Hello, fellow traders!

Key highlights this week include the ECB's interest rate decision, China's GDP growth rate, and inflation figures from several countries. We should also pay particular attention to Christine Lagarde's speech, as it may offer clues about the ECB's future policy stance.

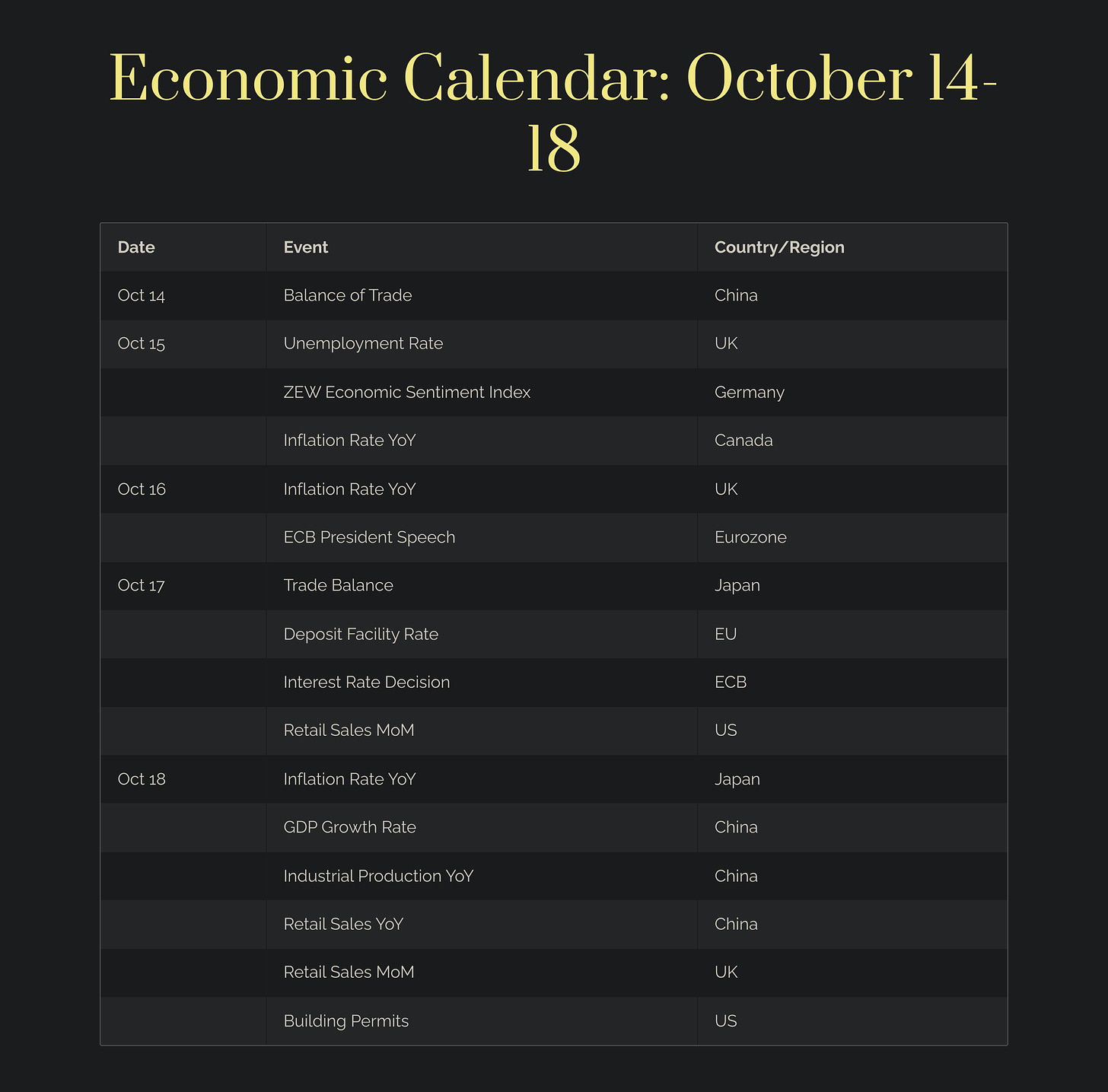

Here’s a snapshot of all the high-priority economic events for Oct 14 - 20.

Let's dive into the specifics:

Monday, October 14

China’s Balance of Trade: difference between a country’s exports and imports of goods and services over a certain period. If a country exports more than it imports, it has a trade surplus; if it imports more than it exports, it has a trade deficit.

Why it matters for Gold: China is the world’s largest exporter and a major player in global trade. It consistently runs a trade surplus largely driven by its massive manufacturing sector, which produces a wide range of goods, from electronics to textiles.

Strong trade surplus:

→ suggests economic strength and stronger Yuan.

→ could lead to a tighter monetary policy.

→ might push Gold prices lower due to higher opportunity costs of holding non-yielding assets like Gold.

Weakening trade balance:

→ might signal economic troubles and cause Yuan to weaken.

→ could lead to looser monetary policy, possibly increasing demand for Gold as a safe-haven asset and pushing XAU/USD higher.

Tuesday, October 15

The UK Unemployment Rate: a percentage of people in the UK who are actively looking for work are currently unemployed released by the Office for National Statistics (ONS).

Why it matters for Gold:

Higher-than-expected unemployment:

→ suggests that the economy is weak. People without jobs tend to spend less, which can slow down economic growth.

→ can push safe-haven assets like Gold up.

→ can also trigger speculation that central banks will keep interest rates low or cut them further, which is bullish for Gold.

Lower-than-expected unemployment:

→ could mean the economy is healthier than traders anticipated.

→ might reduce demand for Gold, as investors feel safer putting their money into riskier assets like stocks.

→ usually means more people have money to spend, which can lead to inflation. Since Gold is often seen as a hedge against inflation, this could drive up Gold prices.

Germany’s ZEW Economic Sentiment Index: measures confidence in the economy—whether things will improve, stay the same, or get worse. It’s based on a survey of financial experts who are asked about their views on how they think the economy will perform over the next six months.

Why it matters for Gold: Germany is Europe’s largest economy, so its economic health has a big impact on global markets.

High optimism:

→ often correlates with stronger equity markets and a preference for riskier assets.

→ Gold, being a safe-haven asset, tends to

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.