Every Monday, I drop a weekly rundown of key financial events and data releases that matter for the Gold market. These are the big moves and trends you need to watch to stay ahead in the XAU/USD game.

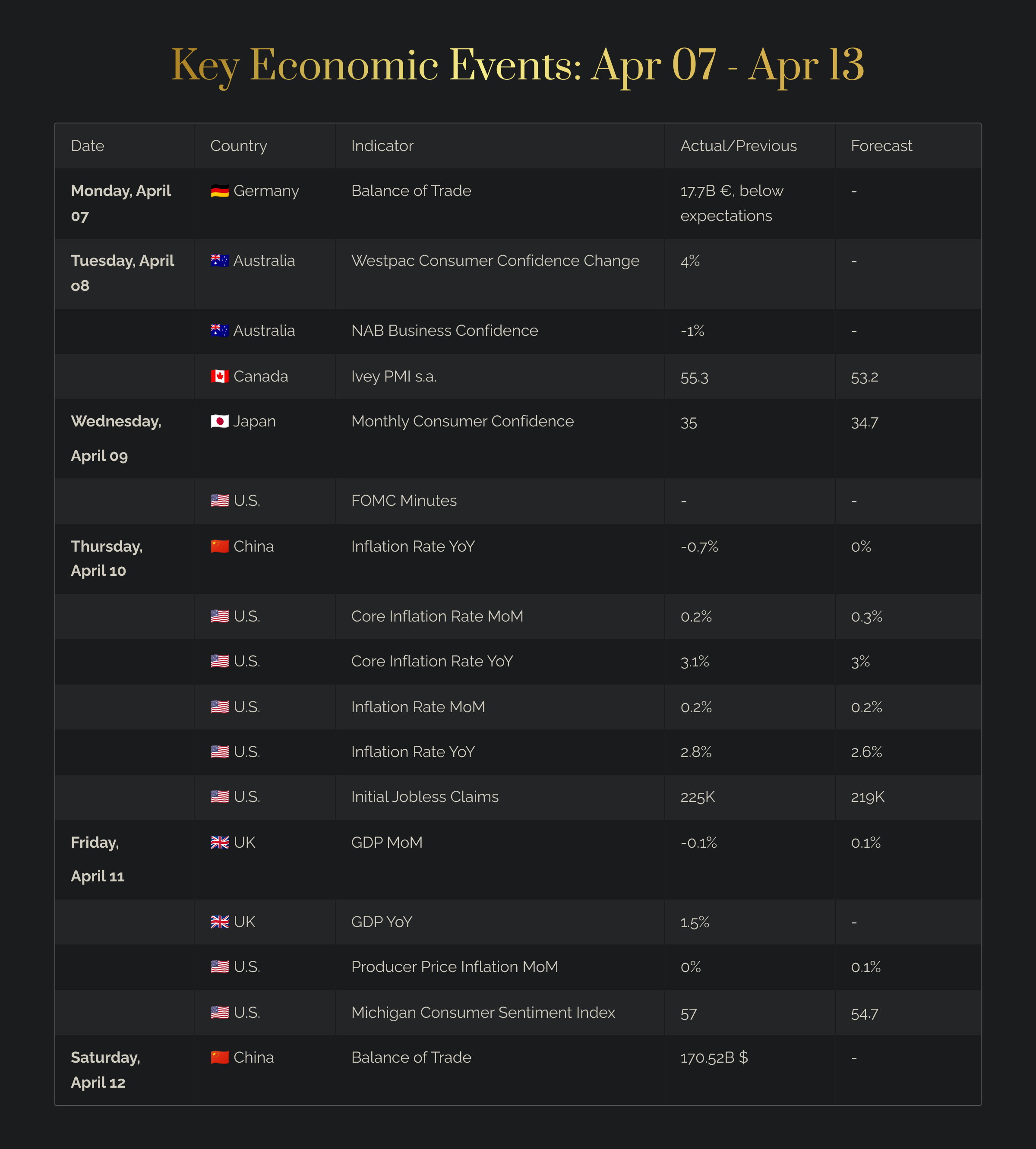

The calendar structure:

Date

Country → Event

What the event is about

📰 Previous readings, forecasts etc.

🚨 Why it matters

🔴 Negative impact on Gold

🟢 Bullish impact on Gold

🟡 Mixed/neutral impact

MONDAY, APRIL 07

🇩🇪 Germany's Balance of Trade

Measures the gap between exports and imports. A surplus means Germany exports more than it imports; a deficit means the opposite.

📰 Actual: 17.7B €, below expectations

🚨 Why it matters for Gold

Germany is the EU’s economic powerhouse. Its trade balance impacts the Euro (EUR) and its relation to USD, which in turn influences Gold prices.

📈 Trade surplus:

→ 🔴 Boosts confidence in the Eurozone, safe haven demand decreases.

→ 🔴 Stronger EUR → Gold more expensive for European buyers.

→ 🟢 If stronger EUR = weaker USD → Gold becomes cheaper for buyers using other currencies, increasing demand.

→🔴 The ECB may hike rates to prevent excessive risk-taking.

📉 Trade deficit → weakening global demand or rising import costs.

→ 🟢 Investors move into Gold for protection.

→ 🟢 Weak EUR → Gold cheaper in Europe → increased demand.

→ 🟢 ECB may turn dovish.

TUESDAY, APRIL 08

🇦🇺 Australia’s Westpac Consumer Confidence Change

Measures how Australians feel about the economy and their willingness to spend.

📰 Previous: 4%

🚨 Why it matters for Gold

Australia’s economy is tied to global trade and commodities. Consumer confidence shifts can reflect broader economic trends, influencing investor sentiment and Gold prices.

📈 A positive reading → higher confidence = more spending = stronger economy.

→ 🟡 Stronger AUD.

→ 🔴 Gold more expensive in AUD → lower domestic demand.

→ 🟢 If AUD strength weakens USD, it could support Gold prices.

→ 🔴 Investors may expect RBA to hold or hike rates → bearish for Gold.

📉 A negative reading → lower confidence = more saving = weaker economy

→ 🟢 Risk-off sentiment → investors shift to safe-haven assets → bullish for Gold.

→ 🟢 RBA could keep or cut rates → weaker AUD → supports Gold upside.

🇦🇺 Australia’s NAB Business Confidence

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.