Recession, soft landing, or no landing? How Gold performs in three economic scenarios

Recession, soft landing, or hard landing—where the economy goes next will ripple through equities, bonds, and currencies.

But what about Gold, the ultimate safe haven?

Gold’s relationship with economic shifts isn’t always simple, but clear patterns emerge if you know where to look.

Let’s unpack how Gold tends to perform in each scenario—and what you can do as a trader before the crowd catches on.

The economic scenarios: Recession, soft landing, or no landing

Before dissecting Gold’s behavior, let’s be crystal clear on what I mean by recession, soft landing, and no landing.

Full-blown recession: An economic decline that lasts at least six months and often measured by two or more consecutive quarters of negative GDP growth. It brings layoffs, lower consumer spending, and tighter credit markets. Think of 2008 or 2020.

Soft landing: The “perfect” scenario when the Federal Reserve manage to curb high inflation and cool overheated growth without triggering a full-blown recession. It’s rare and tough to pull off.

No landing: Growth never truly cools despite aggressive rate hikes. Consumers keep spending, and inflation risks linger. No landing eventually pushes the economy into a sudden, deep downturn. Unemployment spikes, consumers pull back, and markets can see swift, brutal declines.

Why does this matter for Gold traders?

Gold isn’t just some shiny rock or a simple “inflation hedge.” It’s sensitive to:

real interest rates

fiscal deficits

geopolitics

investor sentiment.

In the past, these factors often lined up predictably: a recession meant easier monetary policy and a Gold rally.

But today, things are more complicated. These variables don’t always move in sync, making Gold’s behavior harder to predict.

Understanding these dynamics can be the difference between catching the next Gold rally or missing out entirely.

💪 Gold in a recession: Classic strength

Gold loves recessions. It thrives when fear dominates markets and investors flee risky assets like stocks or corporate bonds.

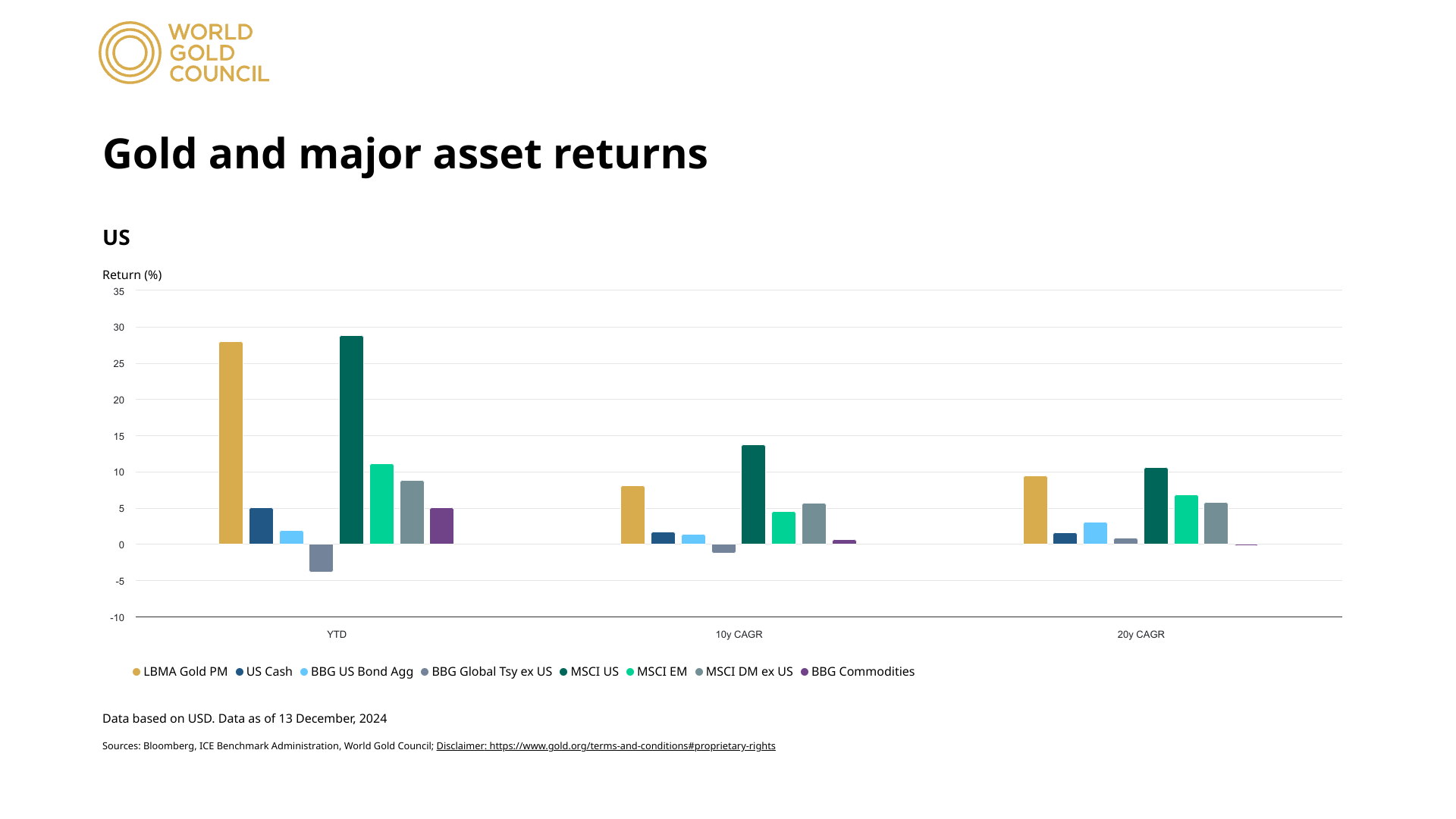

Historically, Gold has delivered some of its best returns when the economy sinks into a downturn.

Case studies

During the 2008 Global Financial Crisis, Gold prices surged from around $700/oz in late 2007 to roughly $1,900/oz by mid-2011, while the S&P 500 plunged almost 50% from peak to trough.

While it didn’t move up in a straight line—2008 saw initial liquidation as investors sold anything with a bid to cover margin calls—Gold ultimately benefited from aggressive monetary easing and the erosion of faith in financial intermediaries.

The brief 2020 COVID-induced recession sent Gold soaring to an all-time high of $2,075 per ounce by August 2020 as central banks printed trillions to save the economy.

Why Gold spikes during recessions

Policy response: When a recession hits, central banks usually cut interest rates and often reintroduce quantitative easing (QE).

For example, during the 2008–2009 financial crisis, the U.S. Federal Reserve brought rates down close to zero, and real yields (nominal yields minus inflation) fell sharply. Gold historically responds inversely to real yields. When real yields drop, gold tends to rally.

Investor psychology: Recessions bring uncertainty. Corporations report weaker earnings, unemployment rises, and the overall risk appetite diminishes. Gold’s role as a “store of value” becomes more pronounced. While equity investors panic, Gold bulls often see it as a life raft. This can mean substantial inflows into Gold ETFs, such as GLD, and interest in Gold futures surges.

Credit stress: When corporate debt markets falter and default risks rise, investors turn to Gold because it isn’t tied to anyone else’s liability. It acts as a safe, independent asset.

Bottom line for trading Gold in a recession

Expect Gold to receive a tailwind from plummeting interest rates, growing fear, and monetary stimulus.

For traders, this often means scaling into long positions in Gold futures, Gold options (via calls or call spreads), or reliable proxies like the GLD ETF, especially on initial dips triggered by forced liquidations.

The key is timing and position sizing, as the initial panic can pull Gold down before it roars back.

🦄 Soft landing - the economic unicorn

A soft landing is the economic dream:

inflation gradually falls back toward central bank targets

unemployment stays low

and GDP grows at a steady, sustainable pace.

In that world, the Fed gradually lowers rates from a position of confidence, not panic.

This environment is trickier for the precious metal.

Without outright panic, Gold must rely on lingering inflation concerns, fiscal deficits, and structural factors to remain supported.

Case study

The mid-1990s is often cited as a successful soft landing. The Fed hiked rates in 1994 to combat inflation, but growth remained steady. During that era, Gold prices were relatively muted, hovering roughly in the $300-$400/oz range for an extended period without significant breakouts.

Another example is the period from 2017 to 2019, a time of moderate growth and low but stable inflation. Gold traded in a relatively narrow range and didn’t break out to new highs until fears of a downturn and geopolitical tensions ramped up in 2020. This is a soft-landing-like environment: not too hot, not too cold, and Gold didn’t go on a tear.

What moves Gold in a soft landing

Stable inflation but still above target: “Victory” over inflation in this scenario still likely means a structural inflation rate is higher than what we had pre-2020. Instead of 2%, maybe it’s stuck at 3% or so. That still corrodes real rates and keeps Gold in the conversation, especially if real yields remain capped by steady rate cuts and stable but modest growth.

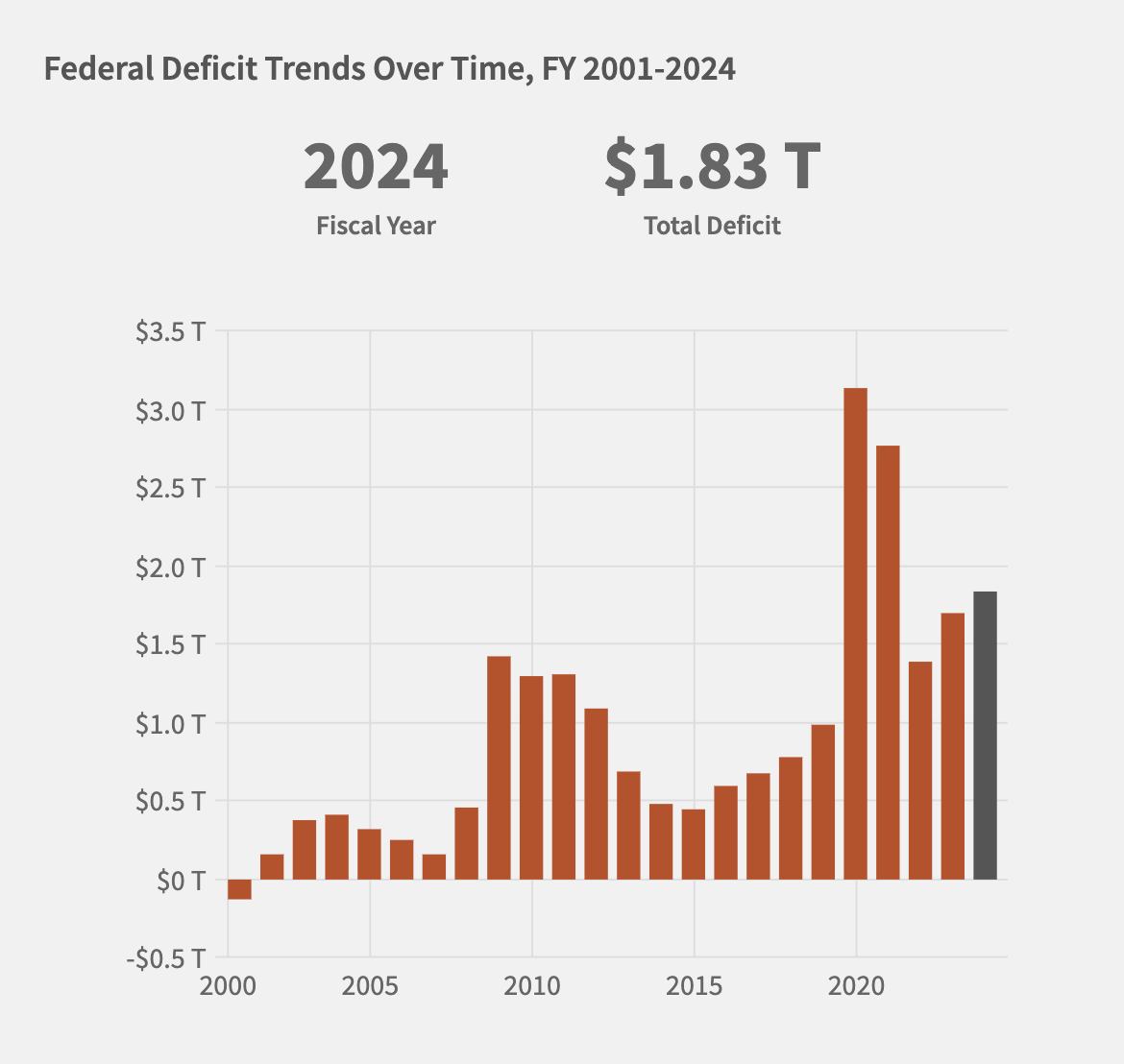

Persistent fiscal deficits: The U.S. fiscal deficit recently exceeded $1.8 trillion annually. Even with steady economic growth, these ongoing deficits can weaken long-term confidence in fiat currencies. In this case, Gold benefits as a reliable long-term store of value.

Productivity vs. structural issues: Advances in AI could boost productivity and contain inflation. But deglobalization, aging demographics, and supply chain reshuffling push costs higher. This tug-of-war can keep Gold supported as investors hedge against unexpected cost pressures and slow-moving inflation risks.

Bottom line for trading Gold in a soft landing

In this case, the Gold’s upside might be more modest. However, steady deficits, moderate inflation, and capped real rates should keep Gold well-supported.

You might consider more tactical, shorter-term trades—scalping or range trading rather than building large directional bets.

Without the big macro catalysts, you’ll have to rely on shorter time frames, mean reversion strategies, or relative value trades (e.g., Gold vs. silver spreads).

📈 No landing - non-stop growth

The no-landing scenario is one of the strangest and most unpredictable outcomes on the table.

It’s the idea that the economy refuses to slow down -consumer spending keeps outperforming expectations, and new growth drivers—like the AI boom—help keep economic momentum alive.

The Fed’s rate hikes aren’t as effective as expected because businesses and households have plenty of liquidity, while global demand for U.S. assets stays strong.

Case study

True no landing scenarios are rare in the data—economies usually cycle through expansions and slowdowns.

But consider periods of stable growth and moderate inflation, such as the mid-to-late 1990s or mid-2010s. During these times, Gold often remained range-bound or mildly trending without explosive moves.

When there’s no macro storm, Gold tends not to steal the spotlight.

What can potentially move Gold

For Gold traders, the no-landing scenario creates a tough spot. It’s not a classic recession where Gold rallies on fear, nor is it a stable environment with clear conditions to trade.

It’s somewhere in between—confusing, uncertain, and unsettling.

Chronic inflation risks: If the economy doesn’t slow, inflation could pick up again, especially if central banks ease too soon. Traders still remember the 1970s, when Arthur Burns eased policy prematurely, fueling a second wave of inflation that eventually required Paul Volcker’s drastic rate hikes. Back then, Gold prices surged nearly tenfold during the decade. If today’s policymakers repeat Burns’ mistakes, Gold could soar as inflation comes roaring back.

Deficit spending and currency debasement: Endless deficits raise doubts about long-term currency stability, driving long-term capital into Gold.

Bottom line for trading Gold in a no landing:

Without a pronounced economic downturn or aggressive monetary easing, Gold’s upside is limited by stable real yields and a possibly firm dollar.

That doesn’t mean Gold collapses— confusion and policy miscalculation can still drive Gold higher. If inflation resurges or deficits start pushing real yields down despite growth, Gold can also surge on longer-term credibility fears. But it may not offer the high-octane moves you see in more turbulent macro conditions.

In a no landing scenario, try mean-reversion strategies. Identify key support and resistance levels and play bounces off support and fades at resistance.

Instead of outright directional plays in Gold, also consider spreading against other precious metals or commodities.

For instance, if you expect silver to outperform during a continued expansion, you could go long silver and short Gold.

Similarly, you could look at Gold vs. copper or other industrial metals to capitalize on differences in economic sensitivity.

The role of the dollar and real yields in all three scenarios

No matter the scenario—recession, soft landing, or hard landing—keep a close eye on the U.S. Dollar Index (DXY) and real yields.

Gold is inversely correlated to the dollar. When the dollar weakens (often in recessionary scenarios due to aggressive monetary easing), Gold usually finds support. In soft landings, the dollar may remain stable, providing less directional impetus for Gold.

Real yields (nominal Treasury yields minus expected inflation) are another crucial driver. Historically, when 10-year real yields dip below zero, Gold prices tend to move higher.

Pay attention to the TIPS market and inflation expectations (breakevens) to gauge where real yields are headed. During recessions, real yields often drop sharply, favoring Gold. During a soft landing, real yields might hover around neutral, reducing dramatic moves in Gold.

Gold positioning for an uncertain future

As a professional trader, your edge comes from being prepared.

✅ So build your macro roadmap in advance:

If you anticipate a recession, gradually build a core long position in Gold. Start small and scale in as data confirms the slowdown.

In a scenario with few macro catalysts (soft landing), focus on technical range-bound strategies.

✅ Know what a recession or hard landing would look like in terms of real yields, Fed policy, and investor sentiment.

✅ Keep tabs on leading indicators: yield curve shapes, PMI data, credit spreads, and consumer confidence. Use that data to tilt your Gold exposure accordingly.

The ultimate goal is to stay ahead of the herd, trade what you see (not what you hope), and leverage Gold’s historical patterns to your advantage.

As we stand at the crossroads of these economic paths, remember: the time to prepare isn’t after everyone’s screaming “recession” on TV.

It’s now.

Safe trading,

and remember: All that glitters is not Gold,

Joe