My Pro Gold Trader Game Plan for NFP Week [Gold Market Movers: Sep 01 - 07]

How amateurs will lose money this week (and how we won't)

The amateur looks at the calendar this week and sees 15+ "high impact" events. They'll spend hours debating EU inflation and Canadian trade data.

Not us. Not here.

After 13 years of trading this market for a living, I've learned the most expensive lesson: the market week isn't a democracy. All events are not created equal.

This entire week is a prelude to two events:

ISM Services Prices Paid

NFP Average Hourly Earnings.

Everything else is designed to pull money from impatient traders.

We will walk through this this calendar event-by-event, and I will show you exactly where the money is, and where the traps are.

Let the rest of the market chase the distractions. We have a plan.

Let’s get to work.

🗓️ TUESDAY, SEP 02

🇪🇺 Eurozone Inflation Rate YoY Flash

Forecast: 2% | Previous: 2%

TLDR: Ignore. It’s background noise. EUR/USD may twitch, but Gold won’t.

💥 Impact:

The only thing that moves the Gold market in a meaningful way right now is the U.S. Dollar, which is a reflection of what the Fed is going to do. The ECB is a secondary character.

The ECB has already committed to staying put for months. A tiny beat or miss won’t change that.

The only way this print matters is if it’s way off expectations, forcing the ECB to rethink everything.

Trading insight:

1.8% - 2.2% - anything in-between these numbers is statistical noise.

>2.5% (super-hot inflation) or <1.7 (deflation) - real market movers. The probability of that is very low.

We’re watching EUR/USD:

First 60 seconds are bots. Step aside.

First 5–15 min candle close is the real tell. Look for wicks vs solid bodies.

If price pushes through a key level and holds for 15–30 minutes, it’s worth a closer look.

In 90% of cases, you’ll just see a wick spike that fades back within the hour.

🇺🇸 The U.S. ISM Manufacturing PMI

Forecast: 49 | Previous: 48 (47.1 New Orders)

TLDR: high-volatility trap. Watch the New Orders to fade the market's initial reaction to the headline.

💥 Impact:

This report is the ghost of an old economy. Twenty years ago, this was a market-moving titan. But right now, the U.S. economy is almost entirely service based, and that's where the inflation and jobs story is.

That said, this report will still cause a commotion for 2 simple reasons:

Why it still moves markets:

Algorithms treat >50 as expansion, <50 as contraction.

Some traders still cling to it, so you get reflexive moves.

We, however, are looking for the one piece of forward-looking number: the New Orders sub-component. New Orders tells us what manufacturers expect to happen next month.

Trading insight:

48.0 - 49.5 headline - irrelevant noise.

<47 (recession fears) or >51 (surprise growth) - the only market movers.

We use the reaction of other markets to diagnose if the move is real or fake. Watch all three screens at once:

XAUUSD - shows the initial, emotional reaction. Let's say the PMI comes in surprisingly strong at 50.5. Gold will likely drop instantly.

10-Year Treasury Yield - "Fed Expectation" meter. If the report is genuinely strong and the market believes it will make the Fed more hawkish, the 10-year yield must rise.

Copper - key industrial metal; its price should rise if the manufacturing outlook is truly improving.

How to read these signals (wait 5-15 minutes after the data release):

Scenario 1: Headline PMI strong + New Orders weak = Gold dips

We know that New Orders matter more in this case than the Headline.

If 10-Yr Yield and Copper are flat or falling, this is a powerful bullish confirmation to enter long on a dip.

Scenario 2: Headline PMI weak + New Orders strong = Gold rips higher

Our fundamental view is bearish because New Orders point to future strength.

If 10-Yr Yield and Copper dipped and start recovering, it’s our confirmation to hunt short entry near key resistance.

You have a choice this week

You can try to piece together the rest of the puzzle yourself...

...or you can get the the complete intelligence briefing, including:

JOLTS data mine: How not to get chopped up post-release.

The NFP action plan: the exact 4 scenarios I am watching and how I plan to execute each.

The "noise" filter: Which data truly matters - 🇦🇺 Australia, 🇬🇧 The UK, or 🇨🇦 Canada + the specific shock numbers that would force us to pay attention.

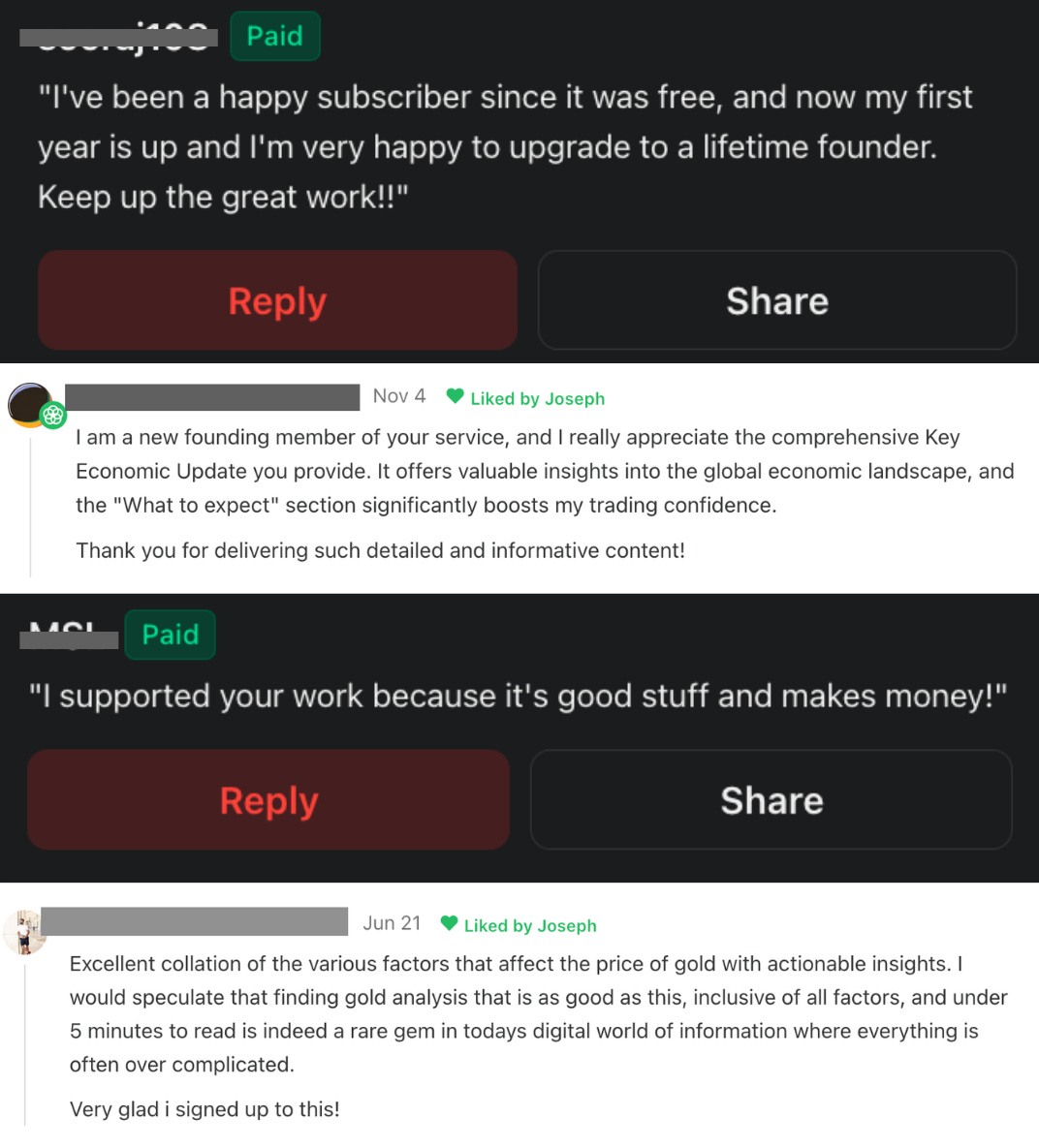

When you subscribe, you also get access to my entire professional toolkit:

Real-time trade alerts: Delivered straight to your Telegram - with exact entries, exits, and stop-loss levels. No guesswork.

The Gold trend-shift indicator: My proprietary warning system for TradingView that helps you see major trend shifts before the crowd.

My weekly roadmap and exact battle plan - get unmatched clarity on what’s ahead.

You don’t need more news. You need a plan.

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.