Hello, fellow traders!

Imagine a world where every dollar in your wallet is backed by actual Gold—where governments can’t just print money whenever they want, inflation stays under control, and financial crises are less likely to happen.

This is the idea behind the Gold standard, a monetary system some people are now calling to bring back as inflation rises and trust in paper currencies weakens.

But could linking the U.S. dollar to Gold again really fix today’s financial problems, or would it just create a whole new set of problems?

Let’s take a look at:

whether going back to the Gold standard today is realistic

and what it might mean for the U.S. and the global economy.

Hint: nothing good.

When the Gold standard ruled the world: Full vs. fractional reserve

From 1821 to 1931, the UK was on the Gold standard, and many other countries, including the United States, adopted it during that time.

With this system, a country’s currency was tied to a specific amount of Gold. This meant governments couldn’t just print more money unless they had the Gold to back it up. It helped keep prices stable over time and gave people confidence in the currency since it was backed by something real and valuable.

There are two main types of Gold standards, each working differently and affecting monetary policy in its own way.

Full reserve Gold standard: The classic version, where every dollar in circulation is fully backed by physical Gold in reserve. If everyone wanted to exchange their dollars for Gold at the same time, the central bank would have enough Gold to cover it. Full reserve systems have only really existed in small, simple economies because it's incredibly expensive and impractical to keep that much Gold in reserve for a large, modern economy.

Fractional reserve Gold standard: In this version, only a portion of the currency is backed by Gold. It assumes not everyone will want to trade their money for Gold at once. This was more common in the 20th century, especially under the Bretton Woods system. But it’s riskier—if people lose faith in the system and there’s a rush to exchange money for Gold, the reserves wouldn’t be enough to meet demand, leading to a possible collapse.

Why did we abandon the Gold standard? Lessons from the 20th century

The Gold standard was essentially abandoned because it limited flexibility in monetary policy.

Under the Bretton Woods system, the U.S. dollar was tied to Gold, and other currencies were tied to the dollar. This system worked well for international trade and gave the U.S. a lot of economic power.

But by the late 1960s, the U.S. economy came under pressure due to the Vietnam War and increased domestic spending.

As the U.S. borrowed more, the dollar became overvalued compared to other currencies. Countries like France started exchanging their dollar reserves for Gold, which began to drain U.S. Gold reserves.

The U.S. couldn’t keep the dollar convertible to Gold while also dealing with rising inflation at home.

So in 1971, President Nixon ended the Gold standard, moving the world to a fiat currency system, where money’s value comes from trust in the government instead of being backed by Gold.

This decision caused short-term inflation but allowed for more flexible control over the economy, which became important in handling economic growth and downturns after the war.

What a modern Gold Standard could mean: The pros and cons

The idea of bringing back the Gold standard has been gaining lots of attention lately.

Proposals like Congressman Alex Mooney's H.R. 9157 bill and conservative plans like the Heritage Foundation’s "Project 2025" show that this idea is no longer just a fringe theory.

Supporters of returning to the Gold standard argue that it could help solve some of the problems we see with fiat currencies today, like inflation and high government debt.

However, the U.S., with its large and complex economy, would face significant challenges under a Gold standard.

🟢 Monetary discipline → 🔴 Limited control over interest rates

In today’s fiat system, governments can print money whenever they want, which often leads to inflation and a weaker currency.

With a Gold standard, the money supply would be tied to the amount of Gold a country has. This would limit how much money can be printed, creating a natural check on inflation and helping prevent hyperinflation, which has happened in places like Weimar Germany, Zimbabwe, and Venezuela.

However, under the Gold standard, the Federal Reserve would have less control over interest rates. In economic downturns, the Fed wouldn’t be able to lower rates to encourage borrowing and investment.

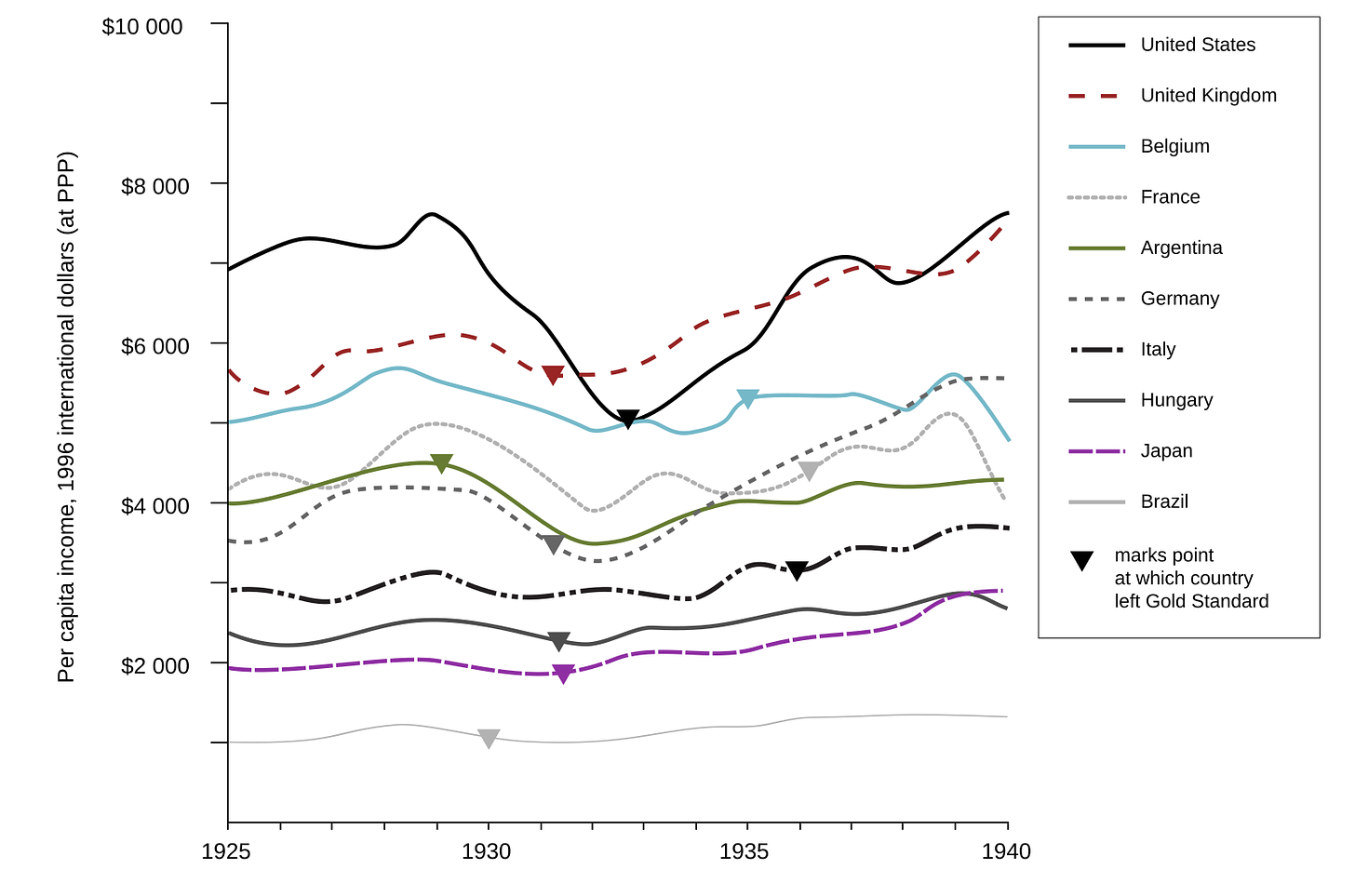

This lack of flexibility could lead to longer recessions, similar to what happened during the Great Depression, when central banks focused more on protecting Gold reserves than on stimulating the economy.

🟢 Long-term price stability → 🔴 Geopolitical tensions

While the Gold standard offers long-term price stability, as the money supply grows in line with slow and predictable Gold production, it would likely only work well for countries that produce a lot of Gold, like China, Russia, Australia, and South Africa.

Other countries, including the U.S., would face difficulties securing enough Gold to support their currencies.

The U.S. holds around 280+ million ounces of Gold, valued at about $628 billion, which is far below what’s needed to back the $2.3 trillion in currency currently in circulation.

For a fully Gold-backed dollar to work, Gold’s price would need to skyrocket—some estimates say it would have to go above $9,000 per ounce.

This could create global imbalances.

Countries with limited Gold reserves would need to run trade surpluses to accumulate Gold, while Gold-producing countries would benefit from rising demand, boosting their economic power.

This could widen the gap between rich and poor nations and cause tensions as countries compete for limited Gold supplies.

🟢 Global credibility → 🔴 Historical weakness

Gold has been trusted for thousands of years as a store of value.

Linking the dollar to Gold could increase confidence in the currency, both domestically and internationally, and strengthen its role as the world’s top currency, especially with the rise of alternatives like cryptocurrencies and a potential BRICS currency.

However, history shows that the Gold standard isn’t a guaranteed solution for economic stability. It didn’t prevent periods of inflation or deflation; it just shifted the timing and size of those fluctuations.

The system collapsed during the Great Depression and again after World War II because it couldn’t keep up with the complexities of global trade and economic management.

In the late 19th century, the U.S. experienced long periods of deflation, which hurt farmers and debtors by increasing the real value of their debts.

The Gold standard wouldn’t fix core issues, but reforms could

Ultimately, the Gold standard is an old system that doesn’t really fix the main problems of modern economies.

Like fiat currencies, Gold is valuable because people believe it is. But, unlike fiat money, the Gold standard doesn't offer the flexibility needed to handle economic growth and stability.

Instead of going back to the Gold standard, we should consider a mix of ideas or other reforms to improve the current system.

One option is to set stricter rules on creating money and controlling inflation. This could include:

focusing the central bank more on keeping prices stable

removing the goal of targeting both inflation and employment

and making the decision-making process more transparent and accountable.

This way, we can tackle issues like inflation and financial discipline without losing the flexibility that comes with a fiat system.

Safe trading,

and remember: All that glitters is not Gold,

Joe