Every Monday, I drop a weekly rundown of key financial events and data releases that matter for the Gold market. These are the big moves and trends you need to watch to stay ahead in the XAU/USD game.

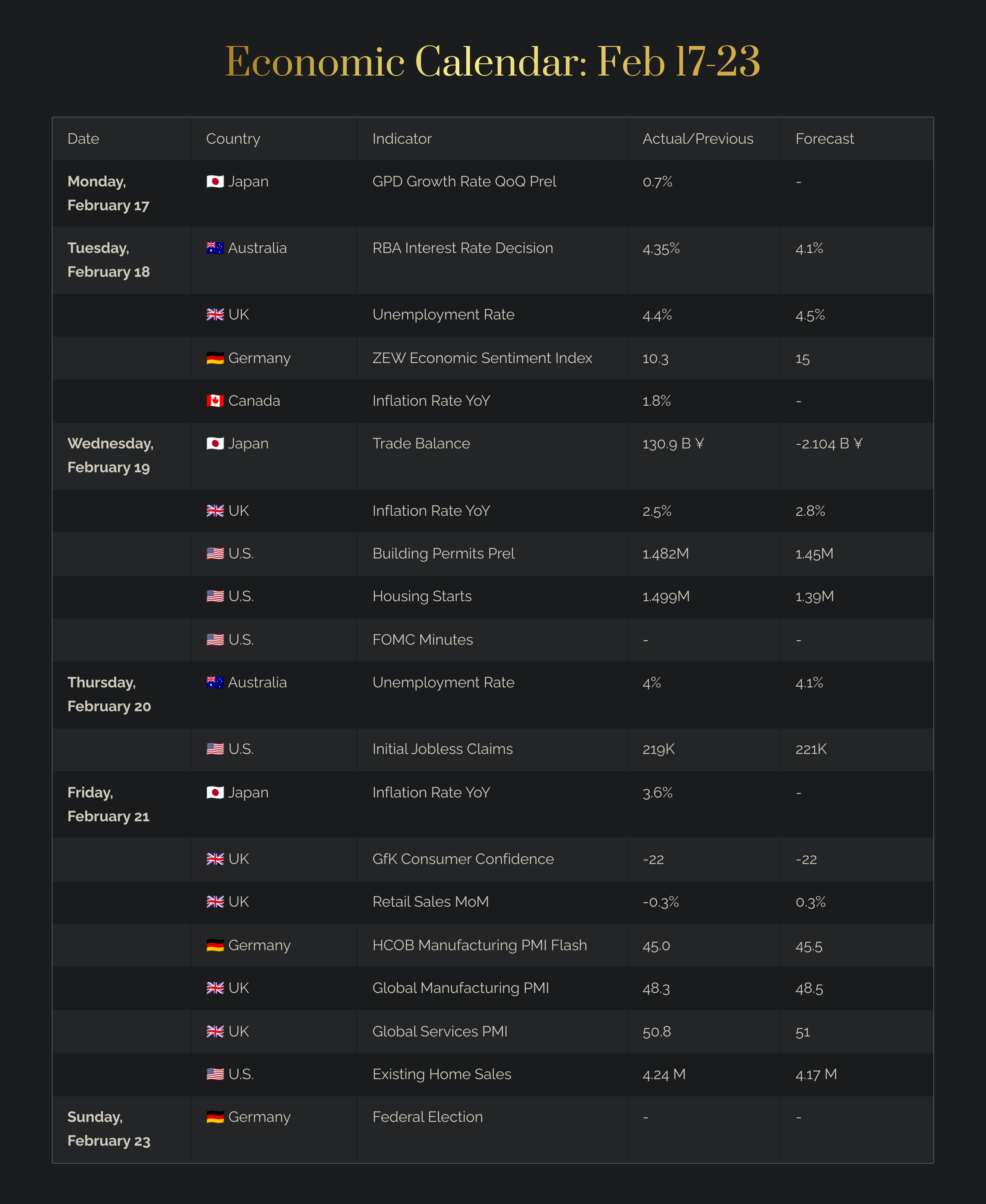

The calendar structure:

Date

Country → Event

What the event is about

📰 Previous readings, forecasts etc.

🚨 Why it matters

🔴 Negative impact on Gold

🟢 Bullish impact on Gold

🟡 Mixed/neutral impact

Monday, February 17

🇯🇵 Japan’s GPD Growth Rate QoQ Prel

measures how much Japan’s economy grew (or shrank) compared to the last quarter. "Preliminary" means it's the first estimate—usually the most market-moving.

📰 Actual: 0.7%, above forecasts

🚨 Why it matters for Gold: Japan is the world’s third-largest economy, so its economic performance affects global markets, including Gold.

📈 GDP higher than expected → businesses are expanding, consumers are spending, and investors feel confident.

→ 🔴 investors may sell Gold and move money into riskier assets like stocks.

→ 🟡 JPY strengthens → reduced chances of BOJ stimulus, potentially weakening USD/JPY. But if risk sentiment improves, USD could rise alongside stocks.

→ 🟢 If strong GDP stirs inflation fears, Gold might hold or rise as an inflation hedge (more relevant if inflation data confirms).

📉 GDP lower than expected → economy slows down or contracts, investors may become cautious.

→ 🟢 generally bullish for Gold as safe-haven demand rises.

→ 🟢 YPY weakens, it could weaken USD/JPY, which might indirectly support Gold.

→ 🟢 If the BOJ steps in with easing measures, Gold could benefit.

Tuesday, February 18

🇦🇺 The RBA Interest Rate Decision

a monthly policy meeting where the RBA’s board decides whether to change, maintain, or cut the cash rate.

This cash rate is the interest rate on overnight loans between banks and is the primary tool the RBA uses to control inflation and manage economic growth in Australia.

📰 Previous: 4.35%

Forecast: 4.1%

🚨 Why it matters for Gold: While the RBA decision directly impacts AUD, its ripple effects on market sentiment and the U.S. dollar (USD) can drive Gold prices.

📈 Rate hike:

→ 🔴 typically bearish for Gold → higher rates boost bond yields, making Gold less attractive.

→ 🔴 AUD & USD strengthen → investors chase higher yields, potentially pushing Gold lower.

→ 🟢 if growth concerns rise, safe-haven demand for Gold could offset some losses.

📉 Rate cut:

→ 🟢 usually bullish for Gold prices → lower rates reduce bond yields, making Gold more appealing.

→ 🟢 AUD & USD weakness → can make Gold cheaper for other currency holders, potentially pushing XAUUSD higher.

→ 🟢 loose monetary policy may push investors toward Gold to protect against currency devaluation.

🇬🇧 The UK Unemployment Rate

measures the percentage of job-seekers who are unemployed.

📰 Previous: 4.4%

Forecast: 4.5%

🚨 Why it matters for Gold: The unemployment rate influences the Bank of England’s (BoE) rate decisions, which directly impact XAU/USD. UK economic health also affects global risk sentiment.

📈 Higher-than-expected unemployment → a weaker economy → lower consumer spending, slower growth.

→ 🟢 safe-haven demand rises

→ 🟢 GBP weakens → Gold gets cheaper locally, potentially boosting demand.

→ 🟢 could fuel speculation of rate cuts, which supports Gold.

📉 Lower-than-expected unemployment → a stronger labor market → signals economic resilience.

→ 🔴 BoE may hike rates, boosting GBP and reducing Gold’s appeal.

→ 🔴 Risk appetite increases → investors may favor stocks over Gold.

→ 🟢 Inflation concerns → more employment means more spending, which could fuel inflation. If inflation picks up, Gold might still find support.

🇩🇪 Germany’s ZEW Economic Sentiment Index

measures confidence in Germany’s economy based on expert surveys about the next six months.

📰 Previous: 10.3

Forecast: 15

🚨 Why it matters for Gold: Germany is Europe’s biggest economy, so its outlook impacts global markets, the euro, and Gold. The ZEW Index is a key gauge of broader Eurozone sentiment.

📈 Higher-than-expected index → experts see economic improvement → optimism rises.

→ 🔴 safe-haven demand drops as investors move to riskier assets.

→ 🔴 EUR strengthens → could signal potential ECB tightening, weighing on Gold.

→ 🟢 USD might weaken → A stronger euro could pressure the U.S. dollar, which might push XAU/USD higher.

📉 Lower-than-expected index → experts expect economic struggles → concerns over the Eurozone.

→ 🟢 more safe-haven demand.

→ 🟢 could prompt more dovish ECB policies, supporting Gold.

→ 🔴 EUR weakens, USD gains – a stronger dollar could push XAU/USD lower.

🇨🇦 Canada's Inflation Rate YoY

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.