Heads up: Your retirement might be in serious trouble.

The financial safety net you've been counting on—social security—is unraveling faster than anyone wants to admit. This isn't alarmism; it's cold, hard fact backed by unsettling data that most people choose to ignore.

Let's dive deep into:

why social security might crumble

how much you can realistically expect from it

why incorporating gold into your retirement portfolio isn't just smart—it's essential.

The social security system is in trouble

According to the latest reports, the trust fund backing the program will be depleted by 2036. After that, recipients will face a 25% cut in benefits.

This isn’t alarmist speculation—it’s math.

Here’s why this is happening:

1/ Aging population

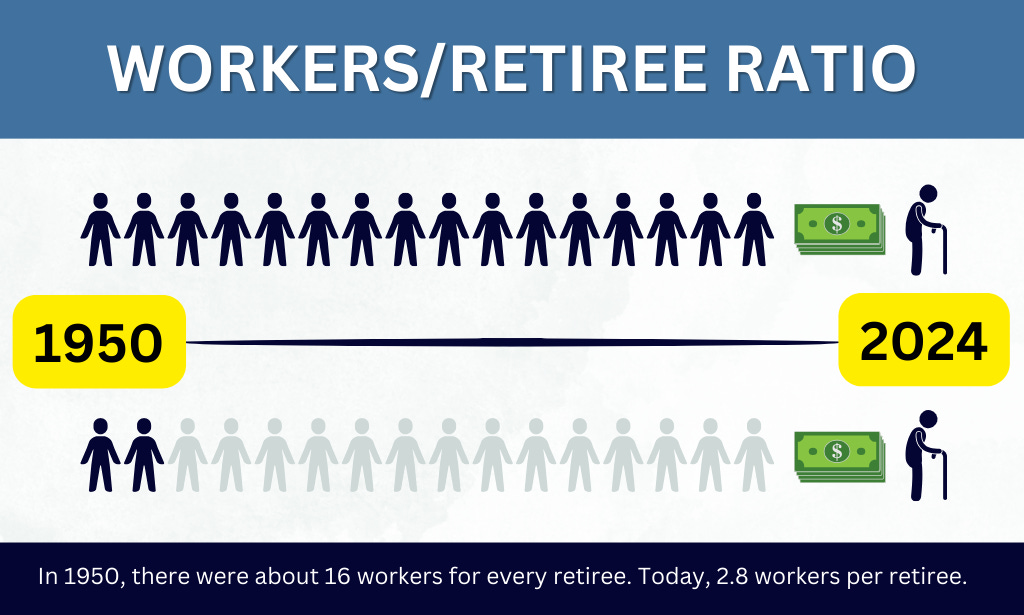

Baby boomers are retiring en masse. The ratio of workers to beneficiaries has plummeted, leaving fewer workers to fund each retiree's check.

In 1950, there were about 16 workers for every retiree.

Today, that ratio has plummeted to just over 2.8 workers per retiree.

2/ Rising costs & Inflation

With people living longer and medical costs on the rise, retirees are drawing more from retirement systems—both for longer periods and at higher rates. This adds pressure to an already strained system.

To make matters worse, the federal government continues to borrow and print money at unprecedented levels.

Over time, this could trigger inflation, eroding the purchasing power of your benefits even if the dollar amount of your payouts stays the same.

3/ The wealth gap

Social Security taxes are designed to apply only to wages and salaries—not investment income or capital gains. This creates a system where income from investments, dividends, and stock options is essentially exempt.

On top of that, there’s a cap on taxable income for Social Security, set at $168,600 in 2024. Any earnings above this threshold aren’t subject to the tax.

Here’s how it works in practice: the average worker pays 6.2% of their salary into Social Security (with an equal match from their employer). But for someone like Elon Musk, who famously took a nominal salary of $0 for several years, Social Security taxes apply only to the portion of income tied to wages—none of his billions in stock options or investment gains contribute.

In other words, high earners often contribute significantly less to the system (relative to their wealth) than middle-income workers.

How much does social security pay out?

Time to crunch some numbers.

As of 2024, the average monthly social security retirement benefit is about $1,830. That's roughly $21,960 a year.

To put it into perspective:

This is just above the federal poverty line for a family of two ($19,720 annually).

A “comfortable” retirement in the U.S. costs at least $55,000 per year.

Now, ask yourself: Can you live the retirement lifestyle you envision on that amount?

The pension gap

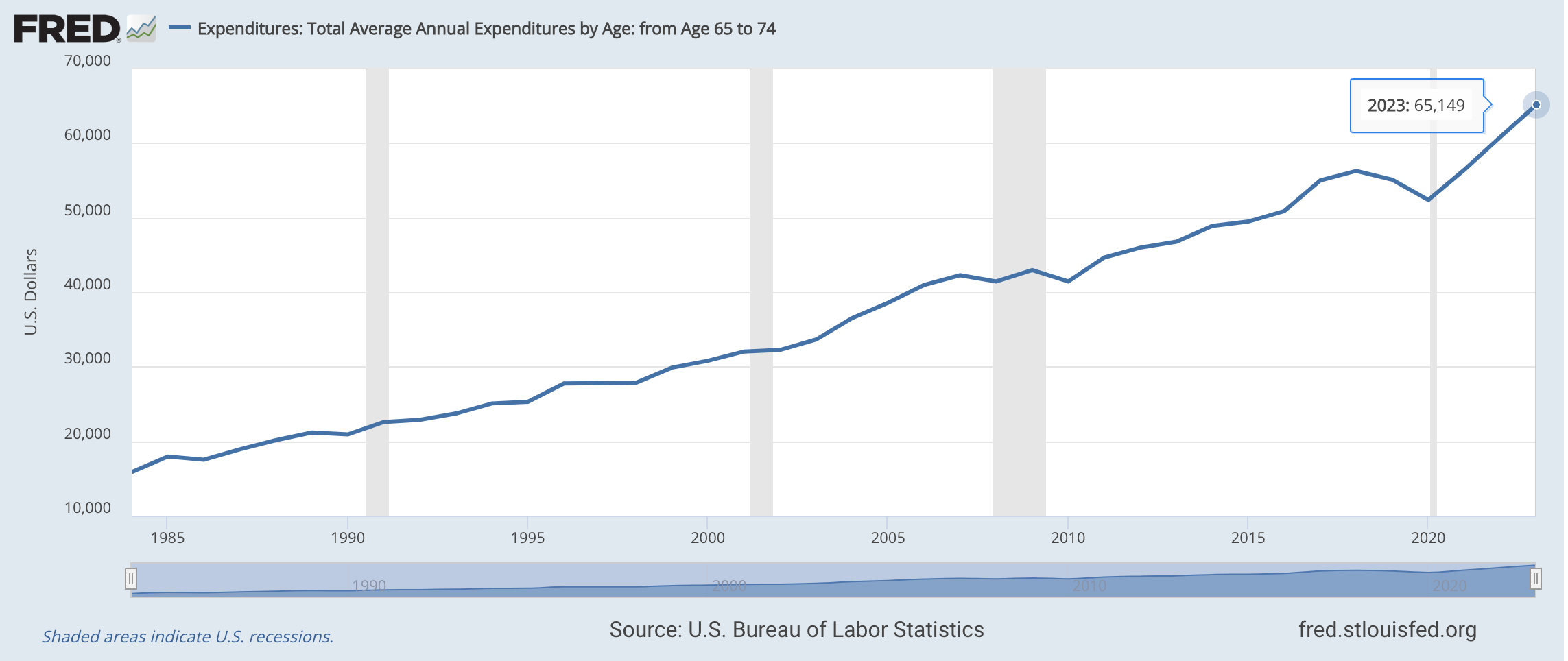

In 2023, the average annual expenditures for those aged 65 and older were around $65,000. This includes housing, food, healthcare, transportation—you know, the essentials.

If social security is providing about $22,000, you're left with a glaring gap of $33,000 per year.

Multiply that over 15 years of retirement, and you're staring at a $495,000 shortfall.

If you want to retire earlier or live longer than the average, that number balloons even further.

Why Gold belongs in your retirement portfolio

So how do you bridge that daunting financial gap? Enter Gold.

Gold has been a store of value for over 5,000 years. Unlike paper currencies, which can be devalued through inflation or mismanagement, Gold retains its worth across generations.

Hedge against inflation: When paper money loses value, Gold often holds steady or even appreciates.

Diversification: Gold doesn't move in lockstep with stocks or bonds, offering a buffer during market volatility. During market downturns, Gold often shines as a safe haven. For example:

During the 2008 financial crisis, the S&P 500 lost over 50% of its value, while Gold rose by more than 25%.

In 2020, as COVID-19 wreaked havoc on global markets, Gold prices hit an all-time high of over $2,000 per ounce.

Liquidity: Gold is universally recognized and easily sold almost anywhere in the world, giving you quick access to cash if needed.

Intrinsic value: Unlike digital assets or fiat currency, Gold has inherent worth.

For retirees, Gold offers stability. While stocks and bonds are vulnerable to market downturns, Gold acts like an insurance policy, preserving your wealth during economic uncertainty.

Gold as retirement strategy: How much is enough?

Calculate your retirement needs

First up, figure out how much money you'll need to live comfortably.

Let's say you aim for an annual income of $55,000 during retirement.

If social security covers $22,000, you're left needing an extra $33,000 per year.

Multiply that by 15 years (a typical retirement horizon), and you’re looking at a total of $495,000.

How much Gold is enough

With Gold prices currently around $2,500 per ounce, here's how the math breaks down:

Total Gold: To cover the $495,000 gap entirely with gold, you'd need approximately 198 ounces ($495,000 ÷ $2,500 per ounce).

Now, let’s be real—not everyone’s in a position to drop serious cash on nearly 200 ounces of Gold. That’s where a balanced approach comes in.

Allocating just a portion of your portfolio to Gold can still provide diversification, inflation protection, and peace of mind.

Strategic allocation

Moderate approach - 15% allocation:

Investment in Gold: $74,250 (15% of $495,000)

Gold ounces needed: About 30 ounces ($74,250 ÷ $2,500)

Aggressive approach - 25% allocation:

Investment in Gold: $123,750 (25% of $495,000)

Gold ounces needed: About 49.5 ounces

5 Practical steps to build your precious metals retirement portfolio

1/ Start now

Time is your ally here. The sooner you begin, the more you can leverage the power of compounding and market movements.

One of the best strategies for building your Gold holdings is dollar-cost averaging (DCA) - investing a fixed dollar amount in Gold at regular intervals, regardless of its price at the time.

By buying regularly, you purchase more Gold when prices are low and less when they are high, evening out the cost over time.

It keeps you committed to your long-term financial goals, regardless of short-term market movements.

To make DCA work for you, start with a manageable schedule, such as:

1 ounce of Gold per year: A steady yet affordable way to build a solid position over time.

¼ ounce every three months: A more frequent option that keeps you actively building your portfolio in smaller, more affordable increments.

2/ Prioritize physical ownership

When it comes to investing in Gold, not all options offer the same level of security or control.

Physical Gold, such as coins and bars, gives you direct ownership and eliminates the counterparty risk inherent in ETFs or Gold-backed funds.

Bullion Bars: Available in various weights, bars often have lower premiums over the spot price.

Coins: Popular options include American Gold Eagles, Canadian Gold Maple Leafs, and South African Krugerrands.

Fractional Gold: For smaller budgets or incremental investments, fractional denominations like 1/10-ounce coins are ideal. They’re also easier to sell in smaller amounts when you need quick liquidity.

3/ Consider tax implications

Don't let Uncle Sam catch you off guard.

Capital Gains Tax: When you sell gold at a profit, the IRS may tax your gains at the collectibles rate (up to 28%), depending on your income bracket and how long you’ve held the asset.

Retirement Accounts: If you want to minimize tax liability, consider a Gold IRA. This type of account lets you hold physical gold within a tax-advantaged retirement structure. You can defer taxes on gains (traditional IRA) or potentially avoid them altogether (Roth IRA).

4/ Diversify within diversification

Yes, you read that right.

Don’t put all your bets on Gold. A balanced mix of Gold, silver, and platinum adds depth and resilience to your portfolio. Each metal brings its own strengths:

Gold: The go-to for stability and a reliable hedge against inflation.

Silver: Offers more upside due to its strong industrial demand, especially with the global shift toward green tech. Watch the gold-to-silver ratio: Historically, this hovers between 65 and 70 (it takes 65–70 ounces of silver to equal 1 ounce of gold). When the ratio goes higher, silver could be undervalued, hinting at a potential opportunity for price gains.

Platinum: Rare and tied to industries like automotive and electronics. It often shines during periods of economic growth.

To keep things flexible, combine physical Gold with paper options like ETFs or mining stocks. Physical gold gives you stability and tangible ownership, while paper gold provides liquidity and easy access to price movements without worrying about storage.

5/ Balance with other investments

Gold should complement, not replace, your other retirement savings.

Rule of thumb is to dedicate 10–25% of your portfolio to Gold, silver, and other precious metals.

Maintain exposure to:

Stocks: For long-term growth.

Bonds: For stability and income.

Real Estate: For diversification and potential passive income.

Don't leave your retirement to chance

The truth is simple: Social Security won’t cut it. With rising living costs and unpredictable markets, it’s on you to plan ahead.

Gold isn’t just an investment—it’s your safety net. A solid, timeless asset that holds its value when paper money can’t.

Start small, even with just one coin. Your future self will thank you for securing real financial peace of mind.

Safe trading,

and remember: All that glitters is not Gold,

Joe

![The IRS vs. Your Bullion: How to Keep More of Your Gold Profits [4 Ways To Legally Minimize Your Gold Tax]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe25bf2af-eeb0-442f-907d-aa7cd94a03ba_1248x832.webp)