Every Monday, I drop a weekly rundown of key financial events and data releases that matter for the Gold market. These are the big moves and trends you need to watch to stay ahead in the XAU/USD game.

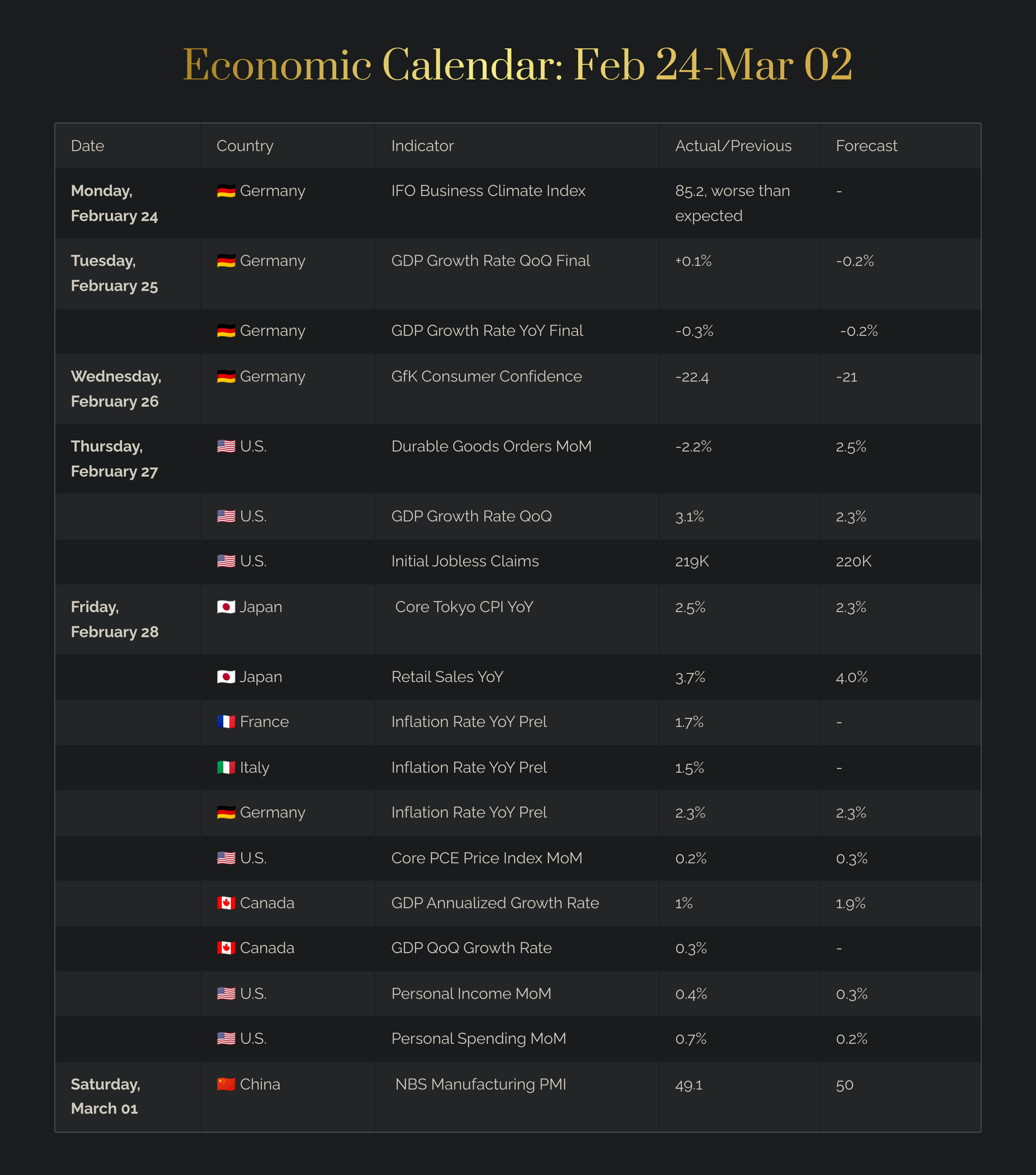

The calendar structure:

Date

Country → Event

What the event is about

📰 Previous readings, forecasts etc.

🚨 Why it matters

🔴 Negative impact on Gold

🟢 Bullish impact on Gold

🟡 Mixed/neutral impact

Monday, February 24

🇩🇪 Germany’s IFO Business Climate Index

measures business sentiment in Germany based on a survey of ~9,000 companies across manufacturing, services, trade, and construction. It reflects how businesses view current conditions and their expectations for the next six months.

📰 Actual: steady at 85.2, worse than expected

🚨 Why it matters for Gold: The IFO Index gauges Germany’s economic health, impacting investor sentiment and, indirectly, Gold demand.

📈 Higher-than expected sentiment → economic strength → confidence in the broader Eurozone.

→ 🔴 Investors may favor riskier assets over Gold.

→ 🟡 A stronger Euro could pressure Gold prices. BUT if it weakens USD → support for Gold.

→ 🔴 Increased global risk appetite might boost the U.S. dollar.📉 Lower-than-expected sentiment → economic risks/a slowdown in Europe.

→ 🟢 Investors may seek safe-haven assets like Gold.

→ 🟢 Increases chances of a dovish monetary policy.→ 🟢 Might weaken the Euro, leading to a potential EUR/USD drop.

Tuesday, February 25

🇩🇪 Germany’s GDP Growth Rate QoQ/YoY Final

measures Germany’s economic performance:

QoQ: Compares GDP to the previous quarter (short-term growth).

YoY: Compares GDP to the same quarter last year (long-term trend).

📰 QoQ Previous: +0.1% | Forecast: -0.2%

YoY Previous: -0.3% | Forecast: -0.2%

🚨 Why these events matter for Gold: As the EU’s largest economy, Germany’s GDP impacts investor sentiment, ECB policy, and the euro, all of which influence Gold prices.

📈 Higher-than-expected GDP growth → economic strength.

→ 🔴 Reduces demand for Gold as investors shift to riskier assets.

→ 🟢 Supports the euro, which can weaken the U.S. dollar → Gold more affordable for international buyers.

→ 🔴 Raises the risk of ECB rate hikes → bonds and other interest-bearing investments more attractive compared to Gold.📉 Lower-than-expected GDP growth → underperforming economy → stagnation/recession concerns:

→ 🟢 Safe-haven demand increases.

→ 🔴 Weakens the euro, strengthening the dollar → lower demand as Gold becomes more expensive.

→ 🟢 Increases chances of ECB rate cuts → higher demand for the metal as a store of value.

Wednesday, February 26

🇩🇪 Germany’s GfK Consumer Confidence

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.