Hello, fellow traders!

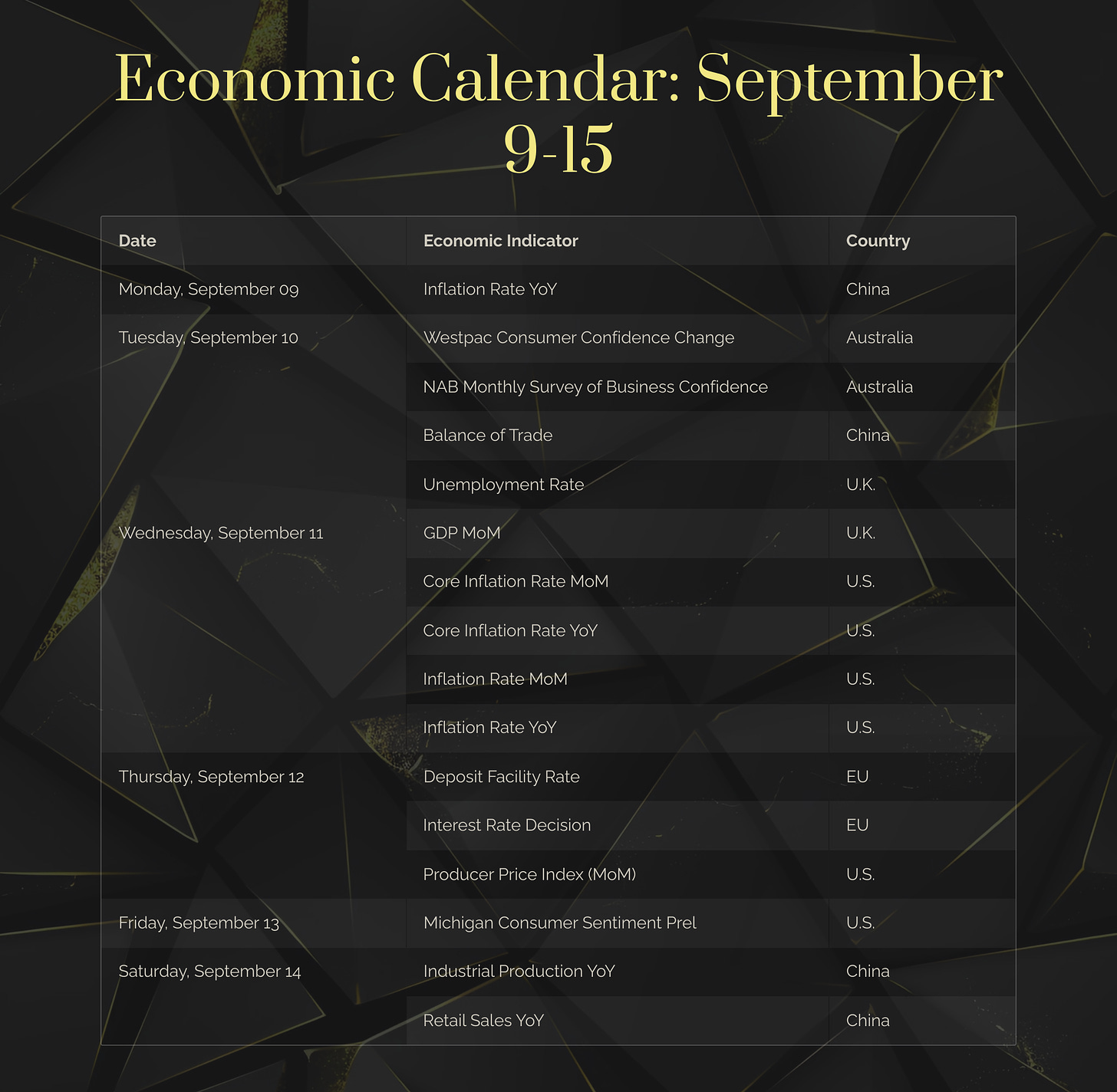

This week's economic calendar is packed with data releases from China, Australia, the UK, US, and EU. Key focus areas include inflation rates, consumer confidence, trade balances, and central bank decisions.

The US inflation data on September 11 and the ECB interest rate decision on September 12 are likely to be particularly impactful for Gold market.

Here’s a snapshot of all the high-priority economic events for September 09 - 15.

Let's dive into the specifics:

Monday, September 09

China's Inflation Rate YoY: measures how much prices of goods and services have risen compared to the same time last year. If inflation is high, it usually means the economy is growing fast, maybe too fast. If it's low or negative (meaning deflation), it could signal that the economy is slowing down or struggling.

Why it matters for Gold: China is one of the largest consumers of Gold globally. If the inflation rate is higher than expected, it can cause fear of rising prices, leading investors to buy more Gold to protect their wealth. This increased demand could drive XAU/USD up. At the same time, if inflation leads to higher incomes in China, we might see more Gold buying from Chinese consumers and investors.

If the inflation data comes in lower than expected, it could signal a weaker economy, possibly reducing demand for Gold in China and putting downward pressure on XAU/USD. Additionally, lower inflation could strengthen the yuan, making Gold more expensive locally and reducing local buying.

Tuesday, September 10

Australia’s Westpac Consumer Confidence Change: measure that tells us how optimistic or pessimistic consumers in Australia are feeling about the overall economy. It's based on a survey that asks people questions about their personal finances, the economy in general, and whether they think it's a good time to buy major household items. A positive change (from the last month) means consumers are feeling more confident, while a negative change suggests they're feeling less optimistic.

Why it matters for Gold: Higher consumer confidence often means people are more willing to spend and invest, which could boost the Australian economy and AUD, which could put some downward pressure on Gold prices in the short term. It might also mean that investors are more willing to take risks and might move away from safe-haven assets like Gold and into riskier investments like stocks. This could potentially lead to a decrease in Gold demand and prices.

On the other hand, a drop in consumer confidence could potentially be positive for Gold. When consumers are feeling less optimistic, they tend to save more and spend less. This cautious behavior often extends to investments, with people looking for safer places to put their money. Gold, being seen as a safe-haven asset, could see increased demand in this scenario.

Australia’s NAB Monthly Survey of Business Confidence: measures the sentiment of Australian businesses across various sectors, providing insights into how confident businesses feel about the current and future state of the economy. Essentially, it reflects business owners' outlook on conditions like demand, profits, employment, and overall economic performance.

Why it matters for Gold: Strong business confidence indicates that companies are optimistic about economic growth, which could lead to more investment, hiring, and overall economic activity. This can be positive for the Australian dollar (AUD) as a strong economy boosts investor confidence in the currency. A stronger AUD can make Gold more expensive in Australian dollars, potentially reducing local demand.

Weak business confidence, on the other hand, signals that businesses are worried about future economic conditions, which might result in less investment and hiring. This can be negative for the AUD, as a weaker economy could lead to lower interest rates and reduced investor interest in Australian assets. Safe-haven assets like Gold, on the contrary, could see boosted demand.

China’s Balance of Trade: difference between a country’s exports and imports of goods and services over a certain period. If a country exports more than it imports, it has a trade surplus; if it imports more than it exports, it has a trade deficit. China is the world’s largest exporter and a major player in global trade. It consistently runs a trade surplus largely driven by its massive manufacturing sector, which produces a wide range of goods, from electronics to textiles.

Why it matters for Gold: Strong trade surplus generally suggests economic strength, which could lead to lower Gold prices due to a stronger Yuan and higher opportunity costs. Conversely, any weakening in China's trade balance might signal economic troubles, possibly increasing demand for Gold as a safe-haven asset and pushing XAU/USD higher. Balance of trade can also influence the central bank’s monetary policy. If the economy is strong, the People's Bank of China might tighten monetary policy, leading to lower demand for Gold as it increases the opportunity cost of holding non-yielding assets like Gold. Conversely, a shrinking trade surplus could signal economic trouble, possibly leading to looser monetary policy and higher XAU/USD prices.

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.