Here’s How to Seamlessly Integrate the Gold Spotter Indicator into Your Strategy [Real-Life Ideas & Examples]

Hello, fellow traders!

My TradingView indicator Gold Spotter adapts to market conditions in real time and gives an early heads-up (usually 3–5 days ahead) on potential turning points.

It’s specifically designed for XAU/USD to highlight shifts that are often overlooked on standard charts.

That said, in the unpredictable world of Gold trading, no single tool can give you the full picture.

By integrating Gold Spotter into your existing toolkit, you can validate or challenge signals from your main strategy and gain a more data-driven edge in your trades.

Let me walk you through:

how to combine Gold Spotter with different trading strategies

pair it with other indicators to build a stronger, more reliable trading system.

A quick note before we dive in:

You’ll need a free TradingView account to access the indicator.

But if you’re serious about trading, upgrading to a premium version is worth it. It unlocks advanced tools like auto chart patterns, volume footprints, and the ability to trade on multiple charts simultaneously.

Trust me, the premium version pays for itself in no time and you can get one now at 60% off.

Using Gold Spotter Indicator For Trend-Following

Trend-following strategies are all about riding strong price movements for as long as possible, whether those trends last for days, weeks, or even months.

1/ Spotting emerging trends

When the market is trending, having extra insight into potential pullbacks, accelerations, or sudden reversals can make a big difference in your timing and risk management.

This is where the Gold Spotter Indicator comes in.

It forecasts short-term shifts, which can be especially useful in two key scenarios:

✅ Continuation signals

Confirms when an existing uptrend or downtrend is likely to keep going.

Gives you the confidence to stay in winning trades longer.

Helps you avoid exiting too early because of minor retracements or price “noise.”

Example:

If the price is forming bullish continuation patterns like flags, pennants, or breakout setups, and the Gold Spotter starts to pivot upward, it gives you confirmation to time your entry for the breakout.

✅ Divergence/exhaustion warnings

If the price makes higher highs, but the Indicator starts rolling over downward (bearish divergence), it’s often a sign that the trend is losing momentum.

In a downtrend, if the price makes lower lows but the Indicator slopes upward (bullish divergence), it could signal that the selling pressure is weakening, and the trend might reverse soon.

2/ Scaling in and out of positions

✅ Scaling in: building positions gradually

Start building your position when your usual trend signals indicate a shift, and the Gold Spotter aligns in the same direction.

Initial entry: Open your first position once your trend filters and the Gold Spotter both confirm bullish (or bearish) momentum.

Adding incrementally: If the trend strengthens and the Indicator continues to show bullish momentum over multiple days, add to your position in small increments. By adding to your position as the market moves in your favor, you spread out your risk instead of committing everything upfront.

Adjust your stop losses closer to the current price to keep your total risk under control.

✅ Scaling out: gradually locking in profits

When the Indicator moves from a strong bullish (or bearish) zone to a neutral or slightly opposite zone, it’s often a good time to exit part of your position.

Scaling out in stages allows you to secure profits while reducing risk in case the trend reverses.

Mean-Reversion Strategies With Gold Spotter

Mean-reversion strategies are built around the idea that prices often return to their historical average or “fair value” after moving too far in one direction.

In Gold trading, this usually means shorting overextended rallies or buying dips that seem oversold.

1/ Anticipating extreme deviations

While traditional oscillators like RSI, CCI, and Stochastics are popular for mean-reversion, the Gold Spotter Indicator offers a unique advantage: it provides early signals, highlighting shifts in market sentiment before most standard tools.

✅ Early overshoot warnings

If Gold rallies hard and the Indicator hits extreme levels before RSI or other oscillators flag overbought conditions, that could be your signal to prepare and plan for a short setup/consolidation.

Likewise, if the Indicator bottoms out ahead of a price reversal, you might get an earlier and better entry point on a dip-buy trade.

✅ Buying pullbacks

In a sideways market, if Gold dips sharply and the Indicator moves into oversold territory, then starts inching upward before price recovers, it suggests an overreaction.

This is often followed by a snap-back rally. Going long in this scenario gives you a favorable risk-reward setup while the rest of the market is still panicking.

Pairing the Gold Spotter Indicator with Other Advanced Tools

Combining the Gold Spotter Indicator with other tools like Volume Profile, Order Flow, or options market analysis can give you a more complete view of market dynamics.

1/ Volume Profile

Volume Profile shows the volume traded at different price levels, highlighting “high-volume nodes” where institutional activity is concentrated.

When Gold approaches these areas, check the Gold Spotter Indicator to see if the price is likely to bounce or break through.

✅ Value areas vs. extremes

In range-bound markets, most trading happens within certain “value areas.” If price drops below these zones but the Indicator turns bullish, it suggests a potential buying opportunity.

On the flip side, if price rallies into low-volume areas (beyond the value zone) and the Indicator signals a reversal, it could be a solid short setup.

2/ Order Flow

Real-time order flow tools (like DOM, footprint charts, or time and sales) can reveal large block trades or “iceberg” orders.

If the Indicator turns bullish and big buy orders appear around the same price level, you’re likely seeing institutional support.

✅ Absorption & rejection

If price tries to push lower but keeps hitting large resting buy orders (absorption) and the Indicator starts curling upward, it’s a strong signal of a potential reversal.

Similarly, rejection from higher price levels paired with bearish signals from the Indicator strengthens a short setup.

3/ Options market

If Implied Volatility spikes suddenly and the Indicator flips from bullish to bearish (or vice versa), it’s often a sign of an upcoming sharp breakout.

The put-call skew shows how institutions are hedging their risk. If the skew tilts sharply, and the Indicator aligns with that bias (e.g., bullish skew + bullish Indicator), it strengthens your trade idea.

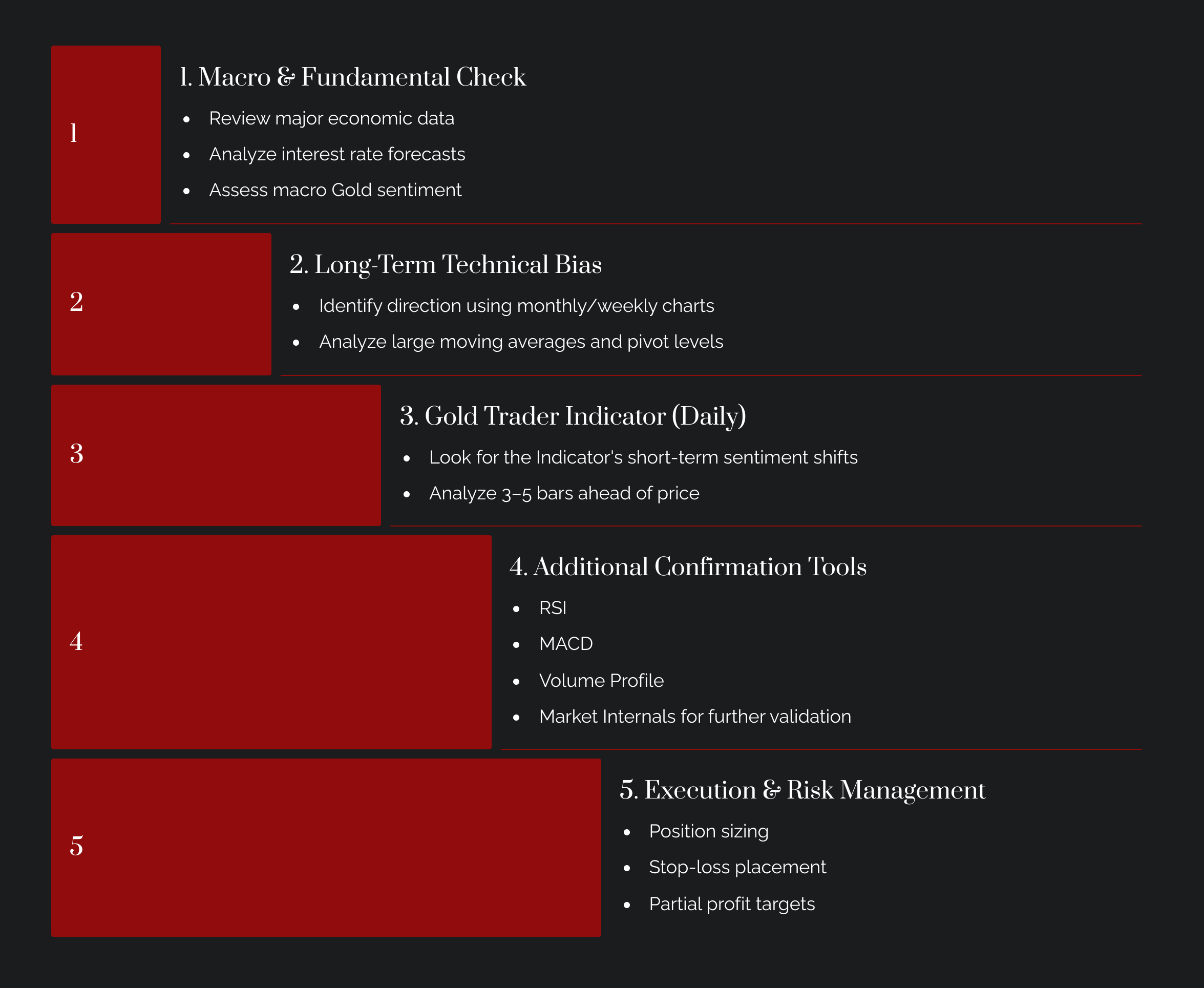

4/ Multi-timeframe confluence

Start with weekly or monthly charts to understand the big-picture trend and key support/resistance levels.

For example, if the long-term trend is bullish, a short-term bearish signal from the Indicator may just be a pullback—likely a buying opportunity.

Then, use daily charts to refine your entries.

You have to decide though which timeframe is your primary guide. If the weekly chart shows a strong bullish trend but the daily chart is bearish, you might reduce your position size rather than aggressively short.

Building a Robust Trading System With the Gold Spotter: Final Tips

This layered approach ensures no single signal takes over.

Instead, every tool works together to confirm and strengthen your trade decisions, helping you maintain consistent performance over time.

Synergize, don’t replace: The Indicator works best when paired with your existing tools—like Volume Profile, order flow, or multi-timeframe analysis. Use it to reinforce or challenge signals from these methods, not as a replacement.

Validate with cross-market data: Pay attention to intermarket correlations and macroeconomic fundamentals to make sure the Indicator’s signals align with broader market trends.

Avoid over-reliance: While the Gold Spotter Indicator is a powerful tool, it shouldn’t be your only decision-making source. Stick to standard risk management, keep using fundamental and technical checks, and apply other filters to validate your trades.

By integrating the Gold Spotter Indicator into your broader trading strategy, you gain a forward-looking tool that complements other methods like volume analysis, macro data, sentiment indicators, and algorithmic strategies.

This holistic approach ensures every trade is based on multiple layers of evidence, giving you a stronger edge in the constantly shifting Gold markets.

Safe trading,

and remember: All that glitters is not Gold,

Joe

p.s. This script is invite-only and exclusive to my paid subscribers. If you’re a paid subscriber, but hasn’t received access to the indicator, please respond to this email or write me a pm with your Trading View username.