Hello, fellow traders!

Gold had a solid week, holding above $2,600 and ending up 0.7% at $2,639 an ounce.

It started Monday at $2,620, supported by geopolitical risks like the Russia-Ukraine conflict. After steady trading, it hit $2,654 on Thursday, a two-week high, fueled by safe-haven demand and last year’s 27% gain.

On Friday, Gold peaked at $2,665 before easing to $2,640 as hawkish Fed signals tempered gains.

Strong demand from Asia, particularly China, helped Gold stay resilient despite a strong dollar and rising Treasury yields. Mixed U.S. manufacturing data added some uncertainty, but overall, the metal stayed supported by ongoing global tensions and central bank buying.

In this week’s update, I’ll:

Decode the technicals: pinpoint the hidden technical clues that could signal a sudden breakout—or a ruthless selloff.

Unpack the global data: highlight the global economic numbers making waves and where they could push Gold’s price in the mid term.

Identify strategic “make-or-break” price zones

Predict what’s next for Gold: give away my short-term and mid-term calls for where XAU/USD is headed.

📊 Let’s look at the technical data

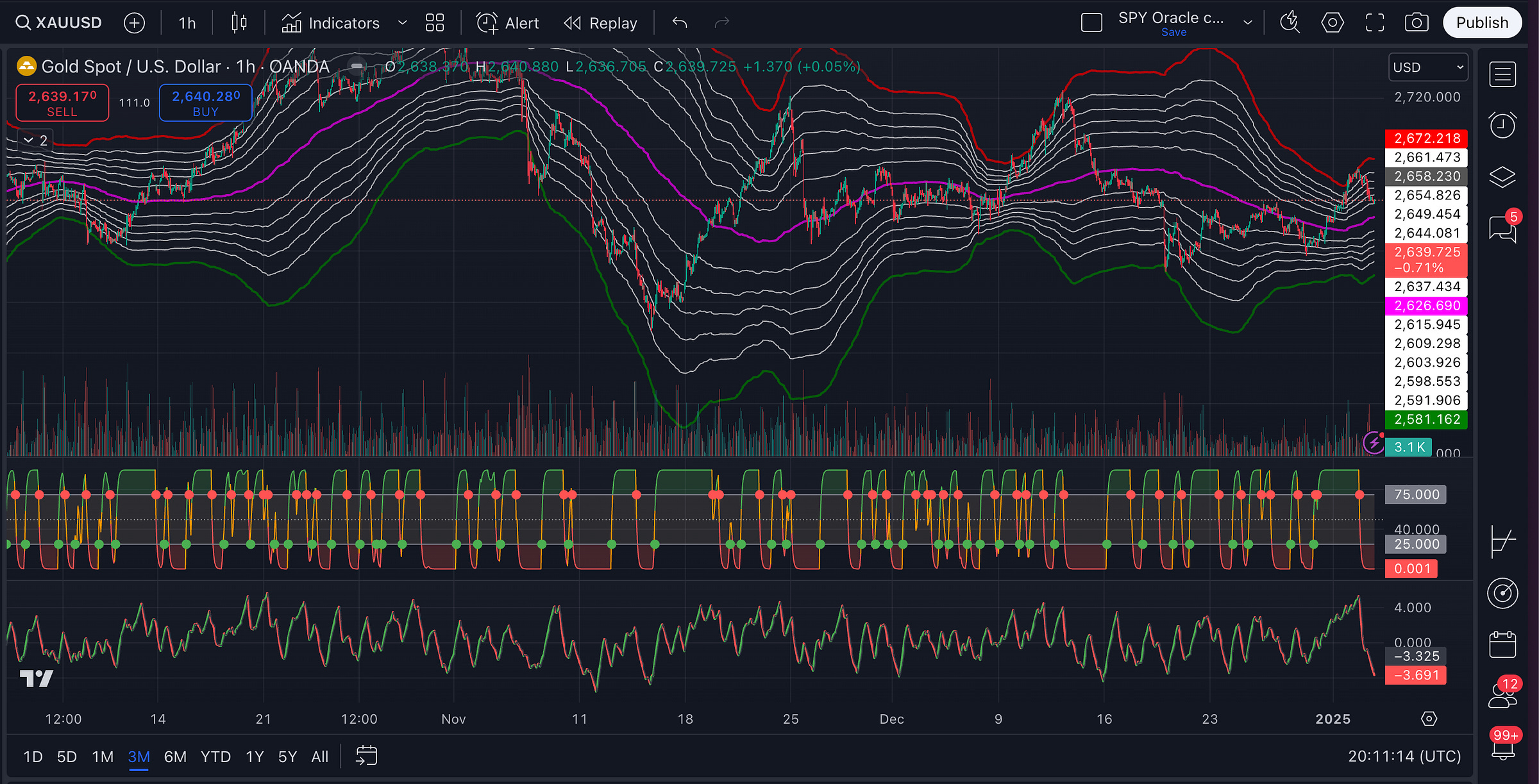

Last 3 months - 1h charts

Elliot Wave suggests a move upside: Gold is in a corrective phase - wave (4).

If it finds support at ~2,636, then we might see an impulsive push higher toward 2,680 or even above 2,700 in Wave (5). RSI is no longer overbought, giving room for an upside push.

If price loses that 2,636 region and heads below 2,620, the count might be invalidated or the correction might extend into a deeper ABC pattern.

Bearish momentum weakening: Momentum oscillators show that while bearish pressure dominates, it's weakening, increasing the chances of a bullish breakout. However, keep an eye on CMF - it’s still slightly negative, which means money flow is mildly favoring the sellers short term.

Watch 2,636–2,650 (SMA 200) zone: this is a

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.