How China Quietly Dominated Gold’s Biggest Rally Yet —A Power Shift You Can’t Ignore

Why Gold kept surging despite US hedge funds reducing longs

Gold ripped past $3,500 on April 22, setting yet another all-time high.

Given the chaos—renewed U.S.–China tensions and Trump bashing Powell again—it looked like a textbook safe-haven rally.

But one thing didn’t fit the script:

Western investors weren’t driving the surge. They were actually selling into it.

So who’s buying? And what does it mean for traders looking ahead?

April’s Rally: Gold Soars, But Speculators Bail

Gold’s run in April 2025 broke all the rules.

Normally, when Gold prices break records, hedge funds and ETFs in the U.S. and Europe jump in.

This time, the opposite happened.

As Gold sprinted above $3,000 and then $3,500, hedge funds were actually scaling back their positions.

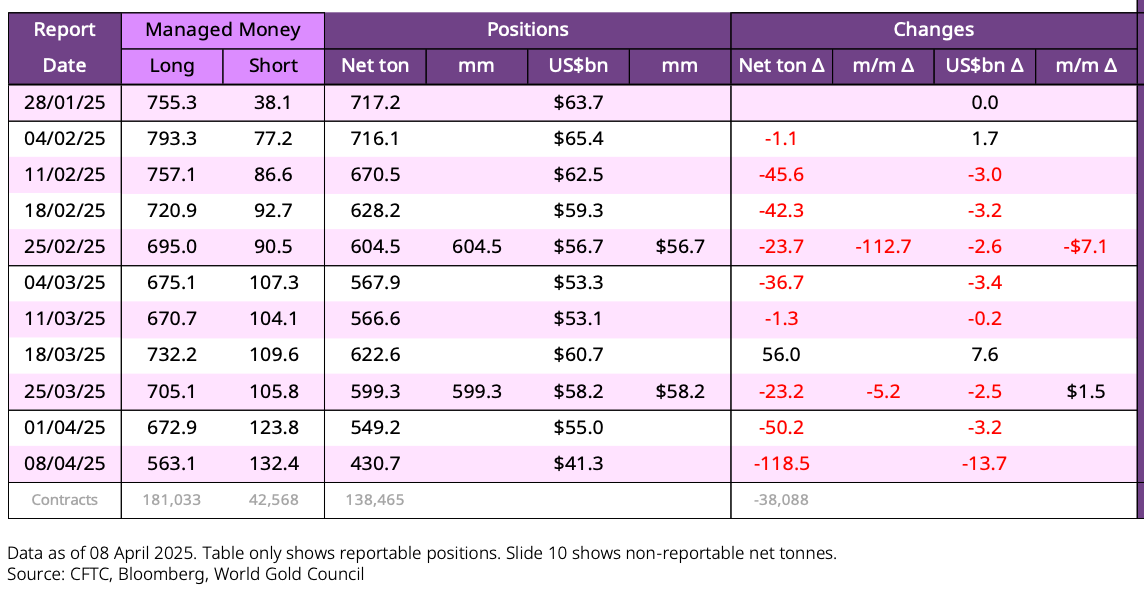

CFTC data shows U.S. managed money longs dropped from ~235,000 on March 18 to just 164,000 by April 29.

That’s roughly a 30% collapse in speculative longs in six weeks – a period during which Gold rallied from the $3200s to new highs.

Historically, you never see Gold up this much while spec longs fall – the only precedent might be the post-2008 surge into 2011.

So what gives?

One clue: not everyone was selling.

Western Outflows vs. Eastern Inflows

Dig into the numbers and the picture clears up fast.

Western investors were exiting. Eastern money—especially from China—was flooding in.

Look at ETF flows.

U.S. Gold ETFs saw strong inflows in early April, but they collapsed mid-month—down over 70% by April 18.

Europe was worse: funds bled assets for the 11th straight month.

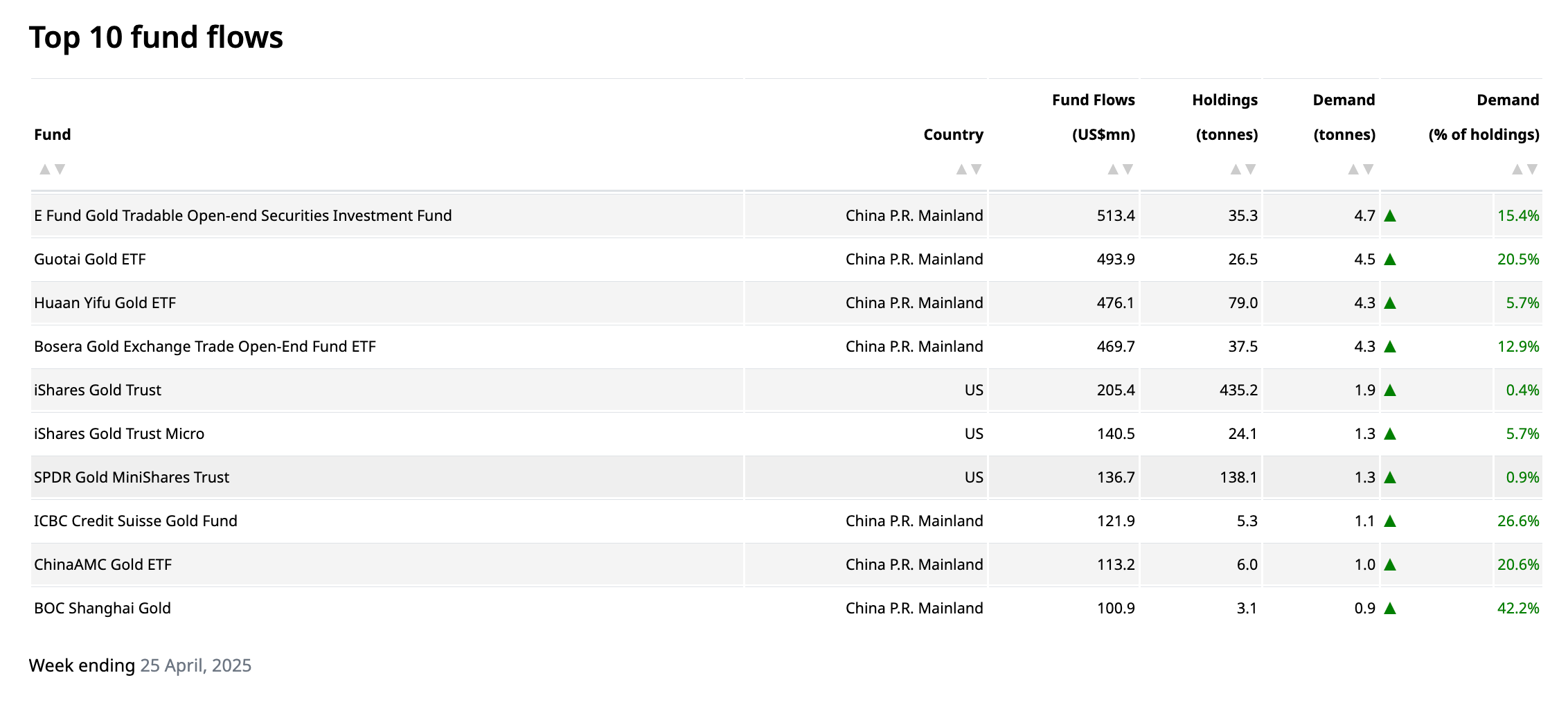

By April 25, Asia carried global ETF flows with +23.3 tonnes, almost entirely from China.

Europe dumped –8.8 tonnes.

North America barely moved at +0.4 t.

Net global inflow? +15 t—all thanks to Asia.

Meanwhile, Chinese futures volume exploded.

ShFE Gold trading averaged 1,200–1,300 tonnes per day by late April – absolutely unprecedented levels. That’s multiple times China’s annual Gold production.

COMEX volume rose too, but it was the Shanghai market that notched new highs in trading activity as Gold price spiked.

Zooming in, you see that Chinese funds dominated the leaderboards.

In mid-April, 4 of the top 5 global Gold ETF inflows were China-listed funds, each hauling in the equivalent of 4–5 tonnes of Gold (over half a billion USD apiece).

The E Fund Gold ETF alone added ~4.7 t in a single week—a 15% boost.

In contrast, GLD (the biggest U.S. fund) shrank by 0.6%.

In short, Western ETF investors largely missed or mistrusted the rally, while Eastern ETF investors piled in.

Why Did the West Bail?

Some of it comes down to risk appetite.

U.S. stocks were bouncing after Trump eased tariff threats. European inflation was cooling, and bond yields were ticking up, making Gold less attractive there.

Essentially, some in the West saw the record price as an opportunity to lock in gains or rotate into risk assets, questioning how much higher Gold could go.

In Asia, the playbook was different: buy the breakout, buy the dip, just buy Gold.

Bull in China Gold Shop: Retail Bullion Frenzy

Even in the physical markets, the East took the lead. Gold dealers in places like Dubai and Mumbai reported heightened demand, but the real star was China’s retail investor.

Chinese households have a long-standing appetite for Gold, and in 2025 they showed up in force.

Q1 data from the China Gold Association showed jewelry demand dropped ~27% YoY (high prices made bling less appealing).

But Gold bars and coins? Up nearly 30% YoY to 138 t.

In other words, Chinese consumers switched from buying jewelry to stacking bullion, treating Gold more as a savings/investment vehicle amid rising prices.

Despite record prices, total Chinese Gold demand only fell 6% YoY—way less than expected. Every price dip is met with eager Chinese buying, putting a solid floor under the market.

All of this paints a clear picture:

While Western traders were selling, China (and Asia broadly) was buying with both hands.

This East-to-West shift is a major reason Gold could defy the usual gravity of speculative positioning. But macro forces are also at play, setting the stage for this unusual Gold surge.

Geopolitics & Macro Fuel: Trump, Tariffs, Basel III, BRICS & More

Beyond supply-demand numbers, the macro backdrop in 2025 is doing Gold a lot of favors—especially for Eastern buyers. While Wall Street hesitated, Asia doubled down.

Put all that together – political risk, structural shifts in the Gold market, strategic buying by nations, and long-term inflation fears – it’s not so surprising that Gold broke $3500 even without Wall Street’s help.

#1 Trump & tariffs 2.0

Trump is back, and with him comes uncertainty. His renewed hardline on China has reignited fears of a Trade War 2.0. Add Fed-bashing, unpredictable foreign policy, and the U.S. feels unstable again.

But importantly, Eastern populations often have fewer alternative hedges that investors in the West.

In China, for example, property and stock markets faced volatility in recent years, so they’re leaning into Gold as the go-to hedge.

#2 Basel III & central bank buying

Starting July 1, 2025, the U.S. fully adopts Basel III rules, treating physical Gold as a Tier-1 asset.

Translation: banks can count bullion at full value with zero haircut. That unlocks balance sheet space and could quietly turbocharge institutional demand—especially in an era of credit tightening.

Plus, central banks globally are on a historic Gold buying spree. China alone has added 13t to its Gold reserves in Q1 of 2025.

Unlike hot money, central banks are price-insensitive, long-term buyers.

#3 Currency debasement & fiscal fears

Inflation is still sticky and the debt loads in major economies are exploding – and there’s a gnawing worry that the only way out is to inflate or depreciate fiat currencies over time.

Traders know that if growth falters, the Fed and ECB will likely pivot back to easing, even if inflation is above target – effectively prioritizing growth (or stability) over currency strength.

Gold is the obvious hedge.

What This Divergence Means for Traders

We’re in rare territory. Gold hit a record high while Western futures longs collapsed.

Eventually, something’s got to give.

Either:

#1 - Western money comes back in

Many hedge funds cut exposure too early – if Gold continues to show strength, we could see a scramble as momentum traders re-enter on the long side, adding fuel to the fire.

Watch weekly COT reports and ETF flow data:

If we start to see managed money longs ticking back up or sizable inflows into funds like GLD and IAU, could mean a second wave is coming.

But if Western investors stay on the sidelines, that could mean a slower, more stable climb powered by Asia—less volatility, fewer fakeouts.

#2 - Or the rally runs out of Eastern fuel

Eastern demand has been wild, but it’s not infinite. Seasonality, high prices, or regulatory noise from Beijing could cool things down.

Watch for softening Shanghai premiums or slowing ETF inflows:

A dip in ShFE volume or signs of policy tightening (e.g. higher transaction taxes, import quotas) could spark a pullback—at least temporarily.

So far, no red flags. In fact, China’s central bank is still buying, but it’s a factor to monitor.

Right now: bulls are in control

For now, the momentum is clearly with the bulls.

Gold’s ability to hold near highs despite rising “risk-on” sentiment elsewhere is raising eyebrows and so far, every dip has been bought - mostly by Asia’s steady hands.

That Gold didn’t tank when spec longs bailed is a bullish signal. It shows deep strength. But it also means there’s no cushion of overexposed longs to unload if we spike—because they already sold.

That’s a double-edged sword. Less risk of a sharp flush, but also the chance of an air-pocket if sentiment flips fast.

Big picture: a regime shift?

The million-dollar question: Are we seeing a regime change where physical demand and Eastern markets set the price, rather than Wall Street?

If so, the key takeaway is that old signals won’t cut it.

A drop in COMEX open interest or ETF outflows in the U.S. isn’t necessarily bearish anymore—if it’s offset by massive Eastern buying.

We now have to broaden our radar to track global flows and demand. Watching Shanghai premiums, Asian ETF flows, and central bank actions may become just as important as tracking COMEX open interest or Fed speeches.

The rise of Eastern buying power means that pullbacks could be shallower than in the past – as buyers in Shanghai or Istanbul step in – but it also means we have to prepare for new patterns of volatility when those buyers pause.

Safe trading,

and remember: All that glitters is not Gold,

Joe

Disclaimer:

The information provided here is for educational and informational purposes only. It does not constitute financial or trading advice, and it should not be taken as such. You should conduct your own independent research and consult with a qualified financial professional before making any trading or investment decisions. All forms of trading and investing involve risks, and past performance is not indicative of future results.