Gold and Bitcoin—two powerhouse assets, yet worlds apart in ideology and strategy.

One has preserved wealth for 4,000 years, surviving wars, empires, and financial crises. The other, barely 15 years old, is a digital alternative that promises freedom from the traditional financial system.

Now, in 2025, with Trump’s Strategic Bitcoin Reserve (SBR) proposal making headlines, the big question is:

Will Gold stay the top choice for protecting wealth, or is Bitcoin finally ready to take its place?

Let’s break it down.

Gold vs Bitcoin: Competing Safe Havens?Understanding the Core Similarities and Differences

Both Gold and Bitcoin are often grouped under the “safe haven” label, but their journeys diverge in critical ways.

Gold’s legacy of stability

For over 4,000 years, Gold has been the go-to asset for preserving wealth. From ancient Egypt to modern superpowers, it has symbolized economic strength and served as protection during times of crisis.

As of late 2024, central banks held 38,764 metric tons of it, with countries like China, India, Poland, and Turkey buying record amounts to reduce their reliance on the U.S. dollar. This shows how Gold remains a key geopolitical hedge.

Gold’s reputation as a safe haven is as strong as ever. In times of war, financial crashes, or inflation, investors turn to it for stability.

During the 2008 financial crisis, Gold surged from $800 to $1,900 per ounce—a 137% increase.

In 2020, during the COVID-19 pandemic, it hit a record $2,070 per ounce.

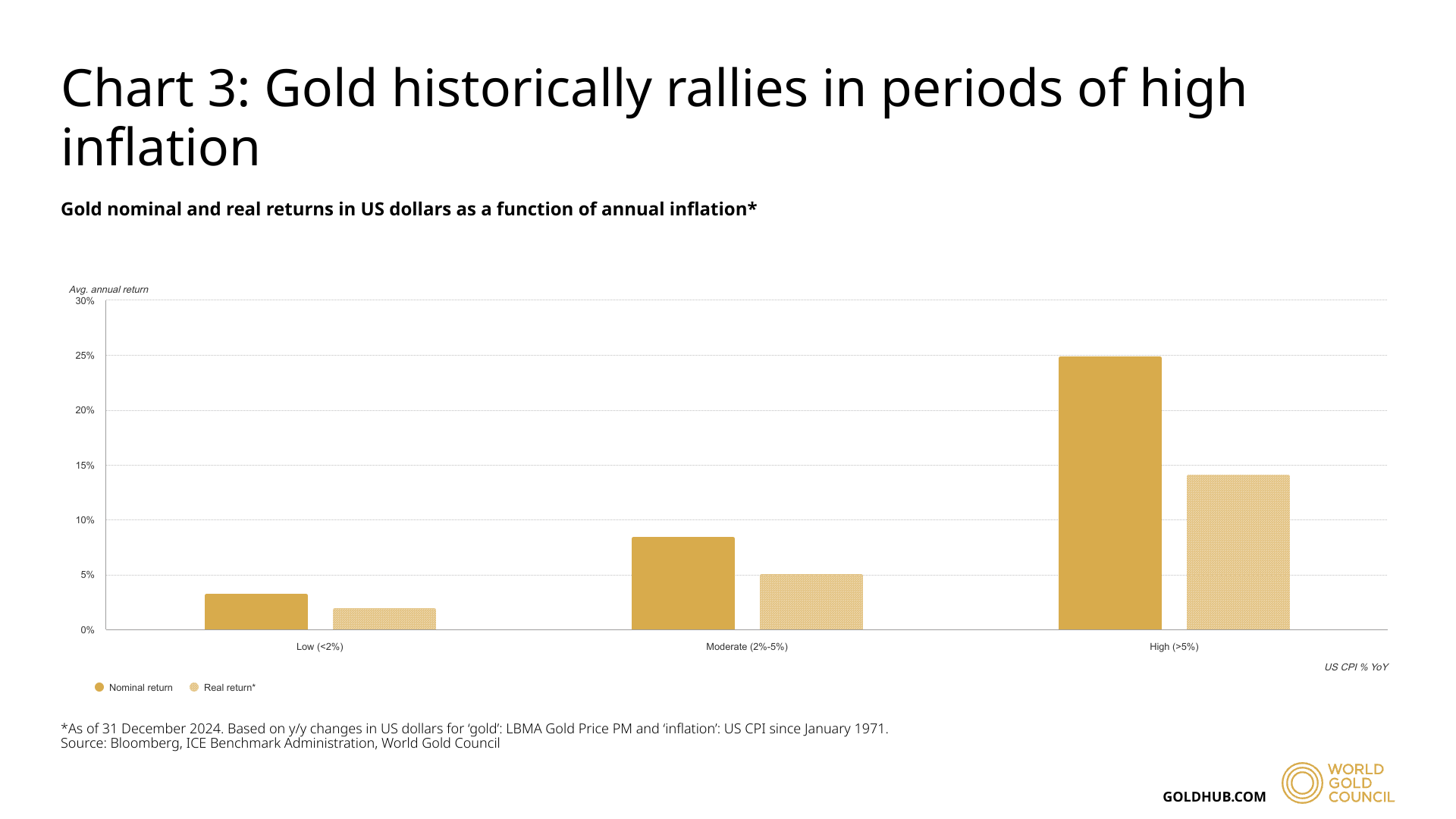

Gold tends to perform well during inflation, currency devaluation, and global uncertainty.

Bitcoin

Bitcoin is still young compared to Gold. Launched in 2009, it has gone from a niche experiment to a multi-hundred-billion-dollar market in just 15 years.

Its appeal lies in its decentralization, scarcity, and potential to function as a "digital Gold." Its adoption has grown due to:

Institutional investment, including Bitcoin ETFs approved in late 2023.

Companies adding Bitcoin to their reserves (e.g., Tesla, MicroStrategy).

Use in countries with unstable currencies, like Argentina and Turkey.

However, Bitcoin’s volatility remains its Achilles’ heel - it jumped from $3,800 in early 2019 to nearly $68,000 by late 2021, then crashed to $35,000 in early 2022, only to surge past $95,000 in the current cycle.

By comparison:

Gold’s annualized volatility is ~10%-15%.

Bitcoin’s annualized volatility is ~60%-70%.

Supporters call Bitcoin “digital Gold” because of its fixed 21 million coin supply and decentralized nature, which prevents it from being inflated by any government.

Trump’s SBR Plan—Will Gold Lose Investors?

President Trump’s Strategic Bitcoin Reserve (SBR) proposal aims to:

Use the 207,000 BTC already seized or held by the U.S. government as part of a Treasury-managed Bitcoin reserve.

Potentially buy more Bitcoin each year, with Congress’s approval, to expand the reserve.

Currently, at least 13 states are actively considering legislation or constitutional amendments to launch their own SBRs.

With the idea of a U.S. Bitcoin reserve gaining traction, many Gold investors are asking:

Will this challenge Gold’s status as the ultimate safe-haven asset?

Here’s what I think might happen next.

Short-term rotation vs. long-term demand

🔻 Bearish View: In the near term, some speculative capital could rotate out of Gold into Bitcoin if the U.S. government officially blesses crypto ownership. Traders chasing quick gains might reduce their Gold holdings.

🟢 Bullish Rebuttal: Gold has weathered many competitive threats over millennia (e.g., the dollar, other currencies) yet remains central to central bank reserves. Bitcoin may gain attention, but Gold’s physical nature and 4,000-year history still make it a trusted store of value.

Confidence in physical assets

🔻 Bearish View: Younger investors, who are comfortable with digital assets, may see Gold as outdated and favor Bitcoin for long-term wealth storage.

🟢 Bullish Rebuttal: In a major crisis—such as cyberattacks or tech failures—physical Gold could become even more valuable. Governments and individuals alike trust Gold as a fail-safe asset when digital systems are at risk.

Systemic Hedge vs. Crypto Hedge

🔻 Bearish View: If Bitcoin continues to gain credibility as “digital Gold,” especially with U.S. government backing, it could take demand away from Gold. Institutions may start shifting reserves from Gold to Bitcoin, limiting Gold’s future price growth.

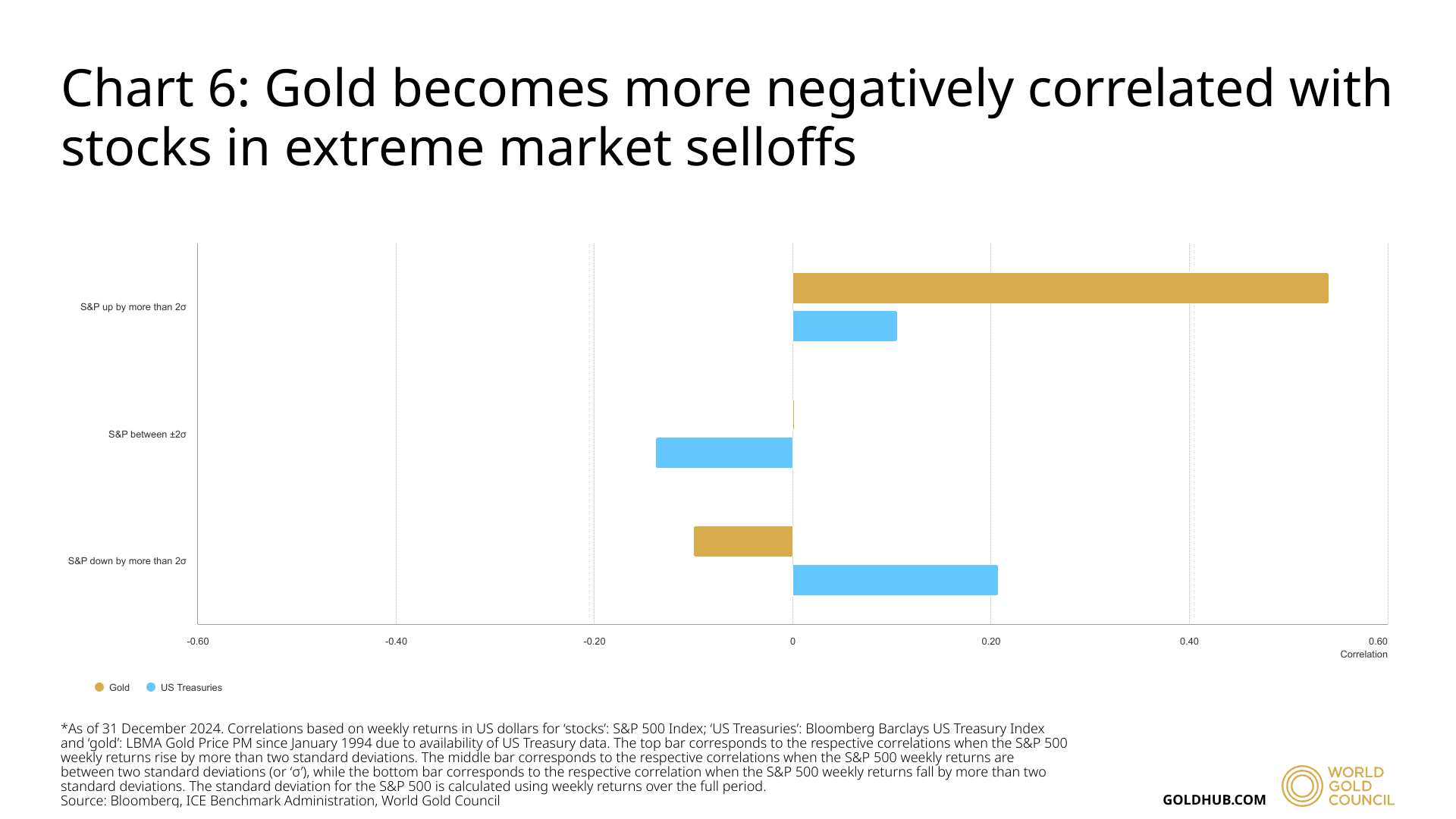

🟢 Bullish Rebuttal: Many investors see Gold and Bitcoin as complements, not competitors. Gold’s negative correlation with stocks increases in market selloffs, making it a more stable hedge in uncertain times. Bitcoin, on the other hand, often moves with risk assets like tech stocks. When markets turn volatile, Gold could still offer more reliable protection.

Investor psychology & history

Gold’s track record speaks for itself—it has protected wealth for centuries and remains a trusted asset in crises.

Bitcoin, still new, excites some investors with its upside potential but also raises concerns due to its volatility.

Gold and Bitcoin: Complementary, Not Competing

Bitcoin’s rise—and the possibility of a U.S. Strategic Bitcoin Reserve (SBR)—might shift some investor capital. But Gold isn’t going anywhere.

Gold remains deeply embedded in central bank reserves, with a massive market size and liquidity. Replacing it entirely with Bitcoin would face serious legal, cultural, and institutional resistance.

A more realistic outcome? Diversification within safe-haven assets.

As Bitcoin adoption grows, a small share of Gold’s market may flow into crypto.

Over time, if Bitcoin’s volatility stabilizes, it could take a larger role—but Gold and Bitcoin are more likely to coexist than compete directly.

Instead of investing all-in on one, it’s smarter to using both Gold and Bitcoin as a multi-layer hedge.

Gold for stability (5–10% of a portfolio)

✅ Proven long-term store of value: Few assets match Gold’s track record. The precious metal has outlasted inflation, financial crises, and entire empires for over 4,000 years.

✅ Global reserve asset: According to the IMF, Gold remains one of the top reserve holdings worldwide—ranked even above the Japanese yen.

✅ Low Volatility: Gold’s price movements are relatively stable and have little correlation with stocks or bonds, making it valuable for portfolio diversification.

Bitcoin for growth (1–2% of a portfolio)

🚀 Higher upside potential: Though Gold can rally strongly, it rarely sees triple-digit annual gains. Bitcoin, being younger and more volatile, has historically offered far higher upside (and downside).

⛓ Digital scarcity: Bitcoin’s supply is capped at 21 million, making it resistant to inflation and government money printing.

Bridging the Old and the New

By 2025, the debate over whether Gold or Bitcoin is the "true" safe-haven asset will likely shift. With rising debt, geopolitical uncertainty, and advancing technology, both assets will play key roles in modern portfolios.

Gold is timeless—backed by history, governments, and institutions.

Bitcoin is revolutionary—offering decentralization, scarcity, and high growth potential.

For investors, understanding both is no longer optional. As financial markets evolve and central bank policies become more extreme, Gold and Bitcoin will increasingly share space in portfolios.

So, the question for 2025 isn’t Gold or Bitcoin—it’s whether you’re prepared to embrace both.

A balanced strategy that blends the stability of Gold with the growth potential of Bitcoin could be the strongest defense against whatever comes next.

Safe trading,

and remember: All that glitters is not Gold,

Joe