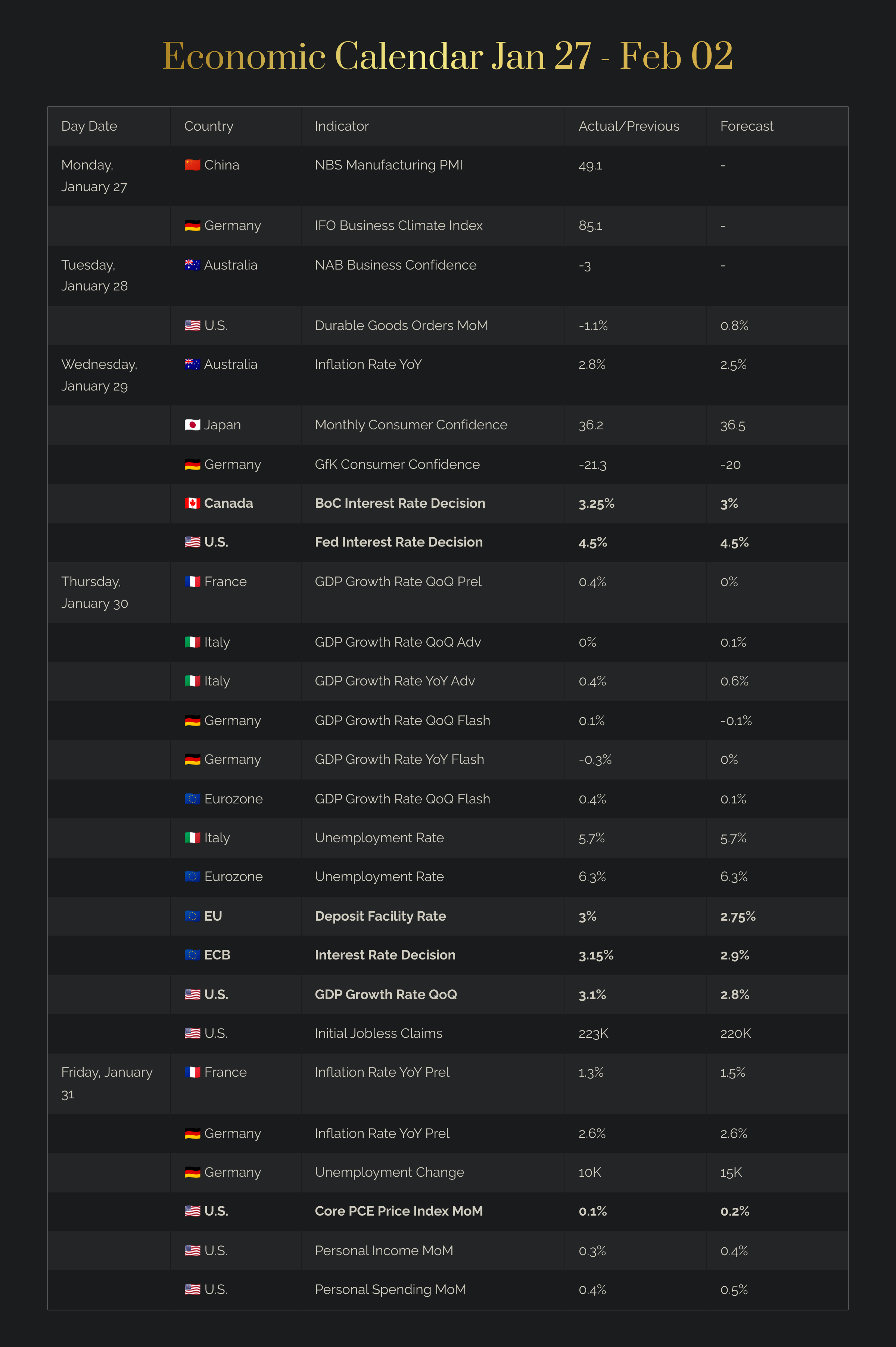

Every Monday, I drop a weekly rundown of key financial events and data releases that matter for the Gold market. These are the big moves and trends you need to watch to stay ahead in the XAU/USD game.

The calendar structure:

Date

Country → Event

What the event is about

📰 Previous readings, forecasts etc.

🚨 Why it matters

🔴 Negative impact on Gold

🟢 Bullish impact on Gold

🟡 Mixed/neutral impact

Monday, January 27

🇨🇳 China’s NBS Manufacturing PMI

measures the performance of the manufacturing sector in China. It is based on a monthly survey of purchasing managers in the manufacturing industry.

A reading above 50 indicates that the manufacturing sector is expanding, while a reading below 50 shows contraction.

📰 Actual: 49.1, lower than expected

🚨 Why it matters for Gold: China is one of the largest consumers of Gold, both for industrial purposes and as a store of value (like jewelry and investment). When its manufacturing sector is doing well, it often signals a stronger Chinese economy. This can lead to different effects on the Gold market, depending on broader global economic trends and sentiment.

📈 Strong PMI (above 50) signals economic strength in China.

→ 🟢 could lead to increased demand for Gold in industrial uses.

→ 🔴 could also boost global risk appetite, making Gold less attractive as a safe haven.

→ 🔴 Chinese yuan can also strengthen and make Gold more expensive for Chinese buyers, reducing the demand.

→ 🟢 strong yuan might weaken the U.S. dollar relative to the yuan, which might offset the negative pressure on Gold, as a weaker dollar makes Gold more affordable for international buyers.

📉 Weak PMI (below 50) suggests a slowdown or contraction in manufacturing, which can trigger concerns about weakening economic growth in China.

→ 🟢 could prompt investors to flock to Gold for safety and push XAU/USD prices higher.

→ 🔴 suggests reduced demand for commodities, which can lead to lower inflationary pressures globally. Lower inflation expectations may reduce the attractiveness of Gold as an inflation hedge, potentially weakening XAU/USD.

→ 🔴 might lead to a stronger dollar if investors turn to U.S. assets for safety. This can put downward pressure on Gold prices.

🇩🇪 Germany’s IFO Business Climate Index

measures business sentiment in Germany based on a survey of about 9,000 German companies from sectors like manufacturing, services, trade, and construction. Businesses are asked about their current business situation and their expectations for the next six months.

📰 Actual: 85.1, higher than expected

🚨 Why it matters for Gold: The IFO Index gives insight into the health of the European economy, which can influence investor risk sentiment and, indirectly, the demand for Gold.

📈 Higher-than expected sentiment suggests economic strength in Germany, which often translates into confidence in the broader Eurozone.

→ 🔴 investors might feel more confident about riskier investments as opposed to Gold.

→ 🔴 might boost the Euro, potentially putting pressure on Gold prices as it reduces Gold’s attractiveness in Eurozone markets.

→ 🔴 the U.S. dollar could strengthen as well due to a stronger global risk appetite.

📉 Lower-than-expected sentiment hints at economic risks or a slowdown in Europe.

→ 🟢 could lead investors to seek “safe-haven” assets like Gold.

→ 🟢 might lead to dovish monetary policy, which is generally supportive of Gold prices.

→ 🟢 might weakens the Euro, leading to a potential EUR/USD drop.

Tuesday, January 28

🇦🇺 Australia’s NAB Business Confidence

provides insights into the business climate by surveying Australian companies on how they feel about the economy in the near future and how they view current conditions, including sales, profitability, and employment.

📰 Previous: -3

🚨 Why it matters for Gold: The NAB Business Confidence can affect Gold prices indirectly, especially through

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.