Bracing for a BRICS Revolution: Could a New Currency Ignite a Gold Frenzy? (+6 Tactics to Stay One Step Ahead)

Hello, fellow traders!

BRICS nations are quietly scooping up Gold on a scale not seen in decades.

Their latest moves—like Gold-backed trading and talk of a fresh currency—signal a coordinated effort to ease away from the mighty U.S. dollar.

If they pull it off, we may be on the verge of a Gold-fueled global shakeup that nobody saw coming.

Let’s find out:

why the Gold rush, and what does it mean for Gold prices?

is another 1970s-style boom—maybe even bigger—right around the corner?

what exactly you can do as a Gold trader to maintain an edge in this volatile market?

A Quick History of Dollar Dominance

The road to dollar supremacy

The U.S. dollar’s global reserve status didn’t happen by chance.

In 1944, representatives from 44 Allied nations met in Bretton Woods, New Hampshire, to create a post-WWII international monetary system.

The result:

Most major currencies were pegged to the U.S. dollar, and the dollar itself was pegged to Gold at a fixed rate of $35 per ounce.

This arrangement gave the United States enormous influence—and effectively crowned the dollar as the world’s primary reserve currency.

By 1971, soaring U.S. spending on social programs and the Vietnam War led President Richard Nixon to end the dollar’s convertibility into Gold.

The Bretton Woods system collapsed, but the dollar’s supremacy persisted, and the dollar continued to dominate global reserves and trade invoicing.

Over the ensuing decades:

Roughly 60% of global foreign exchange reserves remained dollar-denominated.

The U.S. secured “exorbitant privilege,” as French finance minister Valéry Giscard d’Estaing famously called it.

The U.S. could run up debt, rely on foreign buyers of Treasury securities, and finance massive deficits under more favorable terms than virtually any other nation.

The “weaponization” of the dollar

From imposing financial sanctions on adversaries to controlling access to systems like SWIFT, the U.S. has often used the dollar’s centrality in global finance as a strategic tool.

After 9/11, this approach intensified, with Washington freezing billions in foreign reserves belonging to sanctioned states such as Iran, Venezuela, and Russia.

But such actions breed resentment.

Countries that ran afoul of U.S. policy found themselves cut off from global finance. For them, the dollar morphed from a convenient trade instrument into a geopolitical cudgel.

For instance, in 2023, several analysts noted that Russia and China had amped up their Gold purchases partly as an “insurance policy” against dollar sanctions.

Enter BRICS: The Rise of a Multipolar World

Who are the BRICS, and why do they matter?

BRICS is an acronym coined in the early 2000s to describe five major emerging economies: Brazil, Russia, India, China, and South Africa.

Together, they account for:

Over 3.2 billion people, or around 40–45% of the global population.

Roughly 25–31% of global GDP (depending on whether you measure by nominal GDP or purchasing power parity).

Significant production of commodities, from oil (Russia) to agricultural products (Brazil) to gold (Russia, China, and South Africa).

In 2024, several new countries—including Indonesia, Egypt, Ethiopia, Iran, and the UAE—joined or received invitations, expanding the BRICS’ influence.

A recurring theme in these nations’ rhetoric is “de-dollarization”: reducing reliance on the greenback by conducting trade in local currencies or other mediums of exchange—potentially Gold.

The “100% tariff” threat and U.S. pushback

Sensing the dollar’s vulnerability, Trump fired warning shots.

He publicly warned that if BRICS nations try to supplant the dollar, they could face tariffs as high as 100% on their exports to the U.S.

Viewed by some as a defensive measure, and by others as financial warfare masquerading as tariffs, this threat underscores how seriously Washington takes the notion of de-dollarization.

A 100% tariff on key BRICS exports—metals, energy products, and even electronics—would be a massive strain on global supply chains.

This move signals that the U.S. might be ready to “weaponize” trade policy further in a bid to protect the dollar’s dominance.

Whether this threat will be carried out remains to be seen.

Critics argue it could backfire, pushing BRICS even closer together, accelerating their pursuit of alternative currencies, and spurring more Gold accumulation.

The Gold Accumulation Frenzy: Recent Central Bank Buys

According to the World Gold Council, central banks globally purchased over 1,000 metric tons of Gold in 2023—one of the highest levels since 1967.

This record-breaking pace has continued throughout 2024, fueled significantly by BRICS nations.

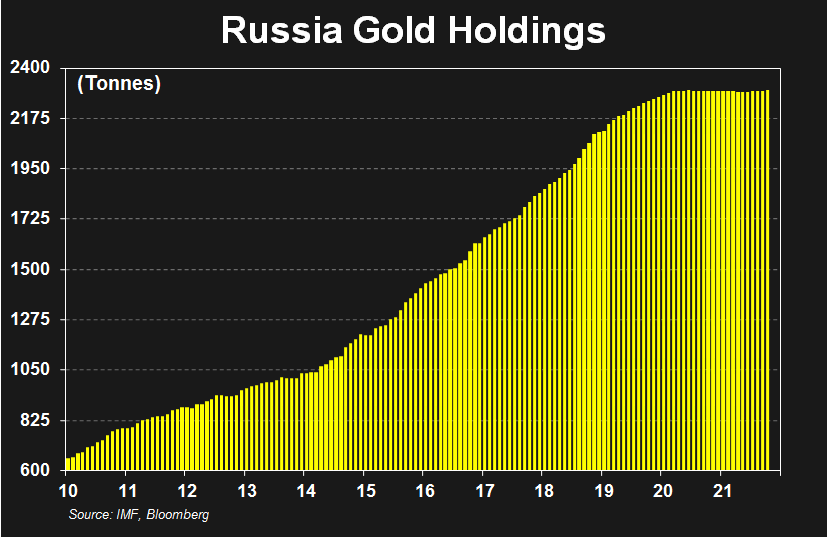

Russia: Leading the pack

2023 Purchases: Approximately 300 metric tons of Gold, more than double its average annual acquisition from 2018 to 2022 (when it typically bought 150 metric tons per year).

Why It Matters: Sanctions have cut Russia off from many Western financial markets, prompting Moscow to shore up “liquid assets” that aren’t easily frozen or confiscated—like Gold.

Strategic Objectives: Stabilize the ruble, circumvent sanctions, and gain greater leverage in global negotiations.

China

2023 Purchases: Roughly 250 metric tons, up from about 200 tons purchased annually between 2018 and 2022.

Recent Disclosure: China’s central bank, the People’s Bank of China (PBOC), disclosed additional Gold purchases in late 2024 and early 2025, reversing a previous pause.

The Bigger Picture: Multiple analysts suggest Beijing underreports its real holdings. Some estimates put China’s total gold hoard well above 20,000 metric tons, once you factor in the People’s Liberation Army, sovereign wealth funds, and private accumulations.

China has also been quietly purchasing Gold Dore (partially refined bars) and concentrate from foreign mining operations, often paying premiums above spot price.

By refining it at home, Beijing conceals its true level of official reserves from institutions like the IMF.

India

2023 Purchases: Around 200 metric tons, a jump from an average of 150 metric tons annually (2018–2022). It maintained its position as the second largest buyer in 2024 after Poland.

Motivation: A deep cultural affinity for Gold plus a strategic pivot to reduce dependence on the dollar.

Outcome: Consistent year-over-year growth in India’s official Gold reserves, reinforcing the notion that Gold is both an economic hedge and a cultural store of wealth.

Brazil, Indonesia, and the newest BRICS members

Brazil (2023): About 100 metric tons—up from 80 metric tons purchased annually between 2018 and 2022.

Indonesia (2024): Added 80 metric tons, rising from a previous average of around 50 metric tons a year.

Implication: As emerging markets seek autonomy from dollar volatility, they’re turning to Gold. Brazil has also signaled moves away from heavy dollar holdings in its reserves, citing financial stability and “national sovereignty.”

South Africa

2023 Purchases: Approximately 50 metric tons, in line with its historical average of 45 metric tons per year.

Context: Although a major Gold producer for decades, South Africa has faced challenges in its mining sector. Nonetheless, it continues to add Gold to its reserves, albeit more slowly.

Why Gold? The Logic Behind De-Dollarization

Hedging against financial “weaponization”

When Russia had $5 billion in U.S. Treasuries effectively seized, it was a stark reminder: holding too many dollar assets can be hazardous if you’re on Washington’s bad side.

Gold, on the other hand, is a tangible reserve asset that cannot be “frozen” by a foreign power. This is a major motivator behind the BRICS Gold spree.

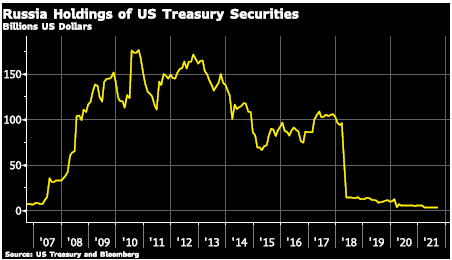

Diversifying away from U.S. Treasuries

Historically, central banks in emerging economies parked their surplus reserves in U.S. government debt. However, negative real yields, rising inflation, and the specter of sanctions have tarnished Treasuries’ appeal.

Starting from 2023, the People’s Bank of China has been trimming its Treasury holdings from about $1 trillion to $760 billion, a multi-year low, and currently completely stopped bond buying.

Russia has nearly exited the Treasury market entirely.

Preparing for a new monetary order

Many analysts, including those at Bank of International Settlements (BIS) and the IMF, have floated ideas of a “Bretton Woods III,” wherein multiple commodities (chief among them Gold) back a system of digital currencies.

China has been test-driving a Central Bank Digital Currency (CBDC) called the “e-CNY,” aiming to bypass the dollar for global transactions.

Gold-backing may not be immediate, but many see it as the ultimate trust anchor for any large-scale alternative to the greenback.

The Gold-Backed BRICS Currency (or Settlement Unit)

From common currency to common settlement

Rumors about a so-called “BRICS currency” swirl with each annual summit.

Leaders clarify they’re not aiming for a single euro-style currency just yet—each member wants to maintain monetary policy sovereignty.

Instead, talk has centered on a common settlement currency (nicknamed the “unit”) that would:

Be partially backed by Gold (one proposal by Dilma Rousseff, President of the BRICS’ New Development Bank, suggests 40% Gold backing).

Operate on new cross-border payment rails that bypass Western-controlled systems like SWIFT.

Serve as a stable anchor for trade, especially in energy and other commodities.

A Gold-backed settlement unit is more feasible and less disruptive, letting countries continue using local currencies for domestic affairs while clearing trade balances in a partially Gold-pegged instrument.

Project mBridge: The “Digital Rails” for Cross-Border Payments

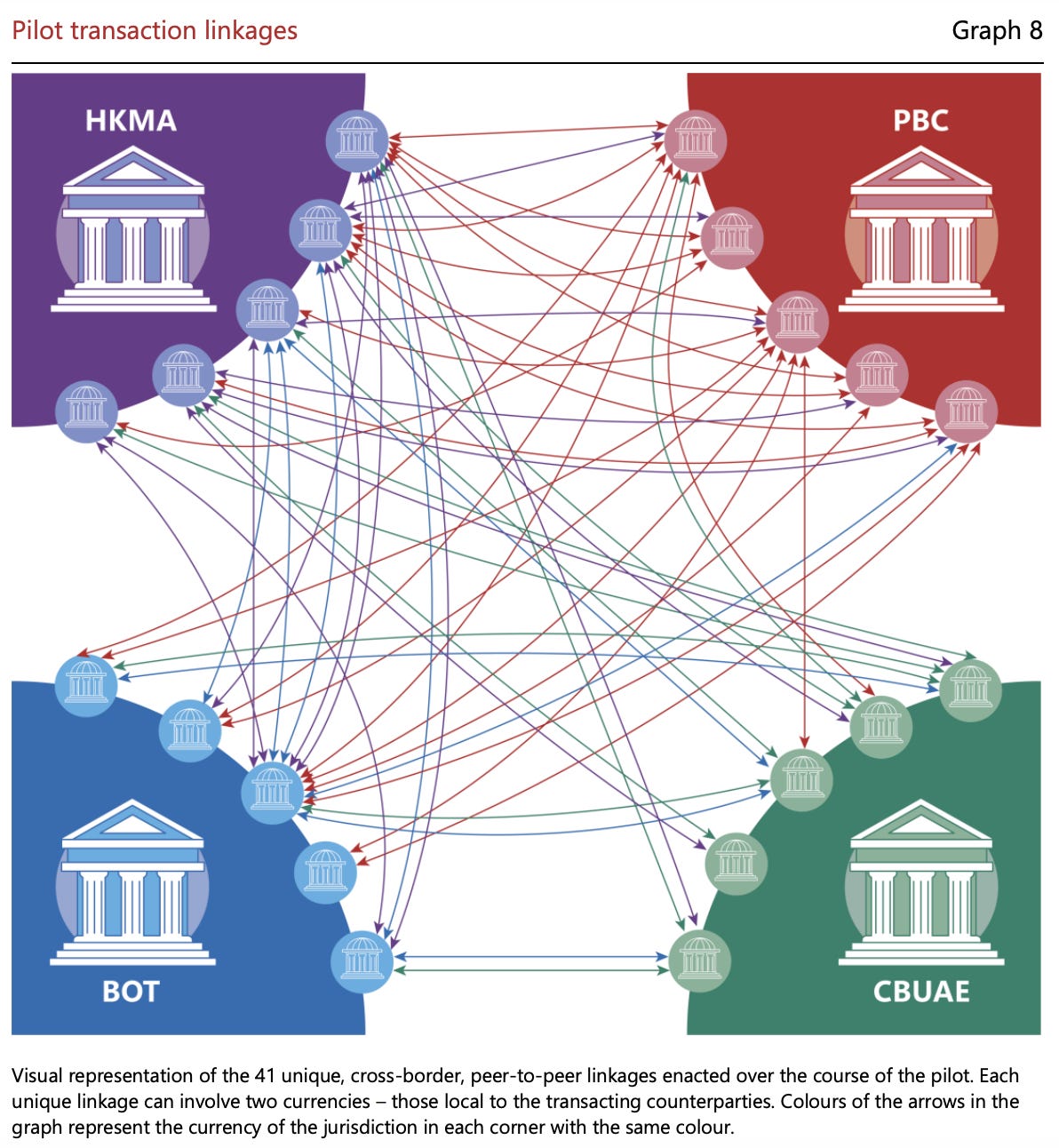

A crucial piece of this plan was Project mBridge, a cross-border central bank digital currency (CBDC) platform.

Co-developed by China, Hong Kong, Thailand, and the United Arab Emirates—under the Bank for International Settlements (BIS) Innovation Hub—Project mBridge aimed to let countries settle trades in their own CBDCs without going through the dollar.

Analysts believed it would:

Expand to BRICS, enabling them to bypass dollar-based pipelines.

Possibly integrate a Gold component to back part of each transaction.

Undermine the petrodollar structure if big oil exporters (like Saudi Arabia) joined.

Suddenly, the BIS’s leadership reversed course, citing sanctions on Russia and claiming the BIS could not facilitate payment systems for sanctioned nations.

Many in BRICS view this as financial “espionage” or sabotage.

Regardless, insiders report China and Russia will press forward with or without BIS support, determined to stand up a platform that allows them to offset trade balances using Gold or non-dollar currencies.

Below the paywall:

How BRICS will affect Gold market and can it spark a price rally?

3 real-world scenarios of further BRICS developmens - winners and losers.

Is BRICS currency even feasable?

6 advanced tactics to maintain an edge as a Gold trader in a volatile market.

Keep reading with a 7-day free trial

Subscribe to The Gold Trader to keep reading this post and get 7 days of free access to the full post archives.