America’s ‘strong economy’ is a sham (or why the official growth data doesn’t match your life)

At first glance, the U.S. economy looks like it’s living the dream—high-flying GDP, “soft-landing” inflation, and a job market that’s a hiring frenzy.

But dig deeper, and you’ll see it’s a house with some seriously shaky foundations.

When you factor in healthcare’s bloated share of GDP, debt-fueled consumption, and wage gains eaten alive by selective inflation, you start to see why so many Americans—on both sides of the political divide—feel worse off.

Real people aren’t feeling the so-called prosperity, and it’s not because they’re blind—it’s because the shiny headlines are skipping some ugly details.

Let's talk about:

the cracks in America’s economic story

why the official numbers don’t match what you’re experiencing in your own life

and how to make financial decisions now that can actually safeguard your future.

The disconnect: People vs. numbers

The official numbers shout success. But for many voters, their daily experiences tell a different story.

Poll after poll shows that average Americans remain skeptical about the economy, unconvinced by the "trust the numbers" narrative.

Historically, when the economy is truly thriving, people tend to feel it.

Take the post-World War II boom:

real wages were rising

the cost of living felt manageable

and most Americans saw the data reflect what they were experiencing in their own lives.

Today, it’s the opposite. The more we hear about economic growth from official reports, the more people seem to dismiss it as out of touch with reality.

Cheapflation

In fact, a recent deep dive into the price data showed that prices for cheaper items—the very things poorer households rely on—have shot up by 30% between January 2020 and May 2024, compared to a 26% average increase and just 22% for pricier goods.

This means that people with lower incomes, who depend on more affordable essentials, felt the impact the hardest.

At the same time, inflation technically "went down," but not in a way that really helps those struggling to make ends meet.

Healthcare costs distorting GDP

Private consumption makes up about 70% of the total economy, which might seem like a strong, free-spending population driving the world’s largest economy.

But dig into the data and you find a giant wedge: Healthcare spending.

Healthcare in America has always been notoriously expensive, and as costs keep climbing, they artificially boost the country’s economic numbers.

Think about that: A nation spending ~17% of its output on healthcare, yet achieving poor outcomes like the lowest life expectancy among wealthy nations.

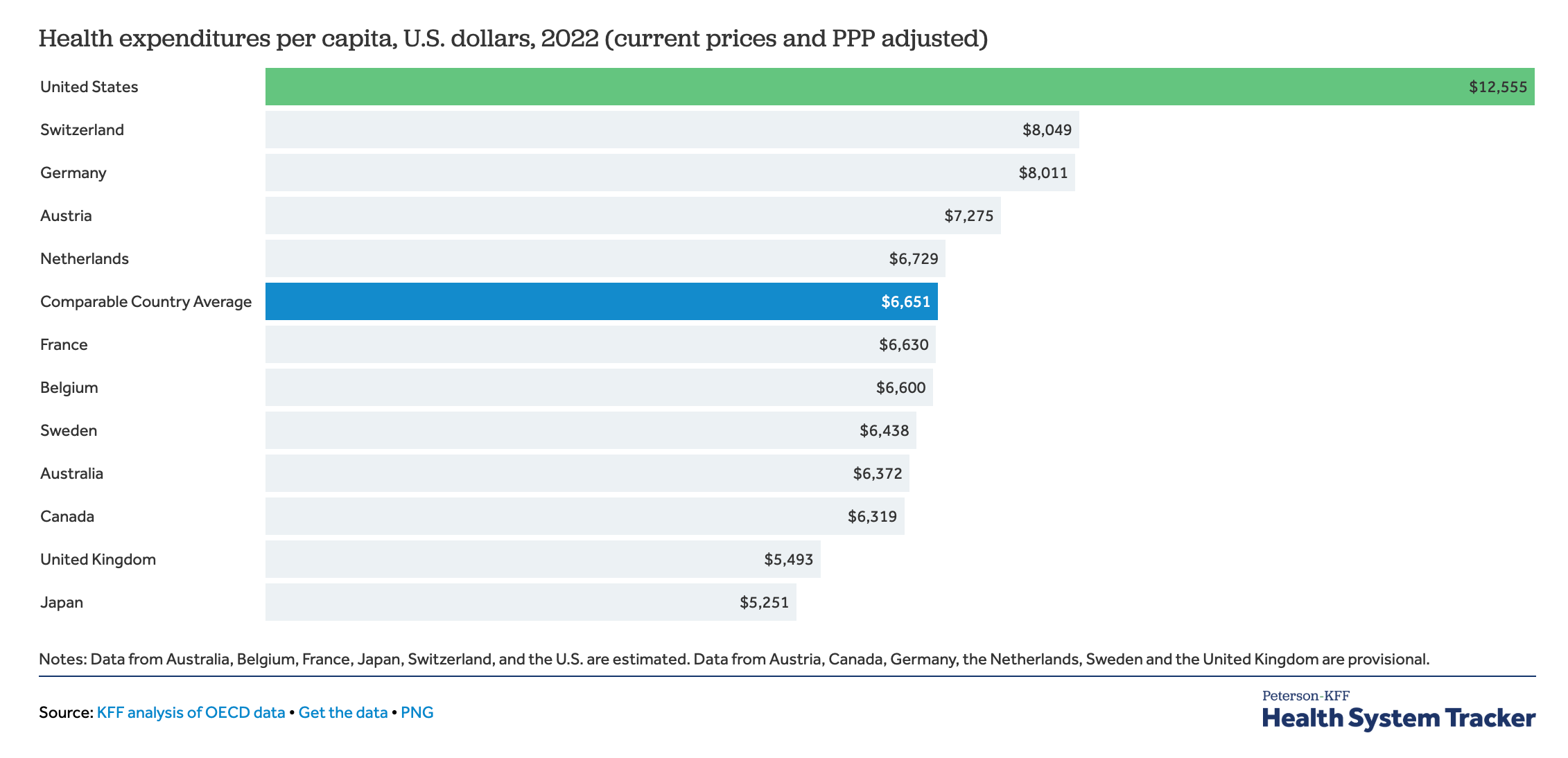

Healthcare now soaks up $12,555 per person annually or ~16% of American household spending, putting a huge dent in their pockets.

This healthcare-induced GDP inflation also skews employment figures.

Roughly 40% of new jobs come from healthcare, but this growth is driven more by soaring costs than by actual economic progress or productivity.

Household debt

The U.S. consumer is spending, sure—but they’re often doing it with money they don’t have.

Right now, U.S. households are carrying nearly $18 trillion in debt, and credit card delinquencies are the highest they’ve been in a decade.

The average household carries around $140,000 in total debt, much of it just to keep up with rising living costs.

So the official numbers talk a big game, but they don’t match what’s happening in real life.

How America’s economic story gets twisted by media

Why do some folks believe the economy is booming while others think it’s falling apart?

It’s not just about who’s running the country—it’s also about where people get their news and how they interpret it.

Political bias in economic perception

Research shows that Americans’ views on inflation and the economy can flip based on party lines.

When a Democrat is in the White House, Republicans often see economic disaster, while Democrats stay optimistic. The opposite happens when the roles are reversed.

Take what happened after 2020: Republicans’ expectations for inflation surged, while Democrats barely changed theirs.

Independents, who are often the deciding factor in elections, started leaning more toward the Republican perspective on inflation.

This shift suggests that economic concerns aren’t just about partisanship—they resonate beyond party lines.

Media amplification

Different media outlets push their own narratives.

Conservative outlets might focus on rising grocery prices and pin the blame on the current administration, while left-leaning ones highlight job growth and higher wages.

Harvard’s Stephanie Stancheva found that many Americans blame the government directly for inflation—and how the story is told plays a big role in shaping that view.

When the official rhetoric calls inflation “transitory” but your weekly grocery bill keeps climbing, it’s no surprise that people feel misled.

Polling confirms the mood swings

Recent Gallup polls reveal that Americans are feeling more pessimistic about the future than they have in decades.

Similarly, Pew Research finds that most people believe life today is harder than it was 50 years ago.

This widespread sense of cynicism doesn’t come out of nowhere—it’s influenced in part by nonstop media coverage and political narratives.

Cracks in the foundation: Lessons from credit bubbles and broken promises

Economic illusions aren’t a new thing—what seems like growth and prosperity can sometimes be hiding deeper issues.

Shaky credit booms

Think about the subprime mortgage crisis of 2008: the economy seemed unstoppable, fueled by easy credit and a booming housing market.

When that bubble burst, it nearly took the whole global financial system down.

Debt-driven growth can look amazing at first—until people start defaulting on loans. That’s when trust disappears, markets crash, and the whole system starts unraveling.

Healthcare and commodity shocks

The 1970s oil crises saw energy prices quadruple. This wiped out real incomes and forced the world to deal with something economists dreaded: stagflation.

Fast-forward to today’s overpriced healthcare system: it’s a slow-motion version of the same problem.

The more household budgets get hammered by non-negotiable expenses like oil (back then) or healthcare (today), the more people realize that the flashy GDP numbers don’t mean squat.

Eventually, when families can’t cope, consumption drops and the illusion of growth collapses.

Political instability

Consider how the Great Depression shattered trust in the old economic order.

Bank failures and soaring unemployment weren’t just numbers—they were everyday realities that eroded public confidence in the system.

More recently, crises in emerging markets, like Argentina’s repeated debt defaults, show that when leaders fail to deliver or keep debt under control, trust vaporizes.

People rush to assets that don’t depend on political credibility. Gold ends up being the Plan B when the system looks rigged.

In short, when economies lean too heavily on debt, juggle massive price shocks in essentials, and get caught in political dramas, the entire structure starts to wobble.

As people see these cracks, they pull back from risky investments and flock to safe havens like Gold.

History has proven it: from the 1970s energy crunch to the 2008 meltdown, when illusions shatter, Gold’s appeal jumps.

Turning doubt into profit: Why Gold is the go-to hedge in today’s uncertain times

The U.S. economy’s official data may still be good enough to keep surface-level confidence intact, but the cracks are becoming more evident every day.

This is where Gold steps in.

Gold doesn’t care about political spin, media hype, or how many new jobs are “created” just because we spend more money fixing our overburdened healthcare system. It’s a timeless asset that people trust when everything else feels rigged.

When uncertainty rises, Gold doesn’t just survive; it thrives.

Why Gold is the smart move now

A safety net in a debt-heavy world: Rising delinquencies show that more people are struggling to keep up with their debts, and this could trigger a domino effect in credit markets. If things start unraveling, investors typically panic—and where do they turn? Gold.

Shield from political turmoil: If you’re tired of watching each election bring a new story about how “great” or “awful” the economy is, Gold is your refuge. Unlike the U.S. dollar or stocks, it’s not tied to political policies or party lines, so it remains stable no matter who’s in charge.

Hedge against distorted data: Sure, GDP might look great because of healthcare spending, but does that really make families wealthier? Or take inflation—official numbers might say it’s under control, but if your grocery bill tells a different story, it’s hard to believe the headlines. When people lose trust in those “official” figures, they look for something real—like Gold.

Protection from rising costs: If you notice your grocery bill outpacing your paycheck, you’re not alone. When the gap between official inflation rates and what you feel at checkout widens, Gold steps up. It’s a store of value that doesn’t lose its shine just because central banks declare victory over inflation.

Long-term outlook: Higher Gold prices are coming

In times of doubt, fear, and economic chaos, money tends to flow into safe havens—and Gold has a solid track record of thriving under these conditions.

Given the current backdrop—ballooning debt, shaky household finances, blurred inflation realities—there’s a massive potential for Gold prices to surge even higher.

For traders, this is your moment:

Position early: Now is the time to consider positioning yourself in Gold. As cracks in the U.S. economic story get harder to ignore, those who get in early could be primed to benefit from a significant price surge.

Diversify and manage risk: For active traders, Gold can act as a safety net. Even if the stock market tumbles or bonds take a hit, Gold often holds steady—and has a history of outperforming when everything else struggles.

Stay ahead of the sentiment shift: Sentiment in the markets can change quickly. Right now, some still buy into the narrative of economic recovery. But as the reality of rising debt, credit stress, and stagnant wages becomes unavoidable, the Gold market could heat up fast. Being ahead of that shift is where savvy traders profit.

Key metrics to watch for traders

Household debt and credit card delinquencies: Rising debt levels and missed payments are red flags for economic stability.

Real wages and living costs: Keep an eye on wage growth, particularly for lower-income households, and how it compares to rising living costs like healthcare.

Inflation vs. reality: Pay attention to the gap between official inflation data and the "real-life" experience of rising prices.

Sentiment indicators: Look for signals showing how confident Americans feel about their financial future.

These nuances matter because they show where the economy’s vulnerabilities lie—and where Gold may find its next catalyst.

Don’t wait for the next crisis headline

The conditions for a Gold rally are already here.

The foundation of America’s current “growth” is shaky at best, and history tells us that when the illusion fades, Gold’s value tends to soar.

Sure, nobody knows the exact timing, but the warning signs are clear: as trust in the system erodes, Gold’s appeal only grows stronger. Get in ahead of the crowd, and you could reap the rewards when the tide inevitably turns.

Safe trading,

and remember: All that glitters is not Gold,

Joe