent decline might feel unsettling, it could also be an ideal buying opportunity for those with a longer-term view who can see past the current noise.

If you’re a long-term Gold investor, dollar-cost averaging into Gold positions can help manage the impact of volatility. With long-term fundamentals still supportive, accumulating during price dips could build value over time.

Safe trading,

and remember: All that glitters is not Gold,

Joe