Facing massive losses from rising interest rates and collapsing bond markets, central banks might be gearing up for a bold move that could shake the global economy overnight.

It could instantly boost their balance sheets and erase trillions in debt.

I'm talking about Gold revaluation—dramatically increasing Gold's official value.

Sounds far-fetched? It's not.

Back in the 1930s, the United States revalued Gold from $20.67 to $35 per ounce, increasing its price by 69% relative to the dollar.

And as we know, history has a way of repeating itself.

Let's dive into why banks might consider revaluing Gold again, how it could affect the trade relations, and what it means for investors like us.

Why are central banks feeling the heat?

To understand why central banks might be considering something as bold as revaluing Gold, we need to look at their financial health—or lack thereof.

Right now, central banks in the U.S. and Europe are sitting on huge unrealized losses from their bond portfolios.

Take the U.S. Federal Reserve, for example.

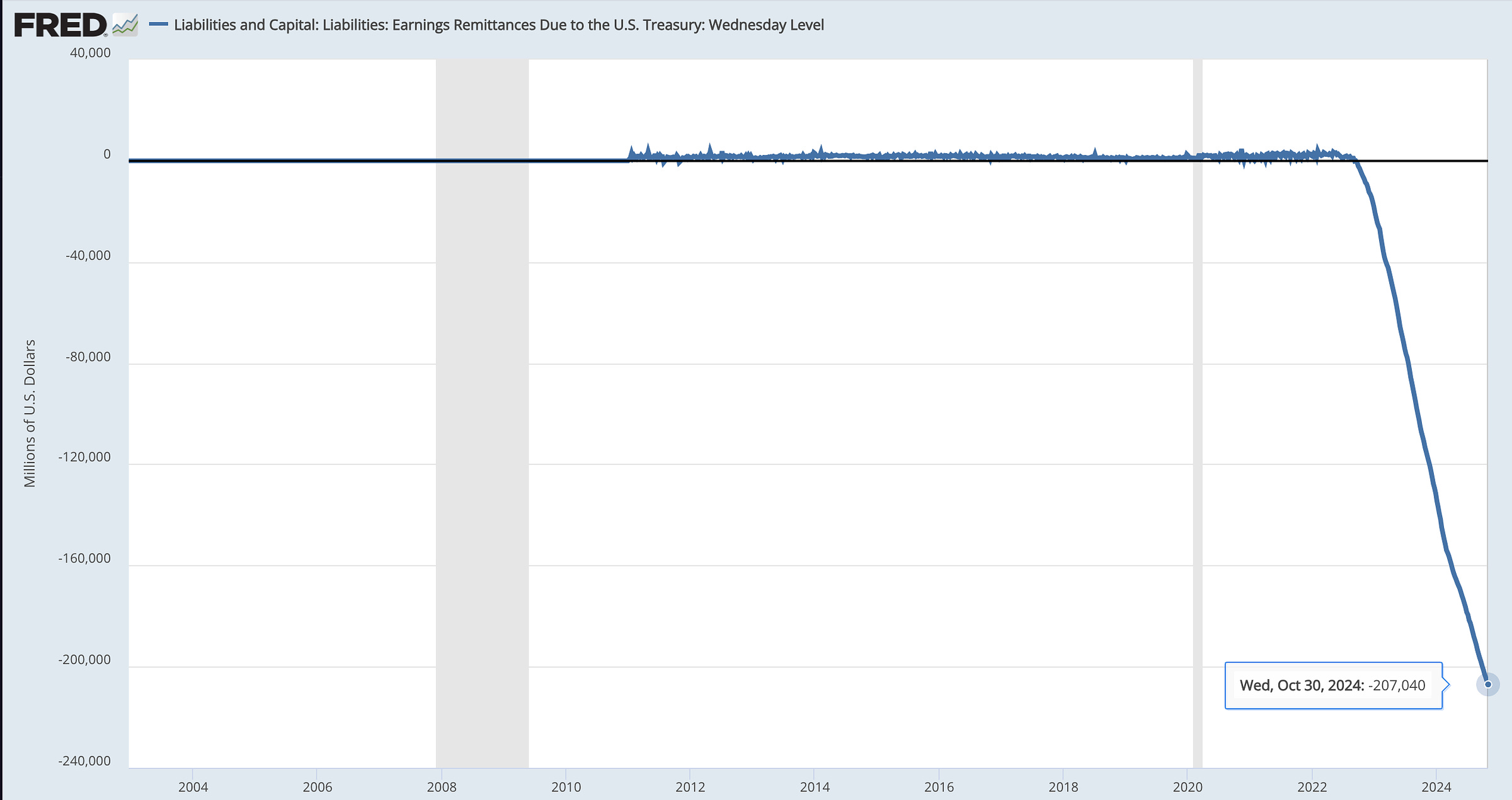

They’ve accumulated -$207.04 billion in unrealized losses and deferred interest expenses as of October 30, 2024, largely on Treasury and mortgage-backed securities.

Why?

Because they’ve been hiking interest rates aggressively, which tanks the value of the long-term bonds they bought when rates were super low during the quantitative easing days.

But it's not just the Fed. Banks around the world are in a similar pickle.

From 2008 to 2024, U.S. banks have seen their unrealized gains and losses nosedive into deep negative territory over the past couple of years. We're talking over $500 billion in unrealized losses.

It’s a clear sign that tighter monetary policies are making it tough for these institutions to manage. As people pull out their deposits, banks are having to sell bonds at a loss just to keep up, which only adds to their financial strain.

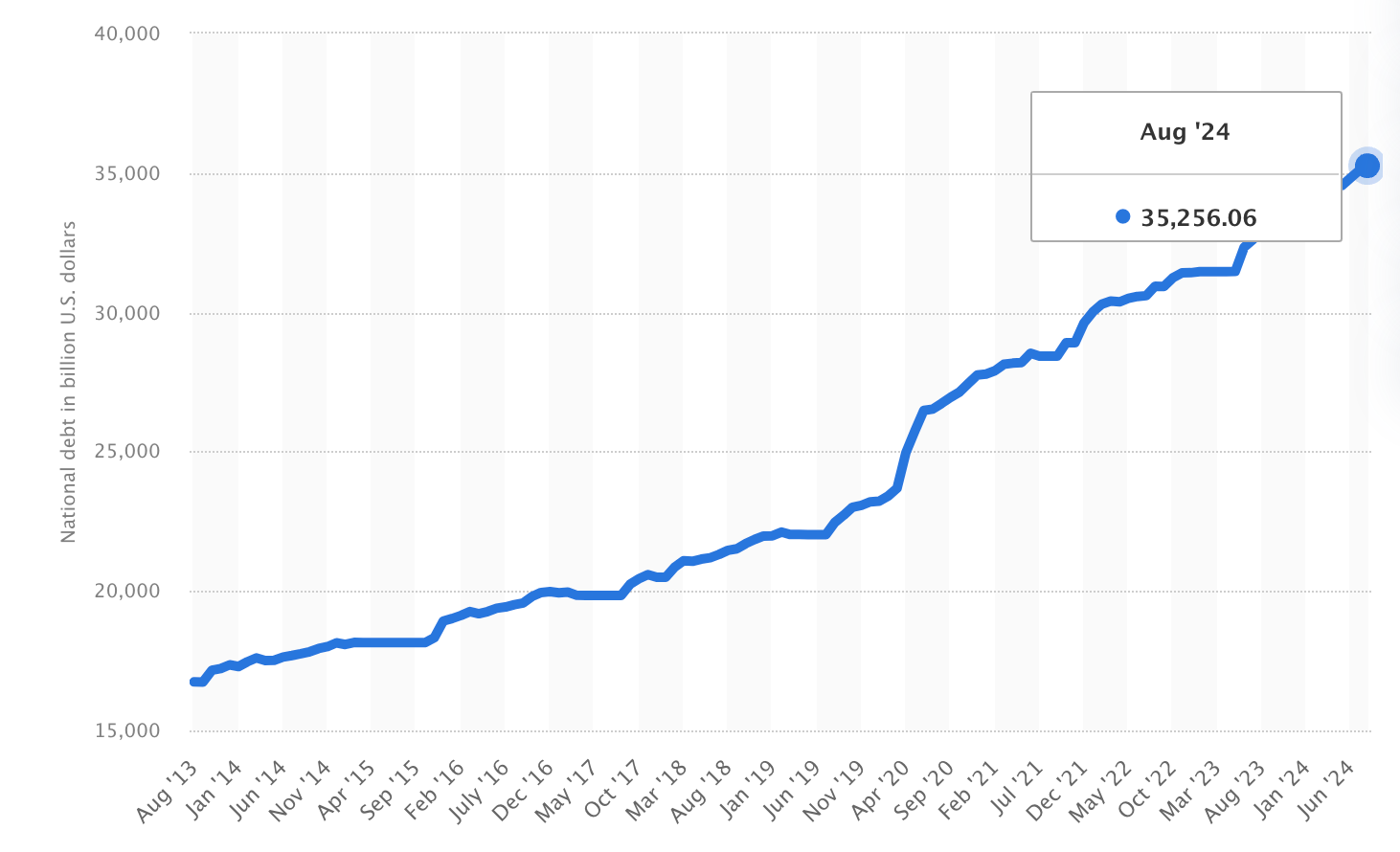

To make matters worse, U.S. government debt has ballooned past $35 trillion. Just the interest payments are approaching $1 trillion a year now—that's more than what the U.S. spends on defense.

With debt levels this high, the usual tricks like raising taxes or cutting spending just won't cut it anymore, and central banks are feeling the squeeze.

Why revaluing Gold could be the central banks’ lifeline

So here's where Gold comes into play.

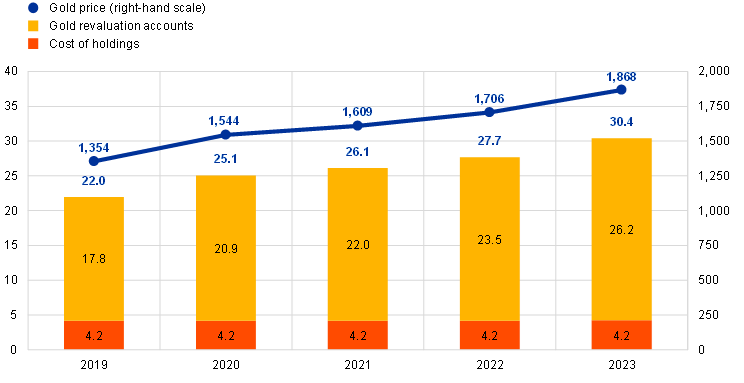

Central banks have massive Gold reserves, a lot of which they picked up ages ago when Gold was dirt cheap— $35 an ounce cheap.

Fast forward to today, and Gold is hovering around $2,700 per ounce. That means their Gold stashes are worth a ton more now.

Take Germany, for example. They bought their Gold for about €8 billion, and now it's worth around €180 billion. That's a huge unrealized gain sitting on their books.

The idea is that by officially revaluing the price of Gold higher, central banks could use these gains to balance out their losses or even wipe out chunks of national debt.

So how would this work?

Well, central banks can use something called a "Gold revaluation account" or GRA. It's basically an accounting method where they adjust the value of their Gold holdings from the old purchase price to the current market price. By doing this, they can "unlock" those unrealized gains and use them to cover up losses elsewhere on their balance sheets.

Now, if the U.S. decides to revalue its Gold reserves—which total about 8,133 metric tonnes and are worth $650+ billion at current prices—to a much higher price like $10,000 per ounce, it would instantly pump trillions into the Fed's balance sheet.

As a short-term perk, this could strengthen the dollar and might make other countries think twice about ditching their dollar reserves - just when the BRICS nations like China and Russia are trying to challenge its dominance.

The best part?

Since Gold isn't something they can just print more of, like paper money, it's not subject to the same immediate inflation risks. This could provide a financial safety net without throwing their currencies into chaos right away.

But wait, revaluing Gold is not all sun and rainbows

Revaluing Gold though involves some big risks.

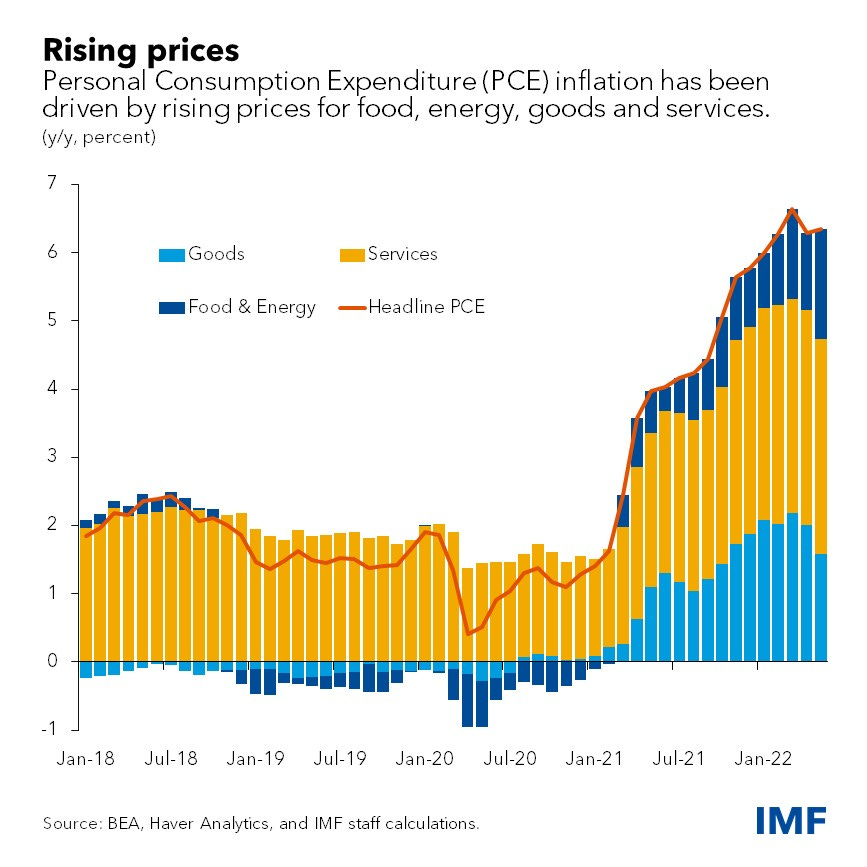

Inflation explosion: If central banks suddenly leverage the increased value of their Gold reserves to inject more money into the economy—say, by financing government spending or expanding lending— and without the economy actually producing more goods and services, it could spark major inflation. Pumping this new "wealth" into the system might jack up prices, kind of like what happened after the pandemic stimulus checks, but possibly even worse. Inflation could shoot back up to 7% or higher, like we saw in 2022.

Diplomatic drama: If the U.S. pumps up the dollar by revaluing Gold, it could tick off important trade partners who are already feeling the strain of the strong dollar. Countries in emerging markets, especially those teaming up with China and Russia, might see this as the U.S. using the dollar as a weapon again. This could push them even faster toward alternatives like Gold-backed trade deals within the BRICS group.

Domestic pushback: Revaluing Gold would stir up heavy lobbying from groups worried about inflation hurting regular folks, especially the middle and working classes. If people see this as the government messing with the currency, there could be a big public outcry, making this move difficult to pull off smoothly.

Revaluing Gold sounds like a conspiracy theory - except that it already happened before

The U.S. has usually steered clear of revaluing Gold since it could weaken the dollar’s position as the global fiat currency. Recognizing Gold as a key support for the dollar might lead people to question the reliability of fiat money and hint at a shift from the current monetary system.

But with the Fed's balance sheet looking worse and deferred assets piling up, they might have to think again.

Back in 2020-2021, the Fed went on a bond-buying spree, which made their balance sheet swell up and locked in super-low interest rates.

Now that rates have shot up, the Fed is paying out 4.80 % on overnight reverse repos and 4.90% on bank reserves but is only earning about 1.75% - 2% on the securities it bought during Quantitative Easing. This mismatch is causing them to incur annual losses estimated at around $100 to $125 billion.

The usual tools like tweaking interest rates or cutting budgets aren't working anymore—they're either political suicide or just won't work economically. With all this pressure, revaluing Gold might give the Fed an escape route.

While it does sound as a conspiracy theory, history shows us that governments have turned to Gold in tough times.

Remember when FDR revalued Gold in 1934 to help pull the U.S. out of the Great Depression? Given today's debt levels and the looming risk of a financial meltdown, revaluing Gold is definitely on the table.

That said, if this crazy scenario of Gold revaluation does play out, it would be more of a band-aid than a cure.

Sure, it might inflate central bank assets and soak up some debt, but it won't solve the core problems—like massive budget deficits, deep-rooted economic imbalances, and soaring interest payments on debt.

There could also be some nasty side effects, like shaking up currency markets and speeding up efforts by countries like China and Russia to move away from the dollar.

The takeaway for Gold traders and investors

If central banks do revalue Gold, it could kick off a massive bull run for the metal. Even a modest revaluation might push Gold prices to $5,000–$10,000 per ounce.

That could mean big gains, but you'll also need to be ready to handle increased market swings.

For investors like you, the takeaways are simple:

Gold is still a crucial hedge against monetary chaos. It's a smart move to hold onto or even boost your investments in hard assets like Gold, because the chances of currency devaluation and high inflation are still pretty high, even if Gold gets revalued.

Spreading your investments across different assets - silver, stocks, real estate - could help protect you against the economic storm that's brewing.

Holding onto a diversified portfolio and getting ready now for even the wildest scenarios could mean the difference between keeping your wealth intact or seeing it shrink. As I always repeat → Forewarned is forearmed.

Safe trading,

and remember: All that glitters is not Gold,

Joe