Hello, fellow traders and welcome to the lesson #12 of the Technical Analysis course.

Today, we’re diving into one of the most crucial skills in trading: managing your trades and setting stop-losses like a pro.

It doesn’t matter if you’re scalping Gold for quick gains or holding positions for weeks—nailing your stop-loss strategy is what separates the pros from the amateurs.

Let’s get into it and break it all down step by step.

I’m using TradingView for my tech analysis and it is hands-down the most user-friendly and intuitive tech analysis tool powered by AI.

It will save you TONS OF time by handling the tough, trivial work, so you can focus on actual analysis and trading.

For the next three days only, you get a Premium annual plan at 70% off + 1 month free.

»»»»»»»»»»»»» Get your discount now here ««««««««««««««««««

What are stop-loss orders

A stop-loss order is your automatic safety net—it closes your trade when the market moves too far against you. It’s there to keep small losses from snowballing into account-crushing disasters.

Nobody likes taking a loss. It stings your ego and drains your balance. But the cold, hard truth is:

Trading without a stop loss is like driving full speed downhill with no brakes.

Markets are unpredictable, and even the best analysis can flop. A properly set stop loss ensures that one bad trade won’t blow up your portfolio.

It’s not optional—it’s essential.

Here’s the only stop loss strategy you need

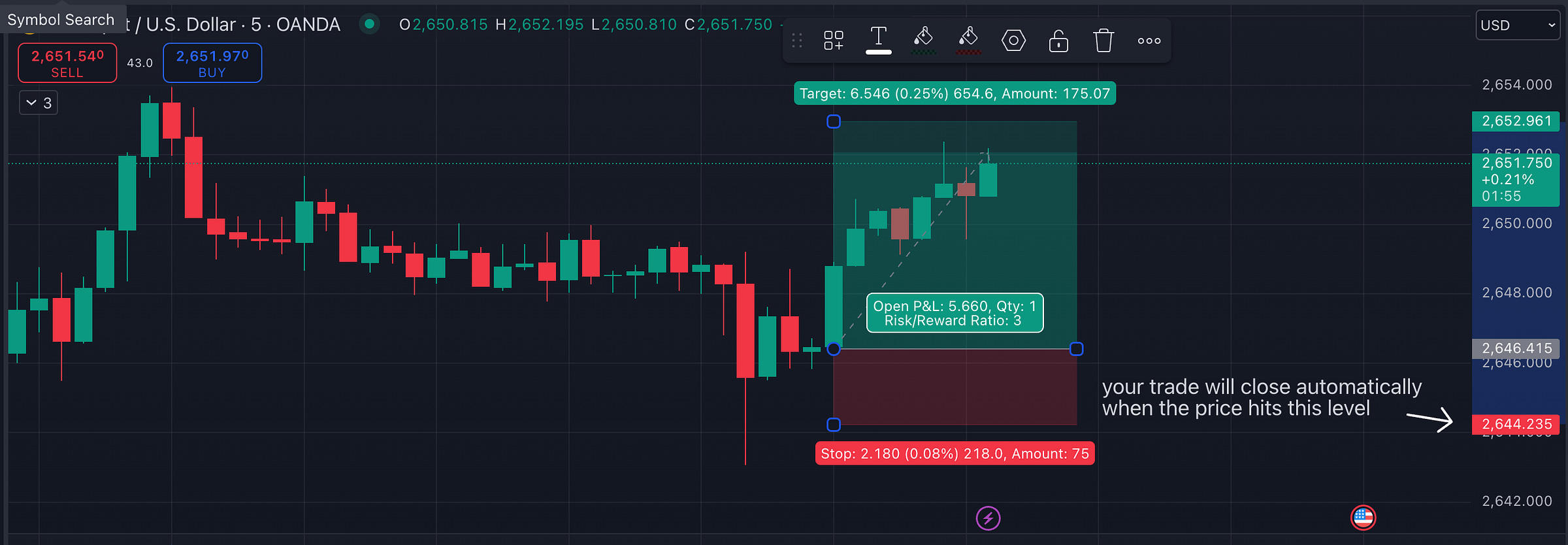

A Risk-Reward Money Stop is a no-BS stop-loss strategy that simplifies your trading game.

It’s all about knowing exactly how much you’re willing to lose (your risk) versus how much you’re aiming to make (your reward).

Why risk-reward stops work:

✅ You know your limits. You decide your max loss upfront, so your capital stays protected.

✅ No emotions, just logic. Stops are set before you even enter the trade. No more holding onto losing trades out of hope or panic.

✅ Profit with less stress. Even if you win fewer trades, you can still grow your account.

This is the magic formula for smart trading:

1:2 means you’re risking $1 to make $2.

1:3 means you’re risking $1 to make $3.

Let’s talk numbers (1:2 ration as an example):

Wins: 5 trades, $200 profit each = $1,000

Losses: 5 trades, $100 loss each = $500

Net profit: $1,000 - $500 = $500

✨ With this strategy, you don’t need to win every time. Even with a 50% win rate, a 1:2 ratio or higher keeps your account in the green.

How to set risk-reward money stops in 3 steps

#1: Set your risk per trade

Decide how much of your account you’re okay with losing on a single trade.

I like to stick to 1% of my total account size, some traders go higher - 1,5–2%.

Example: If your account is $10,000, risking 1% means capping your loss at $100 per trade.

#2: Measure your stop-loss distance

Figure out the distance (in points or dollars) between your entry price and your stop loss.

Example: You buy at $1,950, and support is at $1,940. Your stop-loss distance is $10.

Below 👇, I break down how exactly to calculate your stop loss and where to put it.

#3. Calculate how many lots (or ounces) to trade.

Use this simple formula:

Position Size = Risk Amount ÷ Stop-Loss Distance

Example: Risk Amount = $100

Stop-Loss Distance = $10

Position Size = $100 ÷ $10 = 10 lots (or ounces).

Example: Long position

Entry Price: $2,000

Stop-Loss: $1,990 (Risk = $10 per ounce)

Take-Profit: $2,020 (Reward = $20 per ounce)

Risk: $100

Risk-Reward Ratio: 1:2

Position Size = $100 ÷ $10 = 10 lots (or ounces)

If Stop-Loss is hit: You lose $100.

If Take-Profit is hit: You make $200.

With this 1:2 ratio, you stay profitable even if you only win 40–50% of your trades.

When and where to place risk-reward stops

💡 Pro tip 1: Base stops on technical levels, not random guesses

For example, you can set your stop loss (for long positions) slightly below:

a major support level

a recent swing low. This also sometimes called the "Last-Three-Days Rule" - use the lowest close in the past three days as a base for your stop in an uptrend, giving your trade breathing room.

Example: If XAUUSD’s closing prices over the past three days were $1,990, $2,010, and $2,000, you might set your stop slightly below the lowest close at $1,990.

below a moving average (20, 50, 100 depending on the timeframe you’re trading).

I also suggest avoiding setting stops at obvious psychological levels like $1,900, $2,000, or $2,100.

Market participants often target round numbers, creating liquidity pools that are hunted by institutional traders. Gold’s price might briefly spike to such levels and then reverse.

Instead, place stops slightly above or below round numbers (e.g., at $1,897 instead of $1,900).

💡 Pro tip 2: Factor in volatility

Gold is notorious for wild price swings, especially during big news events.

The ATR-based stop loss is one of my favorite ones because it accounts for market volatility. Unlike fixed stops, ATR stops adapt to changing conditions, ensuring you’re not taken out prematurely during normal market noise.

Here’s how to set stop losses using ATR:

✅ Check the ATR indicator on your chart.

For example, if the ATR on a daily chart for XAU/USD is $15, this means Gold’s price typically moves $15 per day.

✅ Decide how much room you want to give your trade. A common rule is 1.5 to 2 times the ATR.

Example: If the ATR is $15, you could set your stop loss 1.5 × $15 = $22.50 below your entry.

✅ Calculate your position size based on the ATR stop and your risk tolerance.

Example: If you’re risking $200 per trade and your stop loss distance is $22.50, you can buy roughly 0.09 lots (since each $1 move in Gold equals $100 per standard lot).

Setting stop losses using ATR will also help you match stops to the time frame.

On a 15-minute chart, ATR might be $1–$2, leading to tighter stops. While a daily ATR might be $15–$20, meaning you’ll get stops wide enough to withstand significant pullbacks.

💡 Pro tip 3: Don’t move your stops based on emotions

Don’t move your stop further away just because the price is getting close, hoping it’ll turn around. It defeats the whole point of the stop and massively increases your risk.

Once you’ve set your stop, stick to it.

The only time you should adjust it is if it’s part of a clear plan—like trailing your stop to lock in profits or tightening it if the momentum starts fading.

Getting stopped out isn’t a failure. It’s smart risk management. It means you’re protecting your capital and keeping yourself in the game for better trades ahead.

Every trade comes down to balancing risk and reward. With Gold prices constantly moving on geopolitical tensions, central bank decisions, and global demand, having a solid trade management plan isn’t optional—it’s essential.

Protect your capital, lock in your profits, and make the market work for you, not against you.

Safe trading,

and remember: All that glitters is not Gold,

Joe